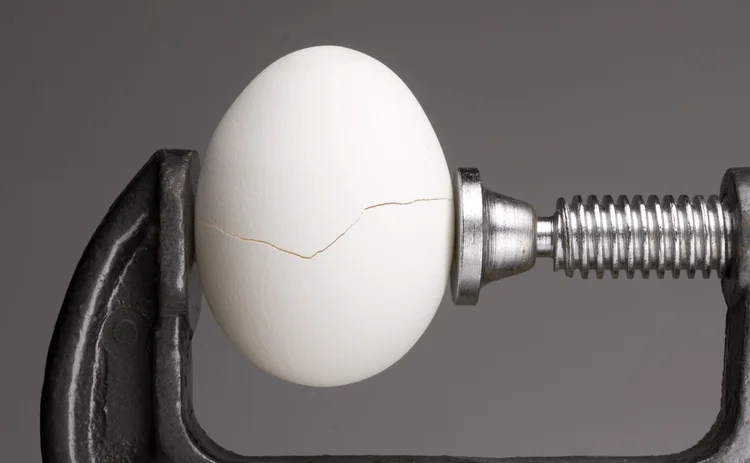

Banks brace for qualitative objections from CCAR

As US banks have bolstered their capital buffers, the focus of the Federal Reserve's annual stress tests is shifting towards data quality and governance

Judging by their dazzling resumes, bank risk managers have a knack for acing maths exams. That may explain why so few are sweating the quantitative portion of the US Federal Reserve Board's annual stress tests for US banks – the results of which were submitted to regulators on April 5.

This year, the Fed ramped up the difficulty with a severely adverse scenario that envisions a sharp economic

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Many banks yet to factor climate into credit risk models

More than a third of banks do not quantify climate risk impact on credit portfolios, study finds

At BNY, a risk-centric approach to GenAI

Centralised platform allows bank to focus on risk management, governance and, not least, talent in its AI build

We’re gonna need a bigger board: geopolitical risk takes centre stage

As threats multiply, responsibility for geopolitical risk is shifting to ERM teams

CROs shoulder climate risk load, but bigger org picture is murky

Dedicated teams vary wildly in size, while ownership is shared among risk, sustainability and the business

Climate Risk Benchmarking: explore the data

View interactive charts from Risk.net’s 43-bank study, covering climate governance, physical and transition risks, stress-testing, technology, and regulation

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

‘The models are not bloody wrong’: a storm in climate risk

Risk.net’s latest benchmarking exercise shows banks confronting decades-long exposures, while grappling with political headwinds, limited resources and data gaps

Cyber insurance premiums dropped unexpectedly in 2025

Competition among carriers drives down premiums, despite increasing frequency and severity of attacks