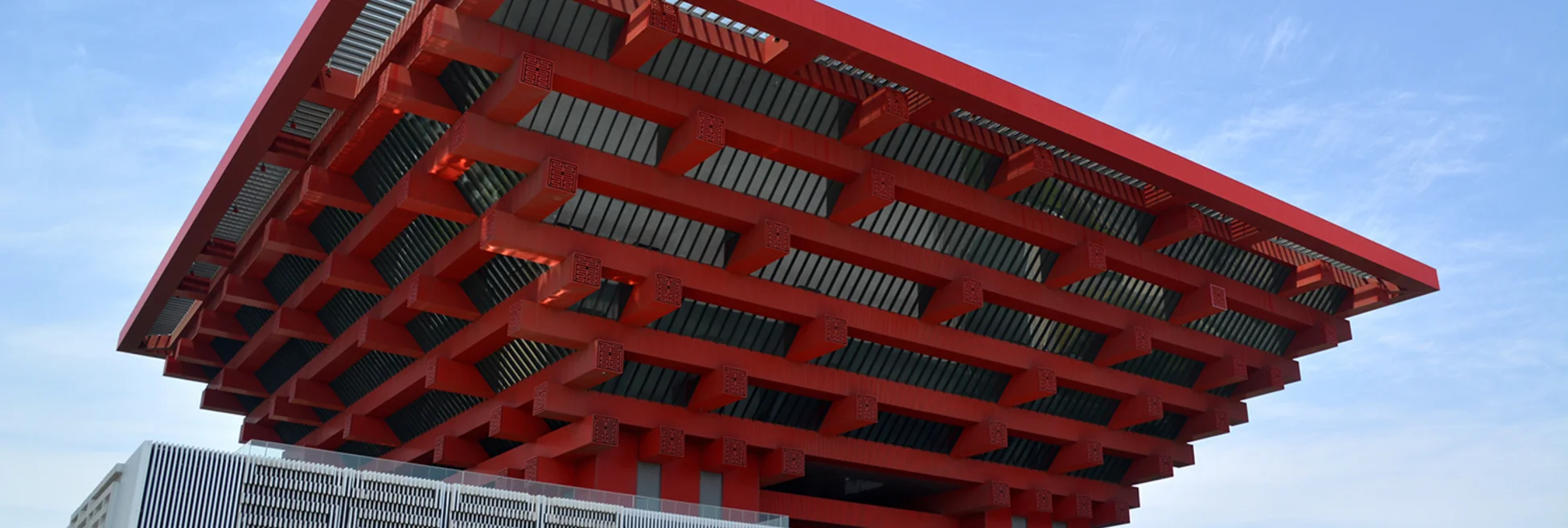

Global banks eye China’s structured products surge

Following a government crackdown on local products, foreign banks look to open joint ventures onshore

For investment banks eyeing a move into China’s glinting wealth management market, the stars seem to have lined up nicely.

A confluence of factors has led to an explosion in structured products, derivatives-linked investments sold by banks, in the first half of this year. China clamped down on traditional wealth management products, a trillion-dollar market hawking products that carried, if little else, an assumed guarantee against loss. Structured products, which can still offer some form of

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

SG looks beyond equity derivatives in new markets push

French bank aims to expand fixed income business to achieve “more stable” revenues across asset mix

Does no-hedge strategy stack up for mag seven mavericks?

At Amazon, Meta and Tesla, the lack of FX hedging might raise eyebrows, but isn’t necessarily a losing technique

HKMA’s renminbi repo plans boost hopes for onshore access

Market participants optimistic that new provisions for offshore repos of onshore bonds is first step towards mainland access

Euro swap spread volatility challenges Bund’s hedging role

German Bunds face scrutiny as euro swap spreads turn negative, forcing traders to rethink hedging strategies

UBS sterling rates head departs

Ian Hale left the Swiss bank in December

Bloomberg offers auto-RFQ chat feed – but banks want a bigger prize

Traders hope for unfettered access to IB chat so they can build their own AI-enhanced trading tools

Intrum auction gives CDS buyers minimal payout

Outcome seen as success for market that needed to adjust auction terms amid ongoing restructuring

South Korea’s FX reforms working amid political crisis, dealers say

Martial law presented first test for reforms aimed at boosting deliverable KRW market