Basel III

WHAT IS THIS? Basel III is a set of bank soundness rules drawn up by the Basel Committee on Banking Supervision in response to the financial crisis. It hikes the minimum amount of capital banks must hold, introduces new leverage and liquidity ratios, and limits the use of internal models.

IIF warns Solvency II risk charges may lead to imprudent asset allocation by insurers

IIF warns Solvency II risk charges may lead to imprudent asset allocation by insurers

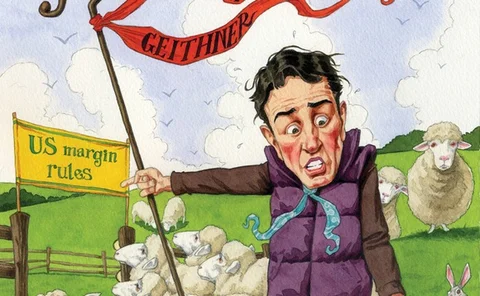

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

CVA's cousin: Dealers try to value early termination clauses

Adjustment anxiety

Basel III liquidity rules shaking up the corporate deposit market

Deposit(ive) thinking

CVA hedging: a false sense of security

Quo vadis, CVA?

Risk Japan 2011: Japan, Europe need to team up to address Dodd-Frank extraterritoriality

Speakers on a panel at Risk Japan 2011 in Tokyo on August 30 debated the effects of international regulatory developments on Japanese financial institutions. Some parties believe Japan needs to team up with Europe to push back on Dodd-Frank…

BBVA given deadline to improve AMA model

BBVA has been given until December 2011 to make improvements to its AMA model by the Bank of Spain, or will not obtain the capital savings the AMA allows

IIF calls for co-ordination in banking and insurance regulation

In its latest report, the IIF calls for cross-sector co-ordination in banking and insurance regulation

Risk.net poll: regulatory changes are not making compensation more risk-based

Basel III's higher capital levels mean "bankers' pay will come down"

Indian banks adequately capitalised for Basel III – Shyamala Gopinath profile

The outgoing deputy governor of the Reserve Bank of India, Shyamala Gopinath, is confident that Indian banks have the necessary capital cushion to absorb the additional requirements of Basel III.

Risk & Return Australia 2011: Co-ordinated supervision critical for global financial stability

Speakers at Risk & Return Australia 2011 believe the ability of supervisors to implement regulation around the world in a consistent manner is the most critical component to financial regulatory reform. They also believe the timeframe for new rules needs…

Basel III charge could spur interest in CCDS

Development of CCDS could be pushed ahead by Basel III CVA charge, suggest market participants

Risk waterfall at CME, Ice makes porting harder, dealers say

The need to provide portability could pressure CCPs to lean more heavily on initial margin than default funds to absorb losses

Ernst & Young's Hank Prybylski discusses risk management in a time of reform

Hank Prybylski of Ernst & Young LLP discusses how firms are effectively dealing with risk management during a time of intense focus on financial regulatory reform.

Corporate FX hedging surges in Asia

Surge in structures

The product no-one wants to sell: portability held up by lack of rules

Under-the-counter derivatives

Q&A: ACP's Nouy on CRD IV, equity in the LCR and CoCos

Behind Basel III

Investor pull to replace regulator push on CoCos: Credit Suisse’s Ervin

A new pull for CoCos

Perverse capital

Perverse capital

Capital One: banking on banking

Capital gains

Sovereign volatility puts Basel III CVA charge in spotlight

Basel III feedback loop between CDS spreads and CVA capital requirements worries dealers, following month of huge sovereign spread moves

Comment: Mario Draghi, governor of the Bank of Italy

Incoming president of the European Central Bank warns against pressure to water down regulatory reform, in this edited version of a foreward to a new Risk book

Counterparty risk capital and CVA

Counterparty risk capital and CVA