Loss data

HSBC North America posted most loss-making days in Q3

The foreign IHC traded in the red 43 out of 64 days, the highest among 32 banks analysed

Op risk data: Two Sigma pays the price for model mess

Also: KuCoin’s AML fail, Angola bribes bite Trafigura, and Trump’s green scepticism. Data by ORX News

TD Bank’s annual op loss tab surges 144% amid AML settlement

US plea deal drives bank’s op RWAs to record C$120 billion

Determination of the fraction of losses and their probabilities by type of risk and business line from aggregate loss data

This paper proposes a novel means to derive the individual loss severities and the frequency of these losses per business line and risk type.

Integrating internal and external loss data via an equivalence principle

The authors put forward a means address data scarcity in operational risk modelling by supplementing internal loss data with external loss data.

US banks seek to open vendors’ black box on green data

Inaugural Fed climate scenario analysis flags lack of transparency around third-party models

Norinchukin hit with 54% rise in op RWAs

Recalibration of underlying parameters is first under new standardised measurement approach

Composite Tukey-type distributions with application to operational risk management

This paper investigates composite Tukey-type distributions and puts forward a new composite model, the improved flexibility of which is demonstrated.

RBI’s op risk charges climb 22% on input-series update

Recalibration reverses savings from discontinuation of AMA a year earlier

Tall order: why a unified op risk taxonomy is still elusive

Banks vary in how they classify operational risk losses – and regulators are in no rush to change the status quo

Estimating the correlation between operational risk loss categories over different time horizons

The authors propose and demonstrate the value of a model with which mathematical techniques can be applied to analytically calculate means, variances and covariances more accurately than Monte Carlo simulations.

A text analysis of operational risk loss descriptions

The authors put forward a workflow for using text analysis to identify underlying risks in operational risk event descriptions.

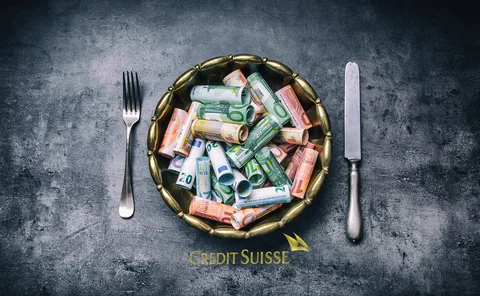

Op risk data: Credit Suisse hit for $900m in offshore trust bust

Also: Goldman boys’ club gets the boot; HSBC double whammy; Havilland’s economic sabotage plan. Data by ORX News

Fed preps new white paper on cyber incident reporting

New proposals due on data capture after Fed dumps bid to use DFAST submissions

ING’s op RWAs climb 7% on AMA update

Second quarterly rise in a row erases most of the reduction in the first half of 2022

Op risk data: Dodgy tax practices cost Credit Suisse €240m

Also: Binance blockchain hack; ING’s Polish AML fail. Data by ORX News

Op risk data: Banks dial in $600m loss for illicit phone use

Also: Santander staff mistreatment; cum-ex rumbles on; CFTC steps up scrutiny of swaps reporting. Data by ORX News

Op risk data: SEC says no to Charles Schwab robo-adviser

Also: China steps up scrutiny of wealth management products; Libor fines still rumble on. Data by ORX News

Op risk data: Allianz dealt a $4bn blow for not-so-Alpha Funds

Also: Credit Suisse cops two cartel shops; banks get slapped in gender pay gap. Data by ORX News

Op risk data: Morgan Stanley, Capital One’s data breach double trouble

Also: Citi shells out $45m for misleading stock trading info; coding clangers cost Credit Suisse $9m. Data by ORX News

Op risk data: Mouldy money makes big stink for NatWest

Also: Santander plays Santa; JPM in messaging mayhem; ‘Sterling Lads’ cost HSBC a couple of bricks. Data by ORX News