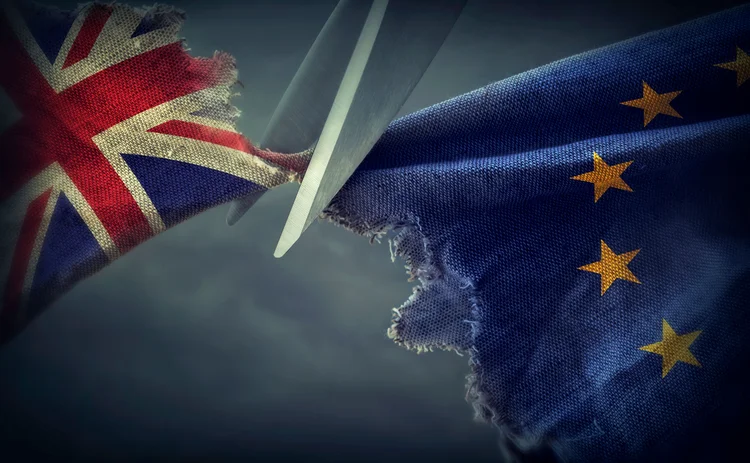

How Brexit split Aegon’s euro swaps book

Years-long effort saw trades quietly move from London to Frankfurt – but firm wants continued access to LCH

After UK voters narrowly chose to leave the European Union in 2016, it took a matter of days for then-French president François Hollande to renew a threat to London’s clearing houses – long coveted by continental politicians and feared by continental supervisors. A fierce tug-of-war has since played out in public while, in private, some large European users of those clearing houses have sought to

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Leveraged ETFs may have fuelled Kospi plunge

Record one-day drop in Korean equity markets follows months-long surge driven by levered bets

Iran conflict forces EM carry trade unwinds

Surging oil prices, rising vol and dollar flight triggered stop-outs of emerging market positions, say dealers

Eurex mulls ‘integrated’ prediction market

Dividend derivatives seen as template for event contract expansion

After market whipsaws, banks put new twist on QIS options

Variable strike options aim to catch recoveries after volatility spikes

Broker quoting gap keeps Eurex-LCH basis alive

Lack of differentiated prices helps retain CCP basis

QIS futures debut – but only simple ones for now

Goldman and Societe Generale kick-start Eurex market with equity baskets

Hedge funds trim US swap spreads on tariff decision

Investors cut back asset swap positions as Supreme Court ruling reignites deficit concerns

Opinions split on EU bond balance sheet squeeze

Some say QT and issuance wave will hamper intermediation; others say dealers nimble enough to respond