BrokerTec outage serves as ‘systemic risk’ wake-up call

January 11 shutdown of the dominant US Treasury market platform worries participants

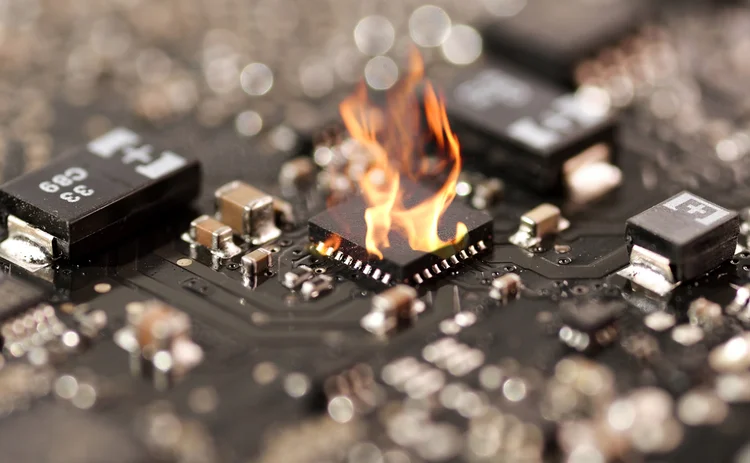

An outage on BrokerTec that shut down trading of US Treasuries for nearly an hour and a half earlier this month has renewed concerns that the platform represents a single point of failure in arguably the world’s most important bond market.

“It woke everybody up, showing that there is systemic risk. We were very fortunate that it was a Friday afternoon and not too much was going on, but it could have been at a much worse time,” said Dawn Newsome, chief technology officer for rates trading at

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Why did UK keep the pension fund clearing exemption?

Liquidity concerns, desire for higher returns and clearing capacity all possible reasons for going its own way

How UBS sold off non-core equity assets at lightning speed

More than 40 auctions have been completed since Credit Suisse acquisition, with a little help from a T-Rex

‘Street Fighter’ Sef RTX grows in interdealer swaps market

Focus on functionality and fees helped volumes on start-up venue from Cawley and Jonns jump fivefold last year

Isda to finalise drafting updated FX definitions this year

New definitions on disruption events and fallbacks are core focus

Treasury clearing timeline ‘too aggressive’ says BofA rates head

Sifma gears up for extension talks with incoming SEC and Treasury officials

SG looks beyond equity derivatives in new markets push

French bank aims to expand fixed income business to achieve “more stable” revenues across asset mix

Does no-hedge strategy stack up for mag seven mavericks?

At Amazon, Meta and Tesla, the lack of FX hedging might raise eyebrows, but isn’t necessarily a losing technique

HKMA’s renminbi repo plans boost hopes for onshore access

Market participants optimistic that new provisions for offshore repos of onshore bonds is first step towards mainland access