GRC buyer’s guide 2024

The core elements of a governance, risk and compliance (GRC) programme – risk management, compliance and audits – have been mainstays of business for decades. In recent years, there has been a growing call to transform the way in which these processes are managed to keep up with the rapidly evolving risk and compliance landscape. Traditionally siloed and ad hoc GRC processes are now giving way to a more connected, data-driven and agile GRC programme.

Download the Metricstream GRC buyer’s guide to understand:

• Why a well-designed and well-run GRC programme is important

• The kinds of GRC solutions available

• How to select the right solution

• MetricStream BusinessGRC

Download the whitepaper

Register for free access to hundreds of resources. Already registered? Sign in here.

More related resources

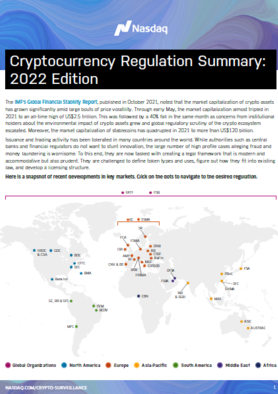

Cryptocurrency Regulation Summary: 2022 edition

The market capitalization of crypto assets has grown significantly amid large bouts of price volatility. Moreover, the market capitalization of stablecoins has quadrupled in 2021 to more than US$120 billion.

How North American Capital Markets Firms Derive Maximum Insight from their Data and Analytic Tools

This report is based on a WatersTechnology survey commissioned by TIBCO and completed in October 2021.

4 ways to bolster cyber risk management and compliance

Since the pandemic, cyber threats against organizations have intensified.

Outrunning risk with cloud

Supercharged risks are running circles around banking risk models. Here’s how the cloud can keep you one step ahead.

Leveraging data in e-FX trading

In a world where electronic trading has infiltrated virtually every aspect of today’s FX market, having access to data and the means to interpret it are fundamental components of a successful e-FX strategy, writes Daniel Chambers, head of Data & Analytics at BidFX.