Fannie Mae

Fannie, Freddie mortgage buying unlikely to drive rates

Adding $200 billion of MBSs in a $9 trillion market won’t revive old hedging footprint

US banks cede to SOFR lending as credit hopes fade

Critics of risk-free rate say dynamic spread will be too late for transition

New Tradeweb/IBA benchmark tipped as ‘competitor’ to SOFR

Forward-looking risk-free rate aimed at US mortgage market could have broader applications

Left out of Fed action, lower-rated CMBS overheat

BBB yield-to-worst spirals as highly-rated bonds recover after central bank and government intervention

Investors cheer debut Fannie SOFR note launch

Healthy demand could have been higher if S&P had approved benchmark

Dodge & Cox turns to MBS as Treasury yields rise

Income Fund grows securitised allocations from 36.1% to 39.7%

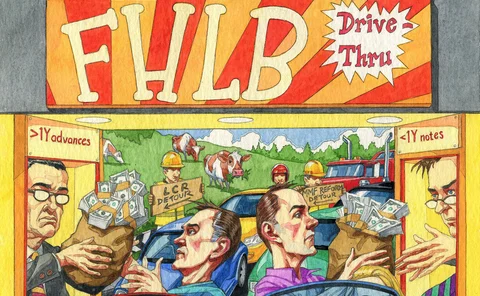

FHLBs: safe as houses?

Health of huge bank funder rests on home loans and money market funds

Soaring Fed Home Loan Bank borrowings spark systemic risk fears

Parallels drawn with Fannie and Freddie as commercial bank borrowing from FHLBs nears $500bn

SSA deal of the year: Fannie Mae

Risk Awards 2017: Mortgage giant refines risk-sharing deals as political landscape shifts

Hedge funds, leverage and mortgages: why Fannie and Freddie's new deals worry some experts

Hedge funds have been keen buyers of the new mortgage risk-sharing deals issued by Fannie Mae and Freddie Mac, but as spreads have tightened, worries about leverage have grown. Some now argue mortgage finance requires a more stable source of capital. By…

UBS 'unethical' in mortgage-backed securities pricing

UBSGAM settles SEC mispricing charges for $300,000

Fannie Mae CEO steps down

Williams to leave agency once replacement is found

SEC charges against Fannie Mae and Freddie Mac execs are 'effort to rehabilitate reputation'

Securities fraud charges brought against former top executives seen by one legal expert as attempt by regulator to improve image

The Hartford appoints Rupp as chief risk officer

Fortune 500 group The Hartford appoints new executive vice-president and chief risk officer

Deloitte sued for $7.6 billion after ignoring 'red flags' in TBW fraud

Deloitte has been sued by TBW's bankrupty trustee and a TBW subsidiary for $7.6 billion in losses, after failing to detect fraud in the mortgage lender

US tax fix smoothes way for back-loading buy-side portfolios

US tax fix to aid buy-side portfolio back-loading

Fannie Mae says FHFA's margin rules would drive up hedging costs

US mortgage giant says segregating variation margin will hurt FHFA- and FCA-regulated entities, and create new funding obligations for swap dealers

US lawmakers push for domestic covered bonds market

Home grown: a domestic US covered bond market