This article was paid for by a contributing third party.More Information.

The trade war moves to Europe

Need to know

- U.S. plants for German automobiles may be most affected if the trade war moves to a European front

- A trade war now likely means there will be more damage to Europe than the U.S.

By Blu Putnam, chief economist, CME Group

October may well see the opening of a new front in the U.S.-initiated trade wars, with Europe being the target this time. Indeed, in preparation for launching tariffs aimed at Europe the new mantra in official Washington seems to be that on many trade issues Europe is worse than China.

We would not agree with that assessment, given the deep, longstanding and mutually beneficial commercial and industrial interests the United States shares with Europe. Regardless, the odds on the U.S. introducing tariffs on many European goods are rising rapidly.

This Would Be A Different Trade War

The trade wars have not hit the U.S. economy all that hard – with the main impact on the whole economy being a substantial reduction in business investment and little impact on consumer spending. But certain sectors of the U.S. economy have been hit quite hard. In this respect, the opening of a trade war front with Europe will be quite different than the war with China. U.S. farmers paid a very high price and bore the brunt of the U.S.-China trade war as China dramatically curtailed purchases of soybeans and other agricultural products from the U.S.

With a new European front, the damage to the U.S. may hit the huge German automobile plants in Alabama and South Carolina. Sizable assembly and battery plant expansions are in the planning and building stages, and U.S. tariffs may derail these plans, costing many future jobs. Also, the busy ports of Mobile and Charleston that enable the automobile supply chains may see a sizable hit to their business.

German Cars, French Wine

Yet again, the overall hit to the U.S. economy will be relatively mild, compared to the damage a U.S.-Europe trade war might do to Germany, in particular. The German economy appears to be entering a recession, led in no small way by its auto industry. So, the timing of the start of a U.S.-Europe trade war would suggest much more damage to Europe than the U.S. overall.

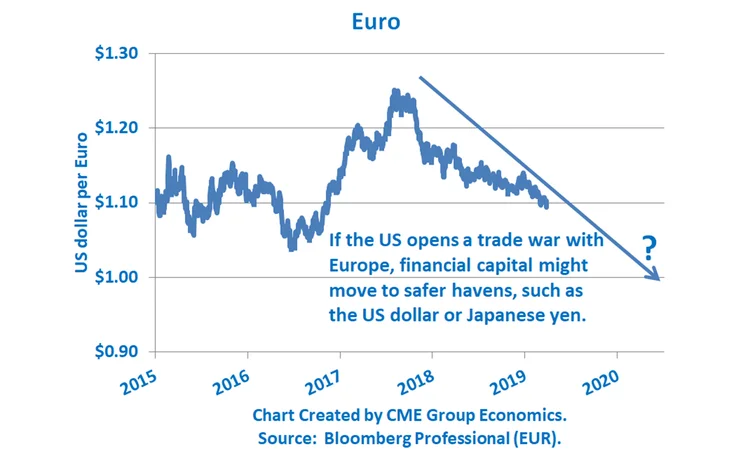

Just for the record, if the U.S. puts tariffs on French wine, as has been threatened, the economic impact will be negligible. One unintended consequence, however, might well be a further depreciation of the Euro versus the dollar, as financial capital in Europe heads for safer havens in North America or emerging markets in Asia. Watch out for parity between the Euro and the U.S. dollar should the trade war turn especially bitter.

Blu Putnam Bluford (Blu) Putnam has served as Managing Director and Chief Economist of CME Group since May 2011. He is responsible for leading economic analysis on global financial markets by identifying emerging trends, evaluating economic factors and forecasting their impact. Prior to joining CME Group, Putnam gained more than 35 years of experience in the financial services industry with concentrations in central banking, investment research and portfolio management. He has authored five books on international finance.

For More Coverage, Visit CME Group’s Trade War Resource Center

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net