This article was paid for by a contributing third party.More Information.

Technology at the service of XVA or ‘XVA as a service’?

Stéphane Rio, founder and chief executive officer of ICA, explains how new technologies can radically change approaches to XVA and other pricing and risk calculations when big data experts and quants work hand in hand

When facing the challenges of XVA computations with older-generation systems and limited in-house computational resources, banks have had to rethink their setups or cut corners completely. In particular, many were compelled to strip their overnight batches down to the bone and discard valuable intermediary results.

Big data technologies allow quants to think differently

Intermediate results are a means for quants and traders to analyse results and track down errors efficiently. They also avoid much of the recalculation when something minor is amended – a single trade or credit support annex term, for example. In a large netting set, this could mean less than 1% of the compute time. For this reason, the ICA system will save all future mark-to-markets of individual transactions and the sensitivities of all netting sets – on each path and on each date of the simulations. For large portfolios this means saving, slicing and dicing hundreds of billions of data points.

With big data technologies, this can now be achieved at a very marginal cost – both in terms of computational time and financial outlay. With a fast investigation tool and highly efficient runs, a world of new possibilities opens up: traders and salespeople can work on real-time pre-trade prices and focus on efficiently optimising XVAs and resources by, for example, selecting who to trade with to minimise margin valuation adjustment or simulating thousands of portfolio scenarios to optimise capital allocation.

Moving to the cloud – A game changer for agile teams

Banks using in-house computational power have finite resources. In their overnight batches, they will need to be frugal with computationally intensive calculations such as cross gammas, while most resources will remain underused intraday. Working with the cloud offers multiple benefits: elasticity, scalability, on-demand accessibility, redundancy and pay-per-use – one uses and pays for what one needs when it is needed. Two conditions are required for this.

First, to share two types of knowledge among a single team: models on the one hand, cloud and large-scale distribution technology on the other. This will allow quants to replace traditional grids, work much closer to models, optimise distribution (to avoid redundant calculations), minimise input/output and develop parallel orchestration with linear performance. Computation time can be reduced to the bare minimum; for example, using 10 times as many cores and reducing computation time tenfold will cost virtually the same amount.

Second, to meet regulators’ requirements and ensure the security of data.

Guidelines from the US Federal Reserve, the UK Financial Conduct Authority and the European Central Bank are logical and clear on how to satisfactorily use public cloud-based technology.

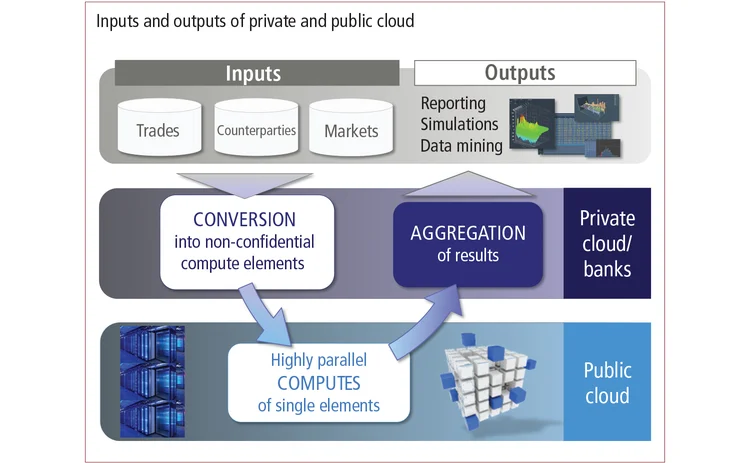

As detailed in the February edition of Risk, ICA added an additional layer of security in ensuring no sensitive information is sent to a public cloud – where the bulk of computations are performed, aggregations and final metrics computations being undertaken locally using ICA’s big data database).

Big data and cloud technology solutions

Big data and cloud technologies are two examples of very mature innovations that banks do not sufficiently leverage – and not only for XVA. ICA combines the skills of quants, new technology experts and experienced former front officers, and is therefore uniquely positioned to offer banks the full benefit of these technologies with two appropriate solutions:

XVA as a service

For users looking for a comprehensive and agile XVA solution, the ICA tool is available ‘as a service’: turn-key real-time XVA trading and risk solutions, including all value-added metrics, risk sensitivities, profit and loss attribution, ad hoc cross gamma, stress tests or other market scenarios, and real-time what-if scenarios (pre-trade pricing, assignments, terminations, change of credit support annex terms, central counterparty upload, and so on).

New technologies at the service of XVA

For banks wishing to continue using proprietary models while moving architecture to a new generation, ICA can inject some or all of those technologies into the bank’s architecture through special implementation projects. ICA has distinctive experience of getting big data and cloud technologies to operate efficiently in a complex pricing and risk environment – and a successful track record.

Read more articles from the 2018 XVA special Report

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net