Asset manager of the year: AllianceBernstein

AllanceBernstein reduces costly operational blunders by bringing risk to the fore

OpRisk Awards 2016

In recent years, many asset management firms have become more diversified and complex. AllianceBernstein, the US asset management subsidiary of French insurer Axa, is among them. In 2011, the firm's business consisted largely of managing cash equity and cash bond portfolios. Since then, it has added a variety of new and less liquid strategies, such as real estate, funds of hedge funds and infrastructure debt.

All things being equal, this proliferation of new activity might be expected to cause an uptick in operational risk. That it hasn't is a source of pride to Andrew Chin, the firm's chief risk officer (CRO). In fact, he and his team have seen a marked decrease in the number of op risk blunders over the past few years. "These new products have required new processes, and yet our annual number of errors has come down or held steady," he says.

When Chin took over as CRO in 2012, the risk management function at AllianceBernstein was seen as bureaucratic and stodgy, its tools cumbersome and its processes simply ‘check-the-box' exercises. However, he quickly moved to raise the profile of risk management, including by holding regular meetings with the audit committee of the board of directors and improving the calibre of risk management professionals.

Chin ensured that he reported directly to the chief executive, with a dotted line to the audit committee of the board. He also began holding closed-door sessions with the audit committee to provide the opportunity to highlight potential risks. Those meetings now take place on a quarterly basis.

"Before I took on the role, risk management didn't have a seat at the table," says Chin. "Now, I make quarterly presentations to the board. It not only helps them to gain a better understanding of risk, but also makes them accountable."

People are a lot more willing to talk about things that almost happened. At the same time, the number of errors has gone down as we learn from these near misses

Andrew Chin, AllianceBernstein

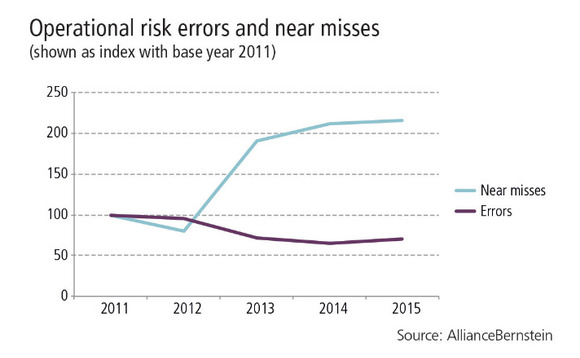

The result has been an improvement in operational risk management as measured by two key metrics: ‘errors' and ‘near misses'. The number of near misses – incidents that could have resulted in a material loss if preventative steps had not been taken – has more than doubled since 2011. During the same period, the number of actual errors has declined by 30% (see graph below).

Instead of assigning blame, Chin wants to encourage staff to learn from their mistakes. "People are a lot more willing to talk about things that almost happened," says Chin. "At the same time, the number of errors has gone down as we learn from these near misses."

As of March this year, there were 53 risk professionals working at AllianceBernstein, about 40 of whom were dedicated to operational risk. Ten of them report directly to Chin, and the others report jointly to Chin and the heads of the firm's business units. This matrix structure aligns the incentives for risk managers. "He is accountable to helping his business unit move forward in a risk-aware way, and at the same time, he ensures the risks are manageable and appropriate from a firm-wide perspective," says Chin.

Compensation for these individuals is determined jointly by Chin and the business heads. "It's critical that compensation be set by business units as well as by me," he says. At times, for example, Chin has disagreed with them over compensation decisions, which helps to ensure independence between risk management and the business units.

Many of those employees have changed in recent years. Since Chin became CRO, there has been a 90% turnover in personnel – a reflection of his determination to instil a proactive and collaborative approach to risk management. Chin says he wanted risk managers with operational experience in business units, who could work with them to identify and manage risks on a forward-looking basis. "I needed people to buy into this vision of risk management being integrated into the business," he explains.

Chin asks every new member of the risk team to tell him what can be improved once they've been on the job for three months, while they still have a fresh perspective. "This simple question sets the tone for how I want the risk managers to operate in the future: proactive, think outside the box, bring new ideas, and not be afraid of challenging the status quo."

He also holds quarterly meetings with the business unit heads to make sure they are integrating risk into their business decisions. "Previously, the senior leaders had little insight into their operational risk profiles, but now they are on top of them," he says. "Currently, our senior leaders are aware of the risk and have taken steps to mitigate those risks."

Recently, AllianceBernstein intensified its analysis of errors and near misses to look for areas of improvement. For example, it became apparent that mistakes were occurring for the same client that appeared to be unrelated – fee issues, trading issues, guideline breaches – but on closer inspection were found to be caused by a lack of communication during the account-opening process. "We realised many of these issues were happening in the early life of relationships," says Chin.

As a result, the firm decided to create a working group, which included sales, IT, operations, risk and portfolio management, to improve communications when on-boarding a client. This helped reduce the number of errors and near misses during that early process.

Elsewhere, the company has increased its focus on vendor risk management. AllianceBernstein uses more than 5,000 vendors – everything from custodians to firms delivering office supplies. Vendor risk management has been decentralised, with each business unit having its own process to vet, on-board and monitor their vendors. Chin says he recognised early on that a centralised vendor risk system for such a large number of vendors would be unwieldy, so he decided to take a risk-based approach, which narrowed the list down to several hundred, based on their access to the company's systems, data or premises. He then established firm-wide standards to on-board these vendors.

"This wasn't easy, because we have to consider the different types of vendors across the firm – from vendors who water the plants to vendors who settle our trades," says Chin. "But we ensured we mitigate the top risks we face as an organisation by having a consistent approach to evaluating vendors."

Issues are identified very early on, and operational risk is no longer seen as a barrier to product launches, but rather as an important part of a successful launch

Andrew Chin, AllianceBernstein

Another aspect of AllianceBernstein's operational risk programme is new product introductions. Fresh products create complexity, and complexity creates operational risk. So the company developed a unified approach, which involved asking new product teams to work with all relevant groups to ensure operational readiness. "If any group – operations, IT, risk, legal, compliance – is not ready, we delay launching the product," Chin says. "The process ensures the company is ready to take on [the] risk of new products up front, so we can develop the processes and tools to mitigate those risks."

Now, the company has become "a lot more streamlined in terms of our planning process for new products", he says. "Issues are identified very early on, and operational risk is no longer seen as a barrier to product launches, but rather as an important part of a successful launch."

Aside from learning from errors and near misses, Chin has tried to instil a commitment to continuous improvement by encouraging his team to learn from others in the industry. The asset management community tends to be collaborative and is willing to share information on issues of common concern, including operational risk, he adds. This has proven especially beneficial in finding out how other firms are managing regulatory risk and vendor risk.

"We regularly reach out to our counterparts at other asset management firms to learn how they've approached similar issues," he says. "Our willingness to learn from others in the industry has given us access to a wealth of ideas that allows us to become smarter."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

BPI says SR 11-7 should go; bank model risk chiefs say ‘no’

Lobby group wants US guidance repealed; practitioners want consistent model supervision and audit

We’re gonna need a bigger board: geopolitical risk takes centre stage

As threats multiply, responsibility for geopolitical risk is shifting to ERM teams

At BNY, a risk-centric approach to GenAI

Centralised platform allows bank to focus on risk management, governance and, not least, talent in its AI build

CROs shoulder climate risk load, but bigger org picture is murky

Dedicated teams vary wildly in size, while ownership is shared among risk, sustainability and the business

‘The models are not bloody wrong’: a storm in climate risk

Risk.net’s latest benchmarking exercise shows banks confronting decades-long exposures, while grappling with political headwinds, limited resources and data gaps

Climate Risk Benchmarking: explore the data

View interactive charts from Risk.net’s 43-bank study, covering climate governance, physical and transition risks, stress-testing, technology, and regulation

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Cyber insurance premiums dropped unexpectedly in 2025

Competition among carriers drives down premiums, despite increasing frequency and severity of attacks