Basel I

Credit risk & modelling – Special report 2021

This Risk special report provides an insight on the challenges facing banks in measuring and mitigating credit risk in the current environment, and the strategies they are deploying to adapt to a more stringent regulatory approach.

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

The theoretical foundations of XVAs

Bloomberg analyses the theoretical basis of XVAs, focusing on the works and findings of its head of quantitative XVA analytics, Mats Kjaer, who emphasises the role of the capital valuation adjustment as a major driver of derivatives trading profitability…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…

2022 – A market risk odyssey

Though January’s final version of FRTB offered no great surprises to those who have followed the regulation since its inception, banks now have a greater idea of what is required of them. Bloomberg explores the importance for banks to have FRTB…

A tech-driven transformation

A panel of experts explores how greater collaboration between risk and finance teams can garner significant benefits and add value, how technological innovation is making the regulatory landscape more complicated to navigate and produce transformative…

Leverage ratio unpopular among non-Basel countries

Few jurisdictions use measure to backstop risk-based capital frameworks

Basel floor change boosts Canadian bank capital ratios

CET1 ratios improve between five and 120 basis points quarter-on-quarter at 'Big Five'

New capital floor saves CIBC C$244 million

Switch to Basel II-based floor adds 16 basis points to bank's CET1 ratio

Focus on Basel output floor calibration misses the point

Until all the final standardised approaches are known, the floor has little meaning

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

Simple indicators better for regulators, BoE economist argues

The experience of the 2008 crisis shows that leverage ratios are better warning signs than more complex measures such as capital ratios

Basel Committee seeks netting-friendly replacement for CEM

Consultation on alternative to much-criticised current exposure method could start in June

The forgotten pillars of Basel II

Forgotten pillars

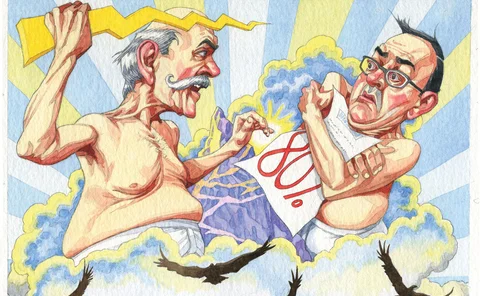

Basel faulty

Basel faulty