Financial crimes regulatory review - January 2022

It has been a significant twelve months for anti-money laundering (“AML”) and financial crimes regulators in the rulemaking process. The AML Act of 2020 (“AMLA”) represents one of the most impactful pieces of anti-money laundering, counter-terrorist financing, and anti-corruption-related legislation in recent years.

The international AML regulatory framework is being drawn more closely together as part of combined approach to fight money laundering, financial crime, terrorist financing, and corruption.

This whitepaper will review some of the legislative and regulatory activity in the last 12 months in what has been an extremely active year particularly in the US.

Download the whitepaper

Register for free access to hundreds of resources. Already registered? Sign in here.

More related resources

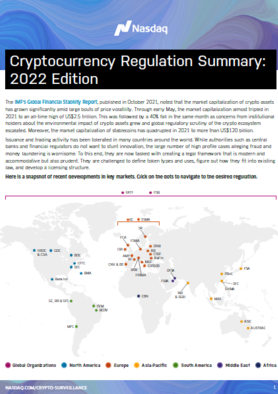

Cryptocurrency Regulation Summary: 2022 edition

The market capitalization of crypto assets has grown significantly amid large bouts of price volatility. Moreover, the market capitalization of stablecoins has quadrupled in 2021 to more than US$120 billion.

How North American Capital Markets Firms Derive Maximum Insight from their Data and Analytic Tools

This report is based on a WatersTechnology survey commissioned by TIBCO and completed in October 2021.

4 ways to bolster cyber risk management and compliance

Since the pandemic, cyber threats against organizations have intensified.

Outrunning risk with cloud

Supercharged risks are running circles around banking risk models. Here’s how the cloud can keep you one step ahead.

Leveraging data in e-FX trading

In a world where electronic trading has infiltrated virtually every aspect of today’s FX market, having access to data and the means to interpret it are fundamental components of a successful e-FX strategy, writes Daniel Chambers, head of Data & Analytics at BidFX.