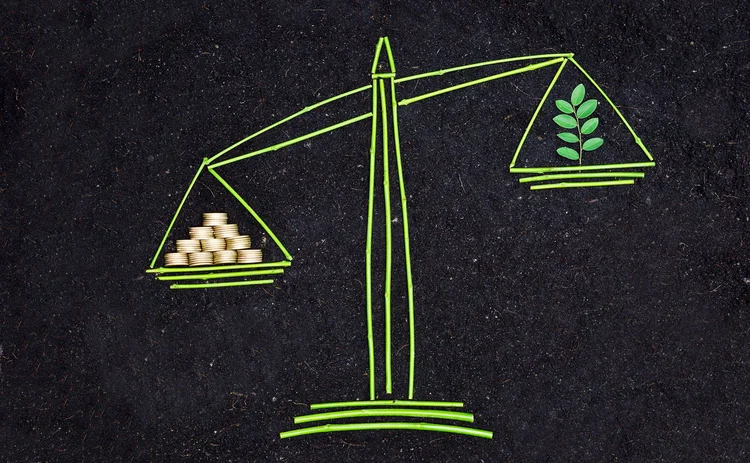

Climate capital in the balance as EBA rejects green risk weights

European regulator suggests climate change must be factored into existing risk categories

You might say bankers’ concerns about climate risk-weighting are evergreen. Banks have long been sceptical about bespoke risk weights that benefit green-friendly deals and penalise those that aren’t. And now, the European Banking Authority has arrived at the same conclusion.

But that doesn’t mean banks are happy with the regulator’s proposed alternatives. Far from it.

“It’s all pushed back to the banks,” says Michel van den Berg, a sustainability adviser who has worked with the major Dutch banks.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Why the survival of internal models is vital for financial stability

Risk quants say stampede to standardised approaches heightens herding and systemic risks

Crypto custody a bit(coin) closer after US accounting U-turn

Federal banking supervisors expected to eventually relax regimes for safeguarding digital assets

Japan’s regulator stands firm behind Basel as peers buckle

Japanese banks fear being at a disadvantage to rivals as Basel III implementation falters

EU racing to comply with active account rules

Industry wants simpler route to exemptions ahead of ‘challenging’ deadline for new clearing regime

CFTC acting chair: ‘We don’t need a Dodd-Frank for crypto’

US regulator wants real-time market surveillance; focuses on rise of liquidity risk

Large banks safer for CCPs than they get credit for

Plentiful pre-positioned liquidity softens the blow of resolution, new research argues

Basel uniformity fades as members defy dress code

Rule-makers diverge from Basel III standards, denting aims of comparability and fuelling fears over fair competition

Fate of US Treasury clearing deadline to be decided at crunch meeting

Isda chief predicts delay as clearing houses await confirmation of go-live dates

Most read

- Banks urged to track vendor AI use, before it’s too late

- Japan’s regulator stands firm behind Basel as peers buckle

- Basel uniformity fades as members defy dress code