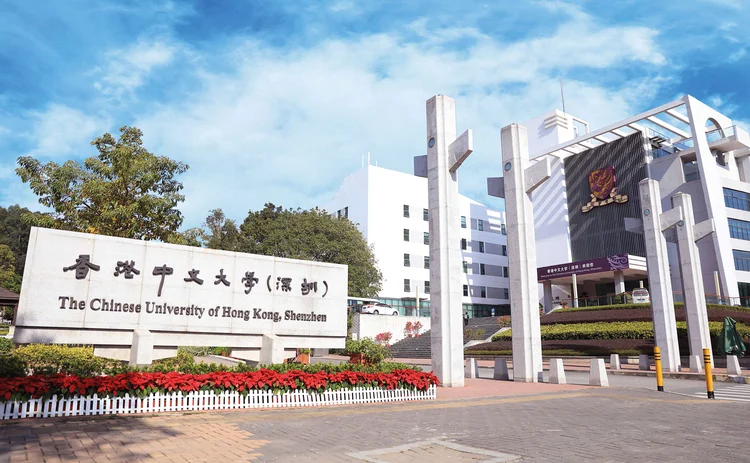

Quant Guide 2022: Chinese University of Hong Kong, Shenzhen

Shenzhen, China

The Chinese University of Hong Kong, Shenzhen – an institution run in partnership by Shenzhen University and the Chinese University of Hong Kong – has continued to expand since its appearance in last year’s Risk.net Quant Guide. Its Master of Science in Financial Engineering has seen growth in its student intake, hired more teaching staff, and improved employment outcomes for its graduates. The programme remains led by Nan Chen, a professor in the university’s department of systems engineering and engineering management.

While the course received slightly fewer applications for its latest outing than last year – going from 1,139 applications to 992 – it accepted a larger number of full-time students, with 109 in the latest intake. The master’s is a popular choice among those who do receive offers, with an offer-holder acceptance rate of 65% for this year. As student numbers have risen, the programme has made teaching hires in tandem, with 27 instructors now on the course, versus last year’s 23. Four of the staff have industry affiliations, up from three in the most recent guide.

The programme’s employment rate has also risen, as have average graduate starting salaries. The university reported a mean starting compensation of 165,000 yuan last year, roughly US$26,000. For this year, the figure has leapt to around US$37,786.

Like last year, the master’s requires students to complete sets of compulsory and elective modules. Quant hopefuls can tackle modules focusing on blockchain and machine learning, quantitative risk management, term structure models and fixed income securities. Elective modules include courses in financial data analysis, credit risk modelling and algorithmic trading.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show