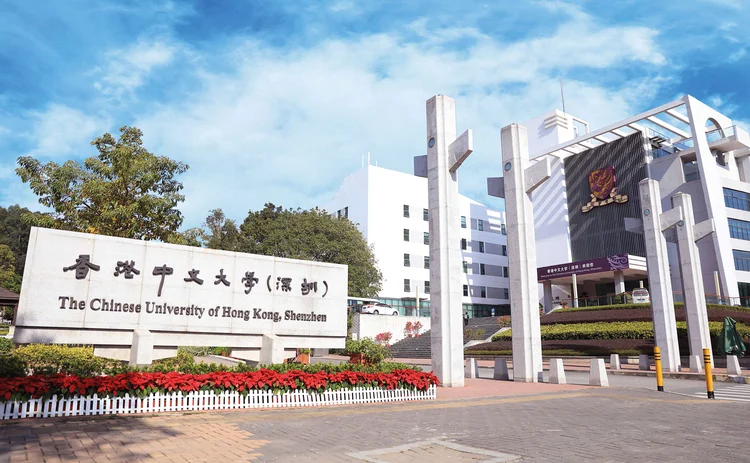

Quant Guide 2020: Chinese University of Hong Kong, Shenzhen

Shenzhen, China

A newcomer to Risk.net’s quant guide, the Chinese University of Hong Kong, Shenzhen is a joint institution created by the Chinese University of Hong Kong, based in Shatin, Hong Kong, and Shenzhen University in mainland China. Under Chinese law, foreign institutions are not allowed to establish campuses on Chinese soil without a domestic sponsor or partnership. Thus, the university is technically a separate institution from CUHK.

In practice, however, academics often work for both. Among those is professor of systems engineering and engineering management Nan Chen, programme director of the joint university’s Master of Science in Financial Engineering, as well as overseeing an undergraduate financial technology degree programme at CUHK. The master’s degree, which was established in 2015, is completed over two years with three seasonal semesters in each, if completed on a full-time basis; the programme had no part-time students in the most recent cohort. It is also one of the more gender-balanced programmes in this year’s guide, with women making up 45% of the student body.

Requirements include classes in stochastic methods, derivatives pricing and an introductory course in Chinese financial markets. As electives, students can take computational methods in financial engineering, credit risk modelling and algorithmic trading. More fintech content has recently been added to the programme as well as campus talks by industry practitioners, says associate professor of practice in financial engineering Raymond Tsang. The new modules, he adds, include topics on data mining and machine learning.

The industrial talks tend to focus on artificial intelligence, big data and blockchain – appropriately, given that Shenzhen is often called China’s Silicon Valley. The programme also gained new personnel in the last year – Olivier Cotard and Ma Xiaofeng joined its pool of 24 instructors, drawn from the Shatin and Shenzhen schools.

The programme, like many others in this year’s guide, is seeing something of a shift in the career paths of its graduates. More students, Tsang says, are joining tech and fintech companies than in the past. The new crop of employers includes tech firm Tencent, AI software provider SenseTime and digital lender WeBank.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show