Auto-hedging

NatWest retunes options tool to create, not hedge

Auto-hedging algo replicates non-linear exposures in spot for clients that can’t trade options

Treasurers turn to AI in bid for sharper forecasting

Wider automation could usher in future of ‘hands-free hedging’, but obstacles lurk in data standards and sharing

Innovation in execution: Morgan Stanley

Risk Awards 2020: Odd-lot bot handles almost half of bank’s credit trades

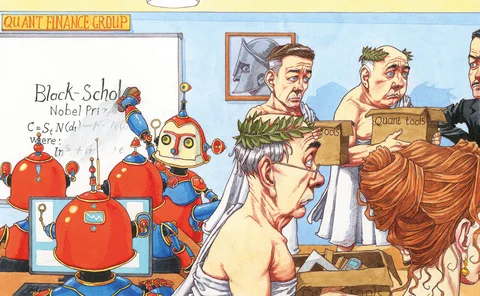

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

JP Morgan turns to machine learning for options hedging

New models sidestep Black-Scholes and could slash hedging costs for some derivatives by up to 80%

To Hull and back: a 20-year hiatus in bank e-trading plans

In the 1990s, banks tried to buy automated trading expertise; now, after a long break, they’re trying to build it

Machine earning: how tech is shaking up bank market-making

As banks get serious about e-trading, humans are being asked to give up their secrets to the machines that could replace them

UBS’s Athanasopoulos on volatility, Mifid and hedging by machine

Risk30 profile: Athanasopoulos sees opportunities to cut hedging costs

Interest rate derivatives house of the year: Citadel Securities

Swaps market outsider changes the way the game is played

Hidden price pressures grow in euro swap market

Clients face wider bid/offer spreads, as dealers struggle to find liquid hedges