Autocallables

Calamos brings popular US autocall ETF to Europe

Dublin filing points to Q1 launch for Calamos Autocallable Income Ucits ETF

Equity derivatives house of the year: JP Morgan

Risk Awards 2026: Volatility strategies and technology investment help realise hyper scale-up

The importance of modelling futures dynamics in commodity index derivatives

Index-based and underlying-based pricing methods for commodity derivatives are presented

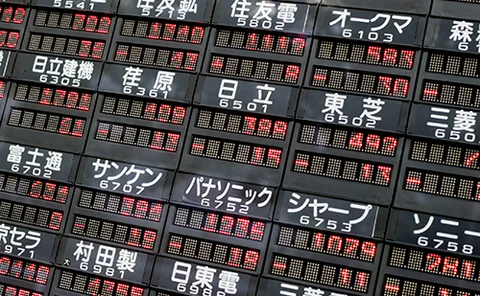

Korean autocalls to make comeback, with ‘smaller pie’ for banks

As equity-linked autocallable channels look set to reopen, new rules could limit market’s revival

Technology vendor of the year and System support and implementation provider of the year: Murex

Murex has combined investment in its MX.3 platform with a delivery model that helps clients upgrade continuously and scale with confidence

BofA preps single-stock autocalls on new CHF indexes

SIX Group indexes slash implied forward cost for US underlyings including Nvidia and Microsoft

US dividend futures top $6bn on structured note boom

Traders also eye opportunities in options on S&P dividends as April rout creates skew dislocations

Calamos’s $200m inflows trigger autocall ETF ‘frenzy’

First mover expands to US tech, Innovator ETFs plans rival listing on September 25

Why Calamos chose swaps for market’s first autocall ETF

Swap-based structure attracts $40 million in first month; backers eye multi-billion-dollar AUM

Investment firms ready plans for US autocallable ETFs

Evergreen format would provide the long-term track record required by portfolio allocators

Did tariff rout expose ‘autocallification’ in US dividend futures?

Bank of America cites curve flattening and beta surge as evidence of autocall hedging

Back-to-back hedging is back on the table for autocall issuers

Deal activity is picking up as prop shops compete with hedge funds for structured products risk

Hedging playbook goes ‘out the window’ as Trump tariffs slam markets

Dispersion, put spreads and VKOs paid off as stocks plunged, but outlook remains wildly uncertain

Autocall curbs hit long-dated Nikkei and HSCEI options

Collapsing Asia structured products inventory saps market-makers of long-dated vol supply

Why vol markets shrugged off Nvidia rout

Gamma, autocalls and stock dispersion helped prevent a broader market meltdown

How UBS sold off non-core equity assets at lightning speed

More than 40 auctions have been completed since Credit Suisse acquisition, with a little help from a T-Rex

China’s snowballs hit by new regulatory clampdown

Restrictions on structured note issuance by securities houses blocks key distribution channel

Supply chain decoupling fires up alpha focus at BofA

Talking Heads: Stock dispersion sees funds gross up on long/short baskets, while US structured notes come of age

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Regulatory crackdown puts Korea autocalls in deep freeze

Mis-selling fears see distributors pull back, leading to 40% issuance fall in a month

First Korean issuer joins Hong Kong warrants market

Kisa anticipates warrant and autocallable hedging synergies