Fintech and regtech: Leading the evolution and regulation of alternative investments

Natasha Bansgopaul

Foreword

Preface

Preface

Introduction: Suptech/regtech defined: Payments, sandboxes and beyond

The uncertain prudential treatment of cryptoassets

US regulatory certainty versus uncertainty for crypto and blockchain

Bermuda: Suptech and regtech supporting the risk-based approach

Suptech: A new era of supervisory philosophy

Cloud computing in the financial sector: A global perspective

DeFi protocol risks: The paradox of cryptofinance

IT transformation in the Prudential Authority of South Africa: A case study

Making the vision a reality: Perspectives from the Monetary Authority of Singapore

Lessons from Hong Kong through the lens of the HKMA

Technological change: Is it different this time?

The ECB’s suptech innovation house: Paving the way for digital transformation of banking supervision

China’s financing opening up and regulatory convergence with the world

Disclosures and market discipline: The promise of regtech

Regtech and new derivatives developments

Fintech and regtech: Leading the evolution and regulation of alternative investments

The role of artificial intelligence and big data in investment management

The promise and challenges of machine learning in finance

Data privacy and alternative data

Digital ID and financial inclusion

Strategic technology: Regulation and innovation of CBDCs

Regulatory sandboxes: Innovation and financial inclusion

Technology and sandbox development innovation in a transitional market: A case study

Developing the regulatory ecosystem: The evolution of stablecoin

Central bank digital currency, regtech and suptech

Digital dollar: Cryptocurrency for everyday commerce

CFTC regtech implications for virtual currency trading

Fintech, regtech, suptech and central bank decision making

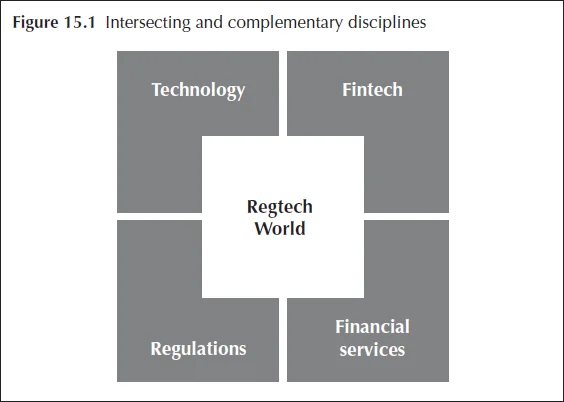

Financial technology (fintech) and alternative investments (alts) are two of the most prevalent concepts to have emerged in financial services over recent years. This chapter will promote the view that the development and growth of fintech innovations, as well as regulatory technology (regtech), have been key catalysts for growth in this developing asset class. Resulting new investment opportunities have also evolved with new new-to-industry concepts and delivery asset allocation methods throughout an industry that is historically conservative, slow and hesitant to change.

The potential benefits from the utilisation of advances in technological tools and solutions can no longer be ignored. The fintech “boom” has also introduced opportunities for new regulatory oversight solutions and efficiencies in compliance and asset management. However, this growth can only be sustained and supported by the introduction and adoption of corresponding tools aligned to fostering innovation in regtech. For regulators, regtech and supervisory technology (suptech) engender more efficient oversight and investor acceptance of growing asset classes, including alts

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net