Invesco

Europe’s Ucits funds: Made in the USA

Counterparty Radar: EU retail funds market is a prime example of Trump’s miscalculation on trade

Vanguard stages swaptions comeback

Counterparty Radar: Deutsche grew book to $11 billion in Q1 to become largest non-US swaptions dealer to mutual funds

Citi halves swaptions book with US retail funds

Counterparty Radar: Mutual funds and ETFs cut exposures by 22% in Q4

Invesco more than triples size of its FX options book

Counterparty Radar: Manager’s portfolio exceeded $5bn notional in Q4

Term SOFR derivatives creep into US fund holdings

Global Atlantic shows sizeable swaps position against the new benchmark as other managers ease into trading

US mutual funds’ passion for LatAm FX options undimmed in Q3

Counterparty Radar: Carry trade opportunities see managers’ positions increase tenfold in 2023

Buy-side traders opt for derivatives automation in pursuit of timing and pricing precision

Increased capacity and efficiency have been key drivers of automation, with the introduction of new technologies at the trading venue level facilitating the implementation of new trading styles. Exploring the impact of high-volume trading and expanding…

BlackRock, Pimco slash mutual fund swaptions books

Counterparty Radar: US retail funds retreat from trade as Morgan Stanley becomes top dealer in Q2

Invesco is first US mutual fund to trade €STR swaptions

Counterparty Radar: Trades were some of just a handful of €STR swaptions to hit the market this year

Large US funds shrink exposure to top FX forward counterparties

Smaller managers increase top-dealer allocations as big beasts pull back

Morgan Stanley scores big with swaption trades

Counterparty Radar: Mutual funds increase pace of transition from USD Libor to SOFR in Q4 2022

MMFs’ reverse repos with Fed surged 35% last year

Fidelity-run funds drove 29% of the $601 billion in new trades

Keep risk parity simple, stupid

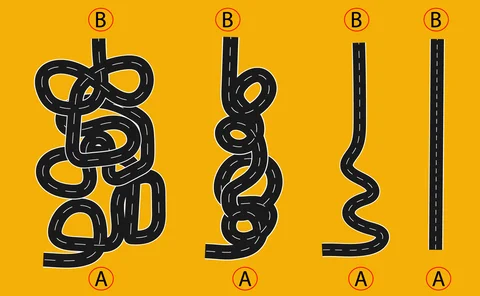

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

State Street flies high in FX forwards as Goldman, Citi dive

Counterparty Radar: Goldman loses half of market share, drops out of dealer top 10

Non-transparent ETF spreads are tighter than transparent ones

Non-transparent ETFs don’t disclose what they own. Market-makers have worked it out anyway

PGIM credit options binge lifts Barclays, Morgan Stanley

Counterparty Radar: Insurer’s AM arm doubled its market share in Q4 2021 as bought protection swells

Funds forced to estimate value of Russian securities

Western asset managers can sell Russian shares from April 1. But they have to value them by March 31

Fillip for credit-sensitive rates as Axi, Critr advance

IHS Markit makes benchmarks available for live products; Invesco appointed as Axi administrator

Morgan Stanley on heels of Goldman in Q3 CDS data

Counterparty Radar: Sold protection, corporate names fuel growth in US funds’ single-name books

US funds pile into LatAm interest rate swaps

Counterparty Radar: Managers still enamoured of non-G10 pairs in Q2, with BRL volumes now up 104% year-to-date

No fair: buy side takes on pricing problem in FX forwards

Interest in TCA is growing as new data sources offer glimpse into murky swaps and forwards market