Carbon trading

Voluntary carbon markets house of the year: Marex

Marex’s support of mangrove projects provides high-quality credits for clients and socio-economic benefits for local communities

Climate risk advisory firm of the year: SparkChange

Energy Risk Awards 2025: Data firm provides unique insight into energy transition winners, losers and mispriced firms

Innovation of the year – Project: Tramontana

Energy Risk Awards 2025: Finance specialist develops transformational agroforestry project

Commodity trade finance house of the year: Tramontana

Energy Risk Awards 2025: Investment firm creates unique carbon trade finance vehicles enabling long-term hedging while developing carbon market liquidity

Climate risk research house of the year: Veyt

Energy Risk Awards 2025: Veyt’s unique views help clients navigate low-carbon markets

Voluntary carbon markets house of the year: SCB Environmental Markets

Energy Risk Awards 2025: Environmental specialist amplifies its commitment to the VCM

Delving into the European Commission’s proposed overhaul of FRTB

Raft of potential changes would benefit both IMA and SA banks – but only temporarily

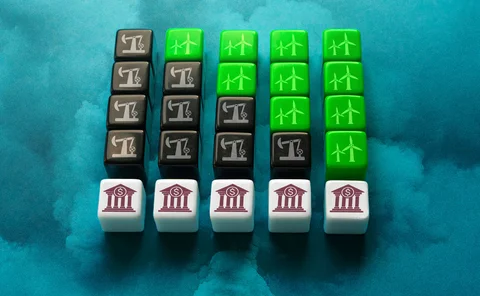

Green knights? Banks step into struggling carbon credit markets

Clearer global standards and a new exchange may attract dealer entry, but supply and demand challenges remain

Voluntary carbon markets need to be ‘cut a bit of slack’

Catherine McGuinness says excessive focus on greenwashing in fledgling market could undermine its development

The carbon equivalence principle: minimising the cost to carbon net zero

A method to align incentives with sustainability in financial markets is introduced

How to account for banks’ contribution to CO2 emissions

Price adjustments will depend on individual counterparties’ carbon footprints

Achieving net zero with carbon offsets: best practices and what to avoid

The race to net zero is on, with tens of thousands of firms now signed up to carbon reduction targets. The use of carbon offsets from voluntary and compliance markets will play a key role in helping firms reach their net-zero and decarbonisation goals…

Throwing green into the mix: how the EU Emissions Trading System impacted the energy mix of French manufacturing firms (2000–16)

This paper investigates links between environmental policy and production decisions, with a focus on firms' energy mixes.

The carbon equivalence principle: methods for project finance

A method to price the environmental impact of financial products is proposed

Voluntary carbon markets go back to basics

Fledgling market is still debating fundamental concepts, but experts remain hopeful about its ultimate utility

Podcast: the right way to wrong-way risk and climate risk in XVA

MUFG quant thinks outside the box on risk management

Carbon markets: what to watch

As carbon markets take on increased importance, Victoria White, senior associate at Allen & Overy, discusses the outlook for carbon trading, highlighting the key developments shaping these markets

SCB’s CEO talks biofuels, food security and the growth of voluntary carbon markets

Kevin McGeeny, founder and chief executive of SCB Group, talks with Energy Risk about his firm’s performance in this year’s Commodity Rankings and the developments he’s keeping an eye on in the biofuels and carbon markets.

Revenues soar for SCB as interest in climate risk intensifies

Sponsored content

Carbon fund increases returns by decreasing supply of permits

Europe’s emissions trading system could be a catalyst for the energy transition, but only if prices rise

CFTC: regulators can help carbon market’s ‘credibility’ problem

Isda AGM: Behnam says commission may have a role to play in supporting growth of voluntary market