Association for Financial Markets in Europe

Can Europe prepare ground for insurers in securitised products?

Convincing regulators to make investing more viable would be a first step to revitalising insurer interest

EU lawmakers’ demand for local capital floors alarms banks

Multiple output floors applied to each entity raises fears of capital increase for large groups

People moves: Barclays switches CEO in post-Staley refresh, and more

Latest job changes across the industry

EU offers reprieve for fund-linked derivatives trades

Banks hope FRTB draft allowing fund managers to supply standardised inputs will cut risk weights

New FRTB timeline makes Europe’s reporting phase ‘obsolete’

European Commission pencils in capital requirements to start at the same time as reporting exercise – or even before

Firms doubt benefits of EU Mifid best execution reform

Esma proposal retains unpopular aggregated reporting; bankers want more cost-benefit analysis

Weather, or not: is climate risk just part of credit risk?

Practitioners divided on whether climate risk can fit into existing credit risk weights

Banks and HFTs team up to solve exchange outage dilemma

Hopes that ‘gentlemen’s agreement’ can break first-mover disadvantage for liquidity providers

EU banks fret over mismatches on ESG disclosure rules

Different timelines for banks and their clients could stymie comparisons between banks

EU targets late 2024 for FRTB internal model reporting

Final IMA rules to be adopted in mid-2021 with three-year implementation period

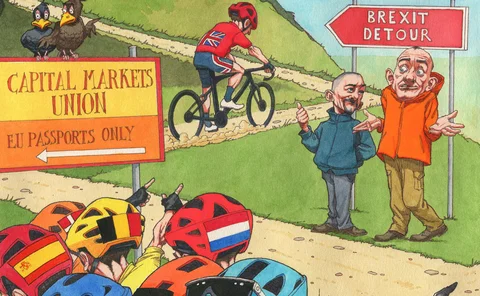

The lonely Londoners: doubts plague UK quest for equivalence

Planned MoU won’t automatically bring equivalence, leaving firms in limbo for unknown duration

Parallel lines: EU begins fight over Basel output floor

Leaked plan to exclude buffers from floor would please EU banks, could anger Basel and US

EBA’s software compromise draws fire on two fronts

UK regulator suggests it will neuter the proposed capital relief, which banks say doesn’t go far enough

Rewards for failure: the ECB’s topsy-turvy market risk relief

Eurozone banks with better models are least able to offset Covid-driven rise in backtesting multiplier

EU banks seek FRTB delay, citing ‘strain’ of virus

Firms want leeway to fight market mayhem, minus burden of new reporting rules

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Structural snags frustrate STS for synthetics

Curbs on excess spread and collateral stymie route to ‘high-quality’ signifier

People moves: ING fills two top roles, RBS confirms Rose as CEO, and more

Latest job changes across the industry

Critical EU benchmarks to be approved by year-end

Authorisation of Euribor is being expedited and could be granted in the summer

Confusion dogs start of Europe’s new securitisation rules

Incomplete rules and lack of clarity on designated supervisors thwarts hoped-for revival of key market

European lawmakers water down proposed no-action powers

ESAs to advise rather than postponing rules themselves; experts warn tool may be too slow to use