Revisiting the challenge to delivering a status of operational resilience in financial markets through an integrated risk management approach

Much before the COVID-19 pandemic, regulators were already focusing substantially on regulations and reporting standards to ensure compliance by the board and senior management, delivering a determined level of operational resilience.

In the UK, the Bank of England (BoE), the Financial Conduct Authority (FCA), and the Prudential Regulation Authority ( PRA) published a joint discussion paper on Operational Resilience in 2018 followed by a joint consultation paper in 2019 with the primary objective of promoting the operational resilience of firms and financial market infrastructures (FMIs). Similar efforts were made by regulators in other jurisdictions. In the European Union, draft legislation, Digital Operational Resilience Act (DORA), was published in 2020.

In the U.S., federal bank regulatory agencies released a paper in October 2020 outlining sound practices for large banks to help them enhance operational resilience.

Given the continued market focus on this subject, this eBook aims to present prevailing views from across industry professionals and consultants. It explores what operational resilience really means in practice and how organizations can gain a view and report to the board, investors, and regulators in an agile and meaningful fashion to attest to their “State of Operational Resilience”.

Download the whitepaper

Register for free access to hundreds of resources. Already registered? Sign in here.

More related resources

Capitalising on CMBS

Maximising value from better risk management and deal efficiency

This Risk.net survey and white paper, commissioned by SS&C Intralinks, assesses the outlook for the CMBS market in the US and Europe, charts the changing risk management priorities of issuers and investors, and reveals the key opportunities to drive efficiency and maximise value in the deal process.

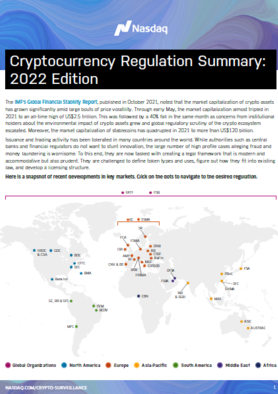

Cryptocurrency Regulation Summary: 2022 edition

The market capitalization of crypto assets has grown significantly amid large bouts of price volatility. Moreover, the market capitalization of stablecoins has quadrupled in 2021 to more than US$120 billion.

How North American Capital Markets Firms Derive Maximum Insight from their Data and Analytic Tools

This report is based on a WatersTechnology survey commissioned by TIBCO and completed in October 2021.

Data to anchor a new age of risk management

Today, modern enterprises must tackle unstructured data, semi-structured data and data with high variety, velocity and volume. But current data systems for compliance cannot perform the requisite advanced analytics that require scale.

New QuantTech platforms paving way for more effective trading operations

In this paper, Chief Product Officer, Satyam Kancharla shares his expert take on QuantTech solutions.