This article was paid for by a contributing third party.More Information.

How regulatory stress testing is shaping the future for banks

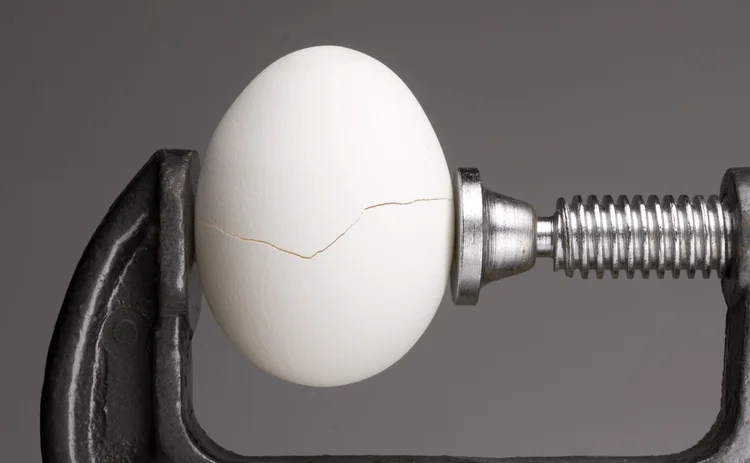

Out of the shortcomings exposed in banks' traditional risk management processes during the recent global financial crisis comes the critical need for improvement. Although the list of needed repairs is long and growing, one particular high-profile risk management requirement is subject to additional regulatory burdens and wider scrutiny: enterprise stress testing. Specifically, it is stress testing of future capital adequacy and often goes under the category of 'forward-looking' risk assessment.

The best known example is the Comprehensive Capital Analysis and Review (CCAR) requirement in the US. The reason given by the US Federal Reserve for this programme is to "ensure that institutions have robust, forward-looking capital planning processes that account for their unique risks and sufficient capital to continue operations throughout times of economic and financial stress." Should the US Federal Reserve find issues, it can act, and this could lead to the potential rejection of capital plans including dividends.

The CCAR process requires both banks and the regulator to analyse bank balance sheets and exposures in a way that is far more detailed and prescriptive than had been undertaken in other jurisdictions. This initiative is moving the industry away from general statements of expectations and basic top-down testing into more involved and invasive analysis. In particular, the European Central Bank and the Bank of England are looking to learn from the Fed with their planned stress-testing programmes and they are likely to issue similar requirements.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net