Risk magazine - Volume 22/Number 12

Articles in this issue

Solvency abuse

Giovanni Cucinotta, head of research at Italian insurance regulator Isvap, talks to Alexander Campbell

Information of interest

The flow of information in financial markets on future liquidity risk generates the rise and fall of demand for default-free bonds. Here, Dorje Brody and Robyn Friedman present an approach to pricing these bonds and the associated derivatives, based on…

Smile dynamics IV

Lorenzo Bergomi addresses the relationship between the smile that stochastic volatility models produce and the dynamics they generate for implied volatilities. He introduces a new quantity, the skew stickiness ratio (SSR), and shows how, at order one in…

Pricing the bail-out

In an introduction to this month’s Cutting Edge, Risk’s technical editor, Mauro Cesa, and assistant technical editor, Laurie Carver, look at a new model proposed by a former Risk magazine quant of the year, which attempts to quantify the effect of state…

Twenty-first century supervision

Much of the regulation governing banks was developed in the last century. But it is time to stop trying to supervise twenty-first century financial institutions with twentieth century oversight tools, argues David Rowe

Knock-on FX

Many banks are now including a credit charge in swap and forward transactions, while increased volatility has upped the cost of options. At the same time, the financial crisis has sparked a suspicion of complex products. How are corporate hedgers and…

Positioning repositories

Regulators on both sides of the Atlantic agree on the need for trade repositories to aid the monitoring of systemic risk. But there is a difference of opinion on where these repositories should be based, leading to the possibility that multiple trade…

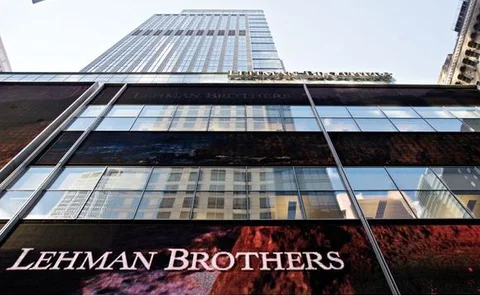

Winding down Lehman

In an exclusive interview with Risk, the administrators of Lehman Brothers International (Europe) discuss their role in handling the largest bankruptcy in corporate history, revealing how the process has raised questions about prime brokerage agreements,…

Less risk, less profit

Regulators are gearing up for a crucial meeting of the Basel Committee this month, which will finalise proposals on capital buffers, quality of capital and a leverage ratio. Sylvie Matherat, head of financial stability at the Banque de France, talks to…

Independent variable

A paper detailing alternative approaches to posting independent amount is expected to be jointly published by the International Swaps and Derivatives Association, the Managed Funds Association and the Securities Industry and Financial Markets Association…

Index clampdown

The growth of commodity index investments has lured an increasingly diverse investor base into commodities in recent years. But with new regulations due to be announced in December, could this process be thrown into reverse? Mark Pengelly reports

ABS retention tension

A report by the Committee of European Banking Supervisors last month criticised aspects of a proposal to require securitisation originators to retain 5% of exposures from 2011, while practitioners maintain the move will do little to align incentives…

CDS tested to the limit

Auctions to settle credit default swaps on media firm Thomson in October tested both the small bang protocol and the nerves of dealers. The outcome puzzled some market participants, while others have called for the removal of restructuring as a credit…

Risk technology rankings 2009

Financial institutions are under pressure to improve risk management processes, with a particular focus on liquidity risk, counterparty credit risk and enterprise risk management. It means many have had to turn to third-party vendors to upgrade their…

Capital punishment?

At a landmark meeting early this month, the Basel Committee will finalise its proposals for a host of measures, including counter-cyclical capital buffers and a leverage ratio. The consultation in early 2010 will be the industry’s last chance to fight…

Loan loss dynamics

The International Accounting Standards Board unveiled a new expected loss approach in November, following criticisms of the current incurred loss model. But European regulators have declared their preference for dynamic provisioning – and have even…

Scaling the peaks on 3s/6s basis

Some banks are drawing attention to a widening in the basis between three-month and six-month Euribor, as financial institutions are forced to use longer-term funding to eliminate mismatches on their balance sheets. How are banks responding? By Duncan…

OTC reforms built to last?

Reform of derivatives markets is gathering pace in the US ahead of a crucial debate in the House of Representatives. But questions remain over exemptions for corporate hedgers and foreign exchange swaps and forwards, meaning the final architecture of the…

Sponsored statement: Bucking the trend

OpenLink enjoys healthy double-digit growth, despite the downturn in the economy, thanks to a diversification of clients, asset classes and geographies. Kevin Hesselbirg, OpenLink’s chief executive officer, talks about the firm’s key projects and…