This article was paid for by a contributing third party.More Information.

Climate risk management – A self-assessment of progress

Due to a combination of increasing social pressure, demands for better disclosure from investors and emerging regulation, companies are increasingly questioning the extent to which they are incorporating climate change into their global risk management. Management Solutions discusses some key ideas that may allow companies to perform a self-assessment of their maturity in climate risk management

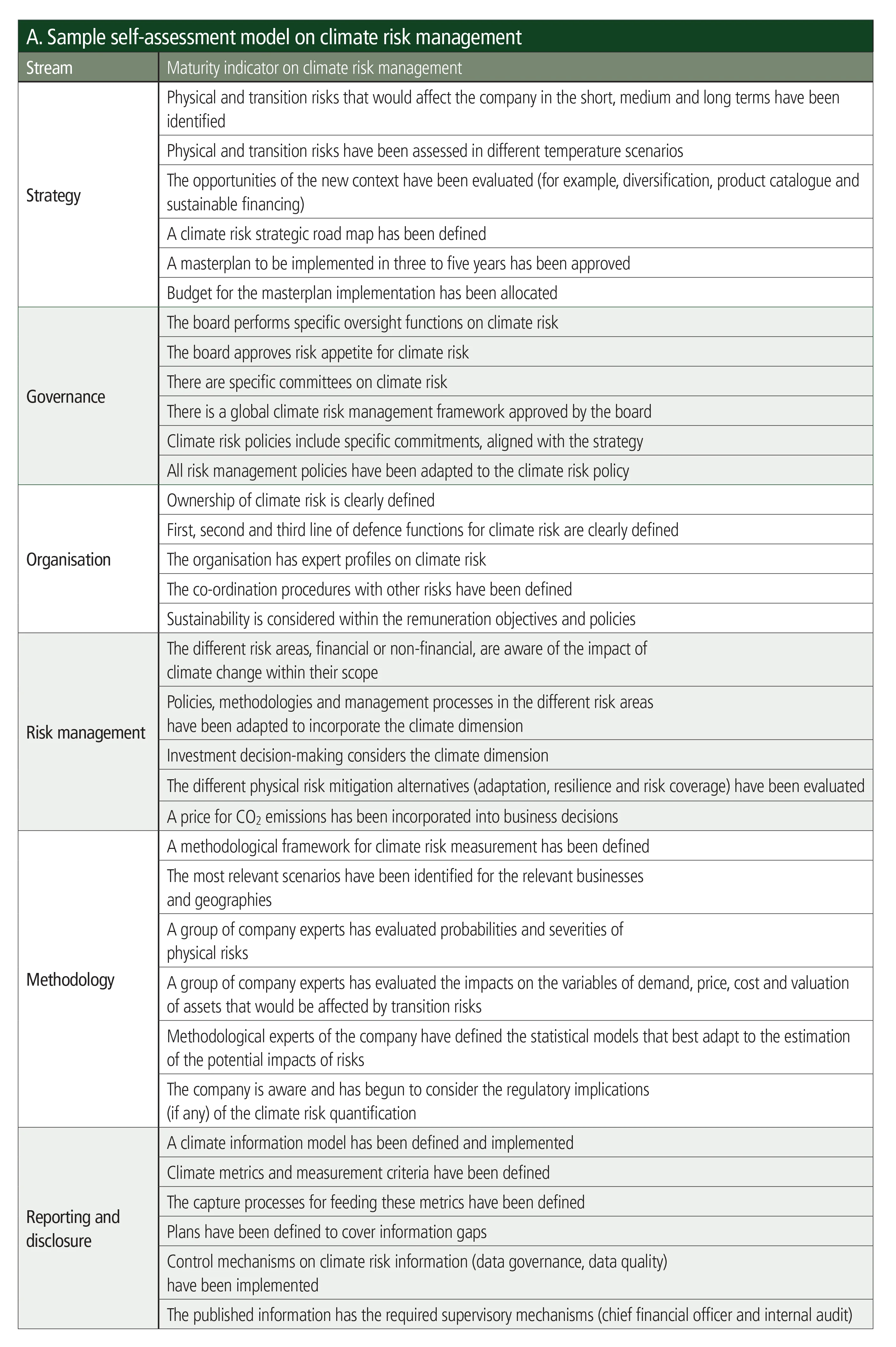

As is the case for most emerging risks, a multidimensional approach to self-assessment is advisable. This article analyses climate risk management through six dimensions: strategy, governance, organisation, risk management, methodology, and reporting and disclosure. Table A presents a sample self-assessment model along these dimensions.

Strategy

Strategy definition requires, as a precondition, both the identification of risks and opportunities in the short, medium and long terms, and the estimation of their financial impact in different temperature scenarios.

The complexity of this process, given the level of uncertainty, is apparent: What extreme physical impacts will take place and when? What political actions and regulations will be adopted? To what extent will technologies that allow a sustainable energy mix or CO2 capture be developed, and when? Despite these unknowns, senior management teams need to define a climate strategy that might profoundly affect the company’s business, which in turns sets off a decisive mobilising effect and crystallises as a tangible masterplan for climate change adaptation.

Governance

From a governance point of view, the incorporation of the climate dimension in global risk management is not a simple endeavour. The crosscutting nature of this risk, the uncertainty in its measurement and the lengthy time horizon of impacts versus the immediacy of the investments to be made entail important barriers.

To overcome these barriers, three structures are suggested: strong sponsorship from the management body, a robust governance with explicit involvement of the board and a framework that includes all six elements of climate risk management.

Organisation

Climate change is a common factor that amplifies multiple risks previously managed by companies through already up-and-running risk areas, and thus its organisational component is, to some degree, a transformational one.

On one hand, a clear definition of accountability on climate risk is required in the different risk areas and for all businesses. On the other, the company will need an area with a global vision to take the lead and promote the plan in a co-ordinated manner and according to the enterprise-wide climate strategy.

The profiles involved are also diverse. These include quants (to develop evaluation methodologies and scenario analysis) and technical profiles (to analyse technological alternatives to reduce the carbon footprint and protect assets from physical impacts). Consequently, a non-trivial question is: does the company have sufficient and specialised resources and, if negative, how does it remediate this in a context of scarcity of these profiles in the labour market?

Risk management

Companies should adapt their risk management practices to the specific ways climate change might affect their business, depending on the industry and geographies in which they operate. In all cases, they must have mitigation strategies for physical and transition risks – and, in the case of the financial sector, assess how counterparties or insured companies are managing their own climate risks.

Regarding physical risks, the company will need to assess different adaptation strategies, such as asset relocation, investment in resilience, disaster recovery and insurance coverage increase. Concerning transition risks, it will need to activate internal levers to promote its transformation, such as the incorporation of sustainability factors in investment decisions or internal pricing of CO2.

Methodology

One of the main challenges in managing climate risk is implementing a methodology to measure its financial impacts. This step requires a transversal knowledge of the company and its strategy. This includes being able to quantitatively determine the extent to which a specific temperature increase would affect physical risks, and how greenhouse gas emission reduction efforts can affect transition risks. Thus, the estimation of impacts should be a transversal exercise that brings together experts from many areas across the company: strategy, operations, legal, business, technology, and so on.

Additionally, in the case of regulated sectors – for example, financial and insurance – risk assessment methodologies would have regulatory implications mainly focused on capital, such as internal capital adequacy assessment and stress-test exercises.

Reporting and disclosure

The existence of a solid climate information model is essential to address the multiple internal and external demands: for example, investors, rating agencies, banks and regulators.

The information model faces multiple challenges: from identifying the fine line between providing transparency and breaching confidentiality, to implementing the procedures to capture all relevant information. Additionally, in the case of the financial industry, the different criteria or the poor data quality provided by clients may create additional difficulties.

Initiatives to establish common criteria and regulation disclosure in certain industries may nevertheless improve the quality of information.

In short, the transformation companies should achieve to face climate change will be profound and complex. Nevertheless, this transformation should be considered a priority by management bodies, for a number of reasons – not least the existing evidence that financial markets are already taking into account the impact of climate risk on the valuation of their investments.

Climate risk – Special report 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net