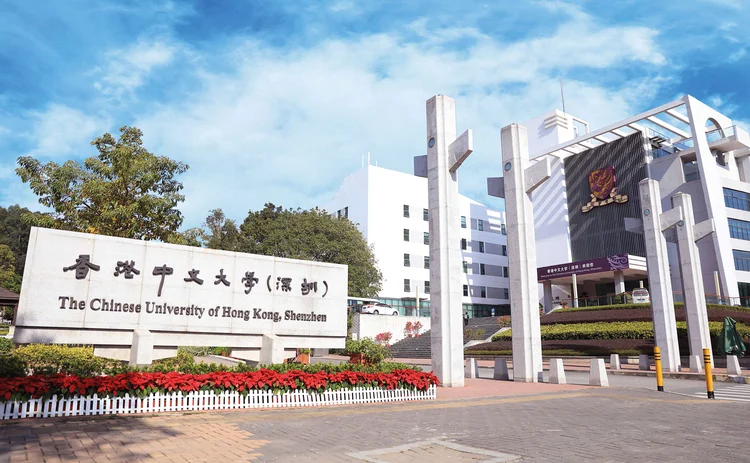

Quant Guide 2021: Chinese University of Hong Kong, Shenzhen

Shenzhen, China

The Master of Science in Financial Engineering at the Chinese University of Hong Kong, Shenzhen, has leapt in popularity since the last edition of the Risk.net Quant Guide was published: applications have more than doubled, up to 1,139 for the latest programme, versus last year’s figure of 503.

The programme has become more selective in turn, extending 155 offers this year against last year’s 230. Far more offer holders accepted their offers this year, too: 111 accepted in 2020, and 93 students – all but one of whom is a domestic citizen – enrolled.

Programme staff have also been busy revamping the curriculum. While the programme has gone through the sorts of coronavirus-related logistical changes that readers of the guide might expect – online classes, a greater emphasis on recording, virtual office hours, remote exams, and so on – some more fundamental adjustments have taken place.

The master’s has been split into two study streams, says associate professor of practice Raymond Tsang. One focuses on quantitative finance, and the other on the field of financial technology. Whichever stream is chosen, a core group of compulsory modules are taken by all students, as was the case last year. This group includes classes in optimisation theory, stochastic modelling and an introductory module tackling the particulars of China’s financial markets. New modules for this year, adds Tsang, include classes in blockchain technology, artificial intelligence and regulation technology.

Three new teaching staff have also joined the programme’s roster of academic instructors: Chris Hongqiang Ding, a specialist in machine learning and data mining; Yanchu Liu, a former PhD student of programme director Nan Chen; and associate professor and assistant dean of the university’s school of data science Zizhuo Wang.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director