Delta risk

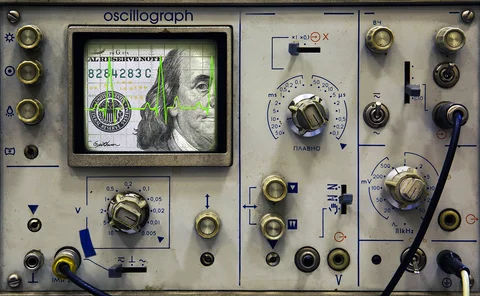

Banks look back in anger as FRTB revives 1990s risk test

Institutions bemoan need for parallel framework to measure portfolios’ sensitivities to market moves

Parameter estimation, bias correction and uncertainty quantification in the Vasicek credit portfolio model

This paper is devoted to the parameterization of correlations in the Vasicek credit portfolio model. First, the authors analytically approximate standard errors for value-at-risk and expected shortfall based on the standard errors of intra-cohort…

Managing option-trading risk when mental accounting influences prices

This paper explores the implications for risk management of mental accounting of a call option with its underlying.

Macquarie wrestles with warrant valuation

Australian bank in negotiations on settlement of Hanergy TFP warrants

Analytical risk contributions for non-linear portfolios

Analytical risk contributions for non-linear portfolios

The Monte Carlo mindset

There is a rich seam to be mined in the provision of tools to calculate counterparty credit risk. Clive Davidson looks at what's on offer so far, and what could be coming on to the market.

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk.

I will survive

Jon Gregory and Jean-Paul Laurent apply an analytical conditional dependence framework to the valuation of default baskets and synthetic CDO tranches, matching Monte Carlo results for pricing and showing significant improvement in the calculation of…

Globalisation and equity index exposure

Does the global presence of large multinational companies diminish the diversification effect inequity portfolios? Gary Robinson argues that this is indeed the case, and suggests a remedy