Refinancing

High leverage in US REITs raises red flags, says FSB

Non-bank CRE investors at risk from falling prices and refinancing crunch

Rabobank LCR down 7% on TLTRO prepayments

Decline expected to continue as bank pays off final loans extended via EU-wide funding scheme

Japan banks’ LCRs pull back for 4th quarter in a row

Rise in net cash outflows remains sustained as HQLAs hit plateau

Euro banks’ funding plans lag TLTRO repayments – EBA

Survey on funding plans shows banks don’t plan to replace ECB lines just yet

EU banks eye debt issuance as central bank funding winds down

The projected increase would not be sufficient to replace TLTROs maturing in 2023, EBA report finds

Sovereign risk manager of the year: Senegal’s Ministry of Finance and Budget

Risk Awards 2020: ADB guarantee cuts swap costs by 500bp, opening the door for a $1.4b forex hedge

Central counterparties: magic relighting candles?

In this paper, the rules of selected major CCPs (LCH, CME, Eurex and ICE) are reviewed for both their end-of-waterfall procedures and the rights granted to clearing members in end-of-waterfall scenarios.

Rising yields prompt China banks to up loan-loss coverage

Domestic and foreign lenders reassessing loan books and tweaking hedging strategies

The management of refinancing risk in Islamic banks

This paper investigates the risk engendered by maturity mismatches.

Deal of the year: Arqiva/HSBC

Deal of the year: Arqiva/HSBC

Law firm Paul Hastings adds to leveraged finance team

Rich Farley joins from rival, Cahill Gordon & Reindel

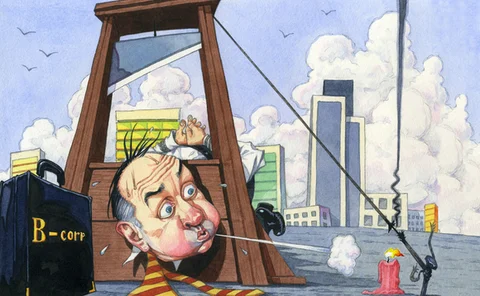

Borrowers warned to not take refinancing risk lightly

With a debt maturity wall looming, issuers should not assume good access to markets today will still be available next year, said participants at a press conference in London

Video: Interview of Natixis's Asia-Pacific energy chief

Charles Maulino, head of global energy & commodities coverage, Asia-Pacific at Natixis, speaks exclusively with Lianna Brinded about the evolution of energy and commodities financing and hedging strategies

Axa IM to lend funds secured by ABS

The essential ABS

Solvency II poses bigger danger to economic stability than bank refinancing

Refinancing risk dwarfed by Solvency II’s impact on insurer appetite for corporate debt

ECB may extend full allocation tenders into 2011

Any withdrawal of liquidity by the ECB at year-end would cause major uncertainty, say bankers

Issuance slowdown raises refinancing fears for high yield borrowers

Corporate bond issuance plummeted in May, with issuers and investors wary of the effects of the ongoing sovereign crisis on the credit markets. Faced with an unprecedented refinancing wall, it may be high yield borrowers who suffer most.

Spanish banks prepare for refinancing risk as CDSs blow out

Refinancing risk increases for Spanish banks as credit default swap (CDS) spreads widen dramatically for a third day running.

A slow recovery

Oil