Quant Guide 2017: NYU Tandon School of Engineering

New York City, USA

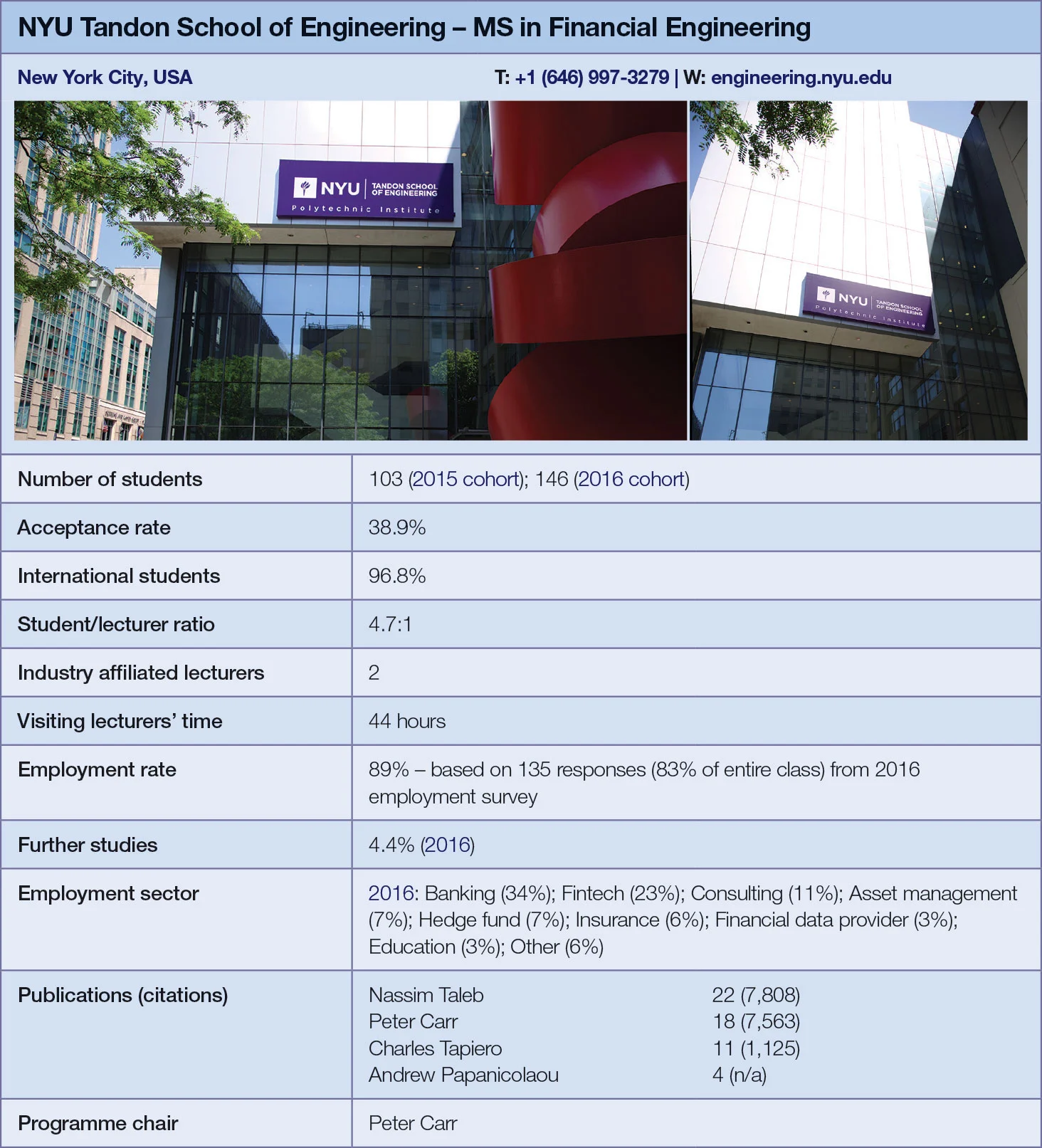

MS in Financial Engineering | metrics table at end of article

In 2015, New York University’s Engineering School was renamed the NYU Tandon School of Engineering in recognition of the generosity of its benefactors – Chandrika and Ranjan Tandon, entrepreneurs who donated $100 million to the school.

According to Peter Carr, chair of the master of science in financial engineering programme, the largesse “prompted changes – brand-new facilities, as well as a dedicated career placement director who came from the industry”.

The revamp could help explain a sharp rise in the number of applicants for this competitive postgraduate-level programme: since 2016, there has been a 25% increase in applications. In 2016, 150 students were admitted. Big intakes do not always translate into bigger class sizes, though: the average group size per course is around 15 people.

The programme seeks to prepare its students for the shifting focus of the financial sector, says Carr, himself the former global head of market modelling at Morgan Stanley and winner of Risk’s quant of the year award in 2003.

“There’s an emerging use of quants to run portfolios. A lot of hedge funds in New York have gone from a hands-on to a quantitative approach to portfolio management,” he says.

The programme’s managers also actively look to recruit industry practitioners: in the past year, eight industry professors joined the faculty. This helps the programme stay up-to-date on areas of growing importance to financial firms, such as artificial intelligence and deep neural networks. This is complemented by the presence of influential academics such as Nassim Taleb, Charles Tapiero and Andrew Papanicolau.

The two-year programme offers four tracks: financial markets and corporate finance; computational finance; technology and algorithmic finance; and risk finance.

Regardless of the track they choose, all students complete the same core modules: financial accounting; economic foundations in finance; quantitative methods in finance; corporate finance; and financial risk management and asset pricing. Students are also required to take a number of compulsory and elective modules as part of their track, supplemented by general electives available to everyone in the programme.

Students from all tracks, apart from risk finance, must select a practical applied lab course from a range of options concentrated on programming and computational finance. Students opting for the financial software engineering laboratory, for example, may contribute to an open-source financial software project, or develop a package for a common financial programming language.

Another core requirement is the completion of a so-called ‘capstone’ experience. This could take one of four forms: a master’s thesis, defined as a work of original research into the theory or practice of financial engineering; a project, in which the student works with a mentor to create a tool or analysis of potential value to the financial community; the completion of two or more designated special topics from the syllabus, followed by a written paper outlining potential advances in these fields; or the completion of an appropriate industry internship.

In addition to offering a wide range of courses as part of its syllabus, the programme also gives students an opportunity to participate in an intensive quantitative boot camp – an optional week-long course that students can choose to take between their first and second year after their internship.

The course provides students with 50 hours of lectures and practice sessions, and offers networking opportunities with practitioners from banks, hedge funds, asset managers and consulting firms.

The workshop is run by Attilio Meucci, chief risk officer of hedge fund KKR and founder of Advanced Risk and Portfolio Management, a company that provides training in advanced quantitative risk and portfolio management across the financial sector. Participants are expected to have prior knowledge of linear algebra, multivariate calculus and statistics.

The boot camp is designed to provide participants with improved quantitative risk management and quantitative decision-making skills. The topics covered in the sessions include portfolio construction, liquidity, trade execution, factor modelling, estimation and data mining, risk modelling, and optimisation.

Competition is encouraged in industry events: students get sponsorship to participate in the Rotman International Trading Competition, the International Association for Quantitative Finance academic competition and the University Trading Challenge at Temple University.

Click here for links to the other universities and an explanation of how to read the metrics tables

Correction, June 21, 2017: The visiting lecturers’ time in the table has been corrected to 44 from zero to reflect updated data from the school, which now includes visiting lecturer hours from lecture series and seminars rather than just courses.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director