Freddie Mac

Fannie, Freddie mortgage buying unlikely to drive rates

Adding $200 billion of MBSs in a $9 trillion market won’t revive old hedging footprint

Finra head recognises ‘challenges’ for bond transparency drive

Cook says regulators thinking about industry’s operational and liquidity concerns

Risk culture 2.0: redefining attitudes and behaviours in an era of change

The world is a very different place than it was prior to the Covid-19 pandemic. From changing work patterns and operational change to geopolitical tensions and rampant inflation, risk departments have never been under so much pressure

Gensler calls for enhanced US bond market transparency

SEC chief advocates shorter Trace reporting delay, public dissemination of Treasuries trades

Show, don’t tell, on op resilience – Fed examiner

OpRisk North America: banks warned of “disconnect” between theory and practice

Establishing an effective conduct risk framework

The stakes have never been higher when it comes to conduct risk. Regulators now look to hold senior managers personally liable for the misconduct of their employee populations and, with teams more globally dispersed, managing conduct and culture is more…

US banks cede to SOFR lending as credit hopes fade

Critics of risk-free rate say dynamic spread will be too late for transition

New Tradeweb/IBA benchmark tipped as ‘competitor’ to SOFR

Forward-looking risk-free rate aimed at US mortgage market could have broader applications

Left out of Fed action, lower-rated CMBS overheat

BBB yield-to-worst spirals as highly-rated bonds recover after central bank and government intervention

Hedging adviser of the year: Chatham Financial

Risk Awards 2020: Hedge accounting solution helps Freddie Mac tackle P&L swings from loan hedges

Dodge & Cox turns to MBS as Treasury yields rise

Income Fund grows securitised allocations from 36.1% to 39.7%

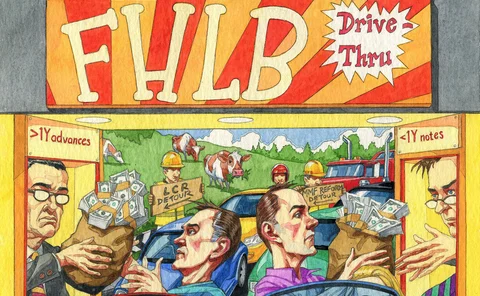

FHLBs: safe as houses?

Health of huge bank funder rests on home loans and money market funds

Soaring Fed Home Loan Bank borrowings spark systemic risk fears

Parallels drawn with Fannie and Freddie as commercial bank borrowing from FHLBs nears $500bn

SSA deal of the year: Fannie Mae

Risk Awards 2017: Mortgage giant refines risk-sharing deals as political landscape shifts

Dynamic credit score modeling with short-term and long-term memories: the case of Freddie Mac’s database

This paper investigates the two mechanisms of memory, short-term memory and long-term memory, in the context of credit risk assessment.

Freddie Mac reviews $600bn hedge book as losses mount

Swap spread inversion contributed to derivatives losses of $2.7 billion in 2015

Hedge funds, leverage and mortgages: why Fannie and Freddie's new deals worry some experts

Hedge funds have been keen buyers of the new mortgage risk-sharing deals issued by Fannie Mae and Freddie Mac, but as spreads have tightened, worries about leverage have grown. Some now argue mortgage finance requires a more stable source of capital. By…

UBS 'unethical' in mortgage-backed securities pricing

UBSGAM settles SEC mispricing charges for $300,000

Fannie Mae CEO steps down

Williams to leave agency once replacement is found