SEC, Treasury warn against zero haircuts for Treasury repos

Gensler and Liang say more conservative treatment of hedge fund trades is desirable

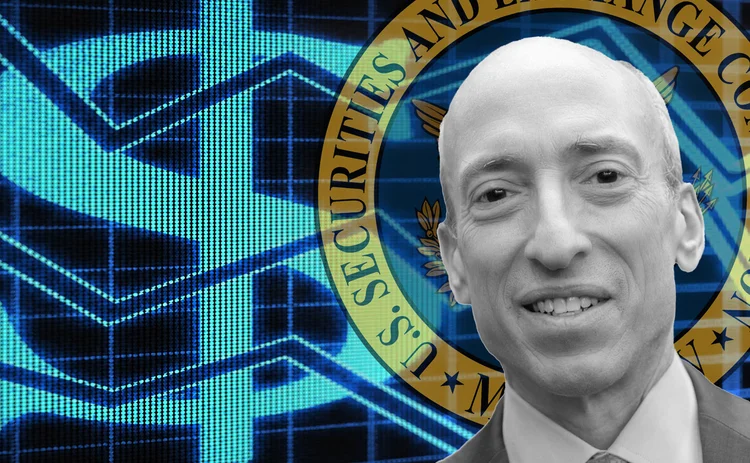

Dealers are not collecting enough margin on repo trades with hedge funds, according to US Securities and Exchange Commission (SEC) chair, Gary Gensler.

“Many hedge funds are receiving the vast majority of their repo financing in the non-centrally cleared bilateral market, where haircuts or initial margin requirements are not necessarily applied,” Gensler said at the Federal Reserve Bank of New

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Why better climate data doesn’t always mean better decision-making

Risk Benchmarking research finds model and systems integration challenges almost as limiting to effective climate risk management

CanDeal looks to simplify third-party risk management

Six-bank vendor due diligence utility seeks international reach

Market players warn against European repo clearing mandate

Regulators urged to await outcome of US mandate and be wary of risks to government bond liquidity

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Esma won’t soften regulatory expectations for cloud and AI

CCP supervisory chair signals heightened scrutiny of third-party risk and operational resilience

AI spend in US could be good for bonds in Europe – finance chiefs

Development of AI is capital-intensive, but adoption less so, which could favour EU

Climate risk managers’ top challenge: a dearth of data

Risk Benchmarking: Banks see client engagement and lender data pooling as solutions to climate blind spots – but few expect it to happen soon

BPI says SR 11-7 should go; bank model risk chiefs say ‘no’

Lobby group wants US guidance repealed; practitioners want consistent model supervision and audit