Core-periphery model of bank networks called into question

Researchers find multiple, asymmetric cores in interbank market, posing different systemic risks

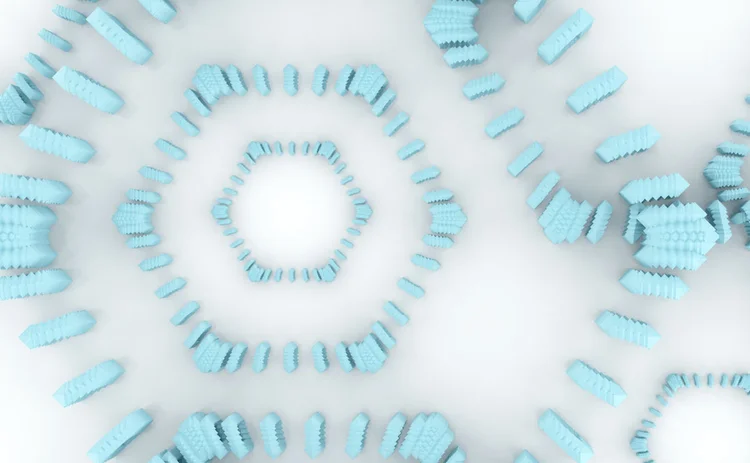

Network analyses of financial markets often tend to come up with the same result. Whether they look at interbank lending, deposits, credit insurance or derivatives exposures, the pattern is a ‘core-periphery’ network, with a core of a few institutions (often the largest) all strongly connected to each other, and a periphery of (generally smaller) institutions with weak connections to a few members of the core.

But new research published in the Journal of Network Theory in Finance suggests the

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

For banks, change risk is inevitable; managing it, optional

Regional bank survey shows steady growth of dedicated change risk functions and adoption of leading indicators

Clearing members ponder the purpose of CME’s mystery FCM

Some think licence will be used to boost crypto clearing capacity, but many questions remain

Review of 2024: as markets took a breather, firms switched focus

In the absence of major crises and rules deadlines, financial firms revamped strategy, services and practices

As supplier risk grows, banks check their third-party guest lists

Dora forces rethink of KRI and appetite frameworks amid reappraisal of what constitutes a key counterparty

Dora flood pitches banks against vendors

Firms ask vendors for late addendums sometimes unrelated to resiliency, requiring renegotiation

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Regionals built first-line defences pre-CrowdStrike

In-business risk teams vary in size and reporting lines, but outage fears are a constant

Op risk data: Santander in car crash of motor-finance fail

Also: Macquarie fined for fake metals trade flaws, Metro makes AML misses, and Invesco red-faced over greenwashing. Data by ORX News