The World’s Fastest File System for Financial Services

Speed. Agility. Storage. In financial services, the need has never been greater. A new breed of applications in technical computing, analytics, and deep learning have placed unprecedented demands on financial services for storage I/O, throughput, latency, and scalability. Which makes Hitachi Content Software for File’s unique features and capabilities more important than ever to your organization.

Hitachi Content Software for File’s performance and scalability deliver high-velocity analytics that can differentiate your financial services and give you a competitive advantage. Hitachi Content Software for File gives you:

- NVIDIA® Magnum IO GPUDirect® Storage Solves the I/O Bottleneck

- Highest performance for algorithmic trading, portfolio analysis, and risk management

- Security, data protection, and disaster resiliency

Download the whitepaper

Register for free access to hundreds of resources. Already registered? Sign in here.

More related resources

Capitalising on CMBS

Maximising value from better risk management and deal efficiency

This Risk.net survey and white paper, commissioned by SS&C Intralinks, assesses the outlook for the CMBS market in the US and Europe, charts the changing risk management priorities of issuers and investors, and reveals the key opportunities to drive efficiency and maximise value in the deal process.

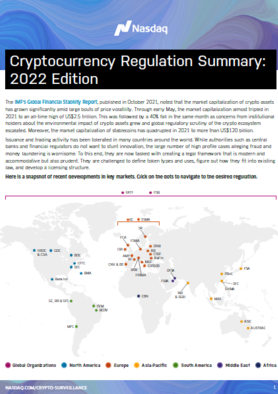

Cryptocurrency Regulation Summary: 2022 edition

The market capitalization of crypto assets has grown significantly amid large bouts of price volatility. Moreover, the market capitalization of stablecoins has quadrupled in 2021 to more than US$120 billion.

How North American Capital Markets Firms Derive Maximum Insight from their Data and Analytic Tools

This report is based on a WatersTechnology survey commissioned by TIBCO and completed in October 2021.

Data to anchor a new age of risk management

Today, modern enterprises must tackle unstructured data, semi-structured data and data with high variety, velocity and volume. But current data systems for compliance cannot perform the requisite advanced analytics that require scale.

New QuantTech platforms paving way for more effective trading operations

In this paper, Chief Product Officer, Satyam Kancharla shares his expert take on QuantTech solutions.