This article was paid for by a contributing third party.More Information.

Collateral resilience is more than just understanding initial margin

New regulations and extreme global events are seeing initial margin (IM) requirements rise in prominence, with investment managers needing to focus on more than just their regulatory and operational compliance

Volatility and trading risk

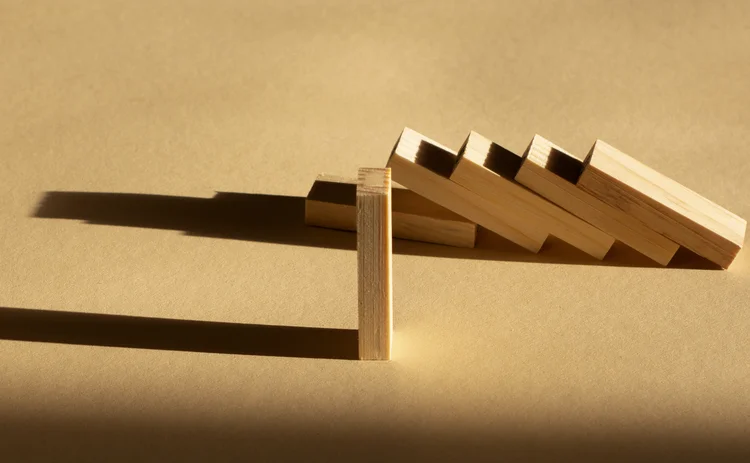

The volatility we have seen across derivatives markets in recent years has presented many challenges to portfolio and risk managers, but one area that has become more significant in recent volatile periods has been the swings in margin requirements to support derivatives portfolios. This impact has been across the board, but recently has been highlighted in areas such as commodities and emerging markets. In addition, increasing regulation – specifically the roll-out of the uncleared margin rules – has broadened the amount of the portfolio that needs to be collateralised, which has created even more stress on collateral demands and meeting counterparty obligations.

We have seen many recent examples of outsized swings in margin requirements that have forced firms to unwind positions or, in some cases, suffer more severe consequences, with some firms forced to cease trading altogether. Two recent examples include an energy firm whose margin has gone up by 600%, and a wealth manager that had to unwind $400 million of positions in the volatile markets of 2020.

Having to back out of trading positions or take losses because of collateral liquidity issues is the last thing any risk manager should countenance.

We are therefore seeing many firms’ kick-off initiatives to strengthen their collateral processes and transparency, as well as raise awareness of the need for collateral resilience as a key control point in the trade control matrix.

What is collateral resilience?

What does this really mean? In essence, collateral resilience is an operating model that ensures there is sufficient collateral available to cover all trading demands, and specifically the unexpected impact of volatile markets.

This means putting post-trade management at the core of the trade control process, alongside compliance, market risk and credit risk management, and implementing tools to track collateral impact from pre-trade, through the lifecycle, until close out.

Given the siloed nature of technology and data in many firms, the exact implementation of a collateral resilience programme will vary, but it should include the following core pillars:

Pillar 1 – Margin optimisation

By using tools such as pre-trade margin checks or post-trade rebalancing, it is often possible to reduce the margin requirement across the portfolio. This reduces the ultimate need for collateral and is thus a key foundation of the entire resilience model.

Pillar 2 – Collateral optimisation

A robust collateral optimisation model will reflect the true value of collateral inventory to the firm, including trading demands and funding costs. A mathematical optimisation can then be applied that ensures the largest possible amount of high-quality liquid asset is retained in the unencumbered pool to allow flexibility when shocks arrive.

Pillar 3 – Forecasting and stress-testing

As with market risk and any other risk control model, it is important to project future potential impacts, and therefore stress-test your books against high-risk scenarios. For collateral resilience, this involves stressing trade levels, margin levels and collateral values, as well as legal terms with counterparts such as eligibility schedules.

Challenges

Of course, none of this is easy to implement and there are common challenges that many firms encounter, including:

- Understanding inventory availability and collateral mobility across the firm. Too often, firms default to posting cash or US Treasuries when they are holding other eligible assets or could easily source alternative collateral assets.

- Integration across business lines. Collateral resilience requires a firm-wide solution that ensures all obligations are met and all sources are utilised. Bilateral, cleared, exchange-traded derivatives and prime brokerage portfolios are often segregated at both business and technology levels, and harmonising across these boundaries has many obstacles.

- Changing business workflows to implement dynamic intraday or pre-trade controls is not simple, as it requires changes to both order staging and execution systems.

- Implementing post-trade optimisation and forecasting requires support for a multitude of counterparty risk and margin models.

- With collateral held at multiple, internal and external sources, firms may struggle to create an all-inclusive, real-time view of their collateral.

Summary

IM has become the topic du jour as a result of new regulations and recent extreme global events. The increasing demand for collateral means investment managers of all styles are required to focus on more than just their daily regulatory and operational compliance. They must also ensure the collateral function can guarantee the ability to support derivatives trading in all market conditions.

Collateral risk is a real risk and should be controlled and monitored with equal focus to that of market and credit risk. This requires a strategic approach with integration across business lines and technology silos, and novel tools that allow for sophisticated control and transparency.

Initial margin – Special report 2022

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net