Risk magazine - January 2015

Articles in this issue

Sovereign risk manager of the year: IGCP

Portuguese debt office ensured clean exit from bailout while ending swaps disputes

OTC infrastructure service of the year: TriOptima

Risk Awards 2015: TriReduce to the rescue

OTC trading platform of the year: UBS Neo

Risk Awards 2015: Aggregation is a brave bet that has made UBS an agent for change

Hedge fund of the year: Napier Park Global Capital

Risk Awards 2015: Credit fund profited from October meltdown

Structured products house of the year: Bank of America Merrill Lynch

Risk Awards 2015: BAML a big player in record year for CLOs

Single-dealer platform of the year: Deutsche Bank

Risk Awards 2015: Evolving Autobahn praised for pricing, swap unwind tool

Interest rate derivatives house of the year: Deutsche Bank

Risk Awards 2015: German bank managed to marry efficiency with high margins

Clearing house of the year: LCH.Clearnet

Risk Awards 2015: UK clearer could unlock leverage ratio

First shots fired in new EU battle over CVA

EBA says "not a viable option" to ignore charge; MEP Ferber warns on business impact

The era of computational abundance – and its risks

Financial firms should plan for a time when they have more computing power than they need

Law firm of the year: Linklaters

Risk Awards 2015: CoCos and Co-Op were big wins for UK firm

Sef of the year: MarketAxess

Innovative approach finds best CDS prices often come from the buy side

Goldman hid swaps profits from clients, whistleblower claims

US bank accused of manipulating client valuation reports to mask profits

Credit derivatives house of the year: Citi

Risk Awards 2015: Strategic decisions made after the crisis paid off in 2014

Quants of the year: Christoph Burgard and Mats Kjaer

Risk Awards 2015: Barclays quants put FVA on solid ground

Asset manager of the year: DoubleLine Capital

Risk Awards 2015: Critics challenged to look at the data by fund branded ‘not rateable’

In-house system of the year: Danske Bank

Risk Awards 2015: CVA in 10 seconds on a MacBook Pro – Danske can do it

OTC client clearer of the year: Citi

Risk Awards 2015: US bank a hit with clients, despite headwinds

Trading technology product of the year (vendor): Algomi

Risk Awards 2015: Software is like Facebook for bond traders - but useful

Exchange of the year: Eurex

Risk Awards 2015: French and Italian bond contracts became popular hedges last year

Currency derivatives house of the year: BNP Paribas

Risk Awards 2015: French bank thrives on emerging markets and exotic risk

Risk solutions house of the year: Societe Generale

Risk Awards 2015: Bank arranged record margin loan in 30 days

Trading technology product of the year (bank): Morgan Stanley

Risk Awards 2015: US bank finds cure for forex fatigue

Lifetime achievement award: Andrew Feldstein

Risk Awards 2015: BlueMountain founder is at the centre of a changing market

Back-office technology product of the year: KPMG

Risk Awards 2015: KPMG drew on UK tax reporting to deliver hit product

Corporate risk manager of the year: Electricity Supply Board of Ireland

Risk Awards 2015: Utility found a new way to tackle bank break clauses

BCBS 239 – Principles for effective risk data aggregation and reporting

Sponsored forum: Risk data aggregation and risk reporting

Bank risk manager of the year: Deutsche Bank

Risk Awards 2015: Teamwork allowed bank to cut VAR by $30 million in three days

Deal of the year: Blackstone/Morgan Stanley

Risk Awards 2015: Bank arranged record margin loan in 30 days

Inflation derivatives house of the year: HSBC

Risk Awards 2015: UK bank married giant linker role with pension fund re-hedge

Risk management technology product of the year: IBM Risk Analytics

Risk Awards 2015: How 'hybrid cloud' helped China's Bloomberg

Credit portfolio manager of the year: Crédit Agricole

Risk Awards 2015: French bank shared trade finance exposure with World Bank

Derivatives house of the year: Societe Generale

Risk Awards 2015: French bank on the front foot as rivals retreat

Pension fund risk manager of the year: PKA

Risk Awards 2015: So smart, banks will pay to do business with Danish fund

Equity derivatives house of the year: Societe Generale

Risk Awards 2015: SG created a clever equity repo workaround, while Newedge acquisition adds heft

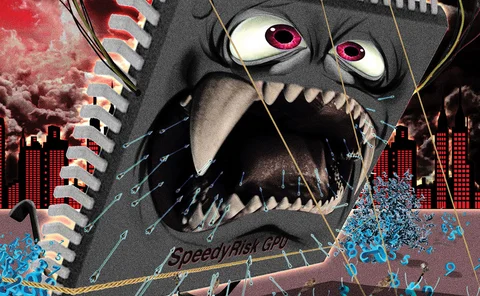

AAD vs GPUs: banks turn to maths trick as chips lose appeal

A maths trick is taking on – and beating – fancy chips as banks try to boost their computing power

Cutting edge introduction: The only way is backward

Quants find way to streamline future value calculations for exotic

West Wheelock Capital: removing rollover risk

Hedge fund seeking to broker long-dated collateral trades

End of the bumping grind?

In quest for processing power, banks are choosing 'unnatural' calculus over fancy chips

People: BAML appoints co-heads of global Ficc trading

Michele Foresti officially resigns from role after failing to receive regulatory approval