Banks discount legacy swaps ahead of ring-fencing deadline

With UK banks facing higher funding costs post ring-fencing, some are offloading costly legacy swaps at huge discounts

Need to know

- UK banks are expected to complete ring-fencing of their retail and deposit businesses by the end of next year.

- This will restrict access to cheaper deposit funding for the riskier investment banking business, meaning its cost of funding is likely to rise.

- Funding costs will subsequently increase on uncollateralised derivatives, leading to losses.

- As a result, banks have looked to offload legacy swaps at discounts of up to 25% of the markto-market.

- As clients need to bless the novations, savvy swap users have been able to capture some or all of the discount.

- For new trades, some banks are already pricing in a jump in the funding cost of swaps with maturities longer than a year.

With the UK’s ring-fencing rules drawing closer, in-scope banks are ramping up their efforts to unwind or novate derivatives trades that could increase their costs in the future, opening up a window of opportunity for market participants to take advantage of attractive discounts on trades.

From the start of 2019, the non-ring-fenced parts of UK banks will be cut off from cheaper deposit funding, and would have to finance themselves through more expensive commercially raised debt or wholesale funding. This means the costs associated with funding uncollateralised derivatives trades, which are likely to reside within the non-ring-fenced entity, are expected to materially increase.

For legacy trades where this has not been priced in, this is a problem. UK banks are said to be looking to offload some of their more funding-intensive trades to other dealers by offering big discounts to allow them to novate. At the same time, many of these trades reside in the non-core units of these banks, and as these units start to wind down, novations have increased.

“This year, UK names have been particularly motivated [to sell]. We had quite a flurry of them coming in before the half-year-end reporting cycle, and since then we have had one or two,” says Ivan Harkins, head of the structuring and advisory team at consultancy JCRA.

The bank novating in the contract would normally benefit from the discount, but as the move needs to be approved by the end-client – typically a corporate – savvy treasurers have used it as an opportunity to capture the discount for themselves.

“We have had instances where we are getting discounts of 20–25% of mark-to-market, but it depends on the type of trade and whether there are mandatory breaks,” adds Harkins.

Downgrade triggers in legacy contracts are also cause for concern – some fear if swaps with these clauses are moved to a new, lower-rated entity, banks could be in breach and have to hand over significant amounts of margin.

For new trades, some banks are already passing on part of this expected rising cost to clients, say market participants. Some have observed jumps in estimated funding costs being priced into trades longer than a year.

Both UK banks we deal with had meetings with me about ring-fencing. Their approach is they will put as many swaps as they can in the ring-fence and only put them in the non-ring-fenced [entity] if they have to

UK-based corporate treasurer

It is not all doom and gloom for UK banks, though. For new trades where there is a funding benefit, they are also able to offer cheaper pricing. Furthermore, they might be able to mitigate the impact of the funding increase, for instance by using a blended funding rate based on group funding levels. Some are also said to be looking to place as many corporate trades, which are typically long dated and uncollateralised, in the ring-fenced entity, where funding rates are lower.

“Both UK banks we deal with had meetings with me about ring-fencing. Their approach is they will put as many swaps as they can in the ring-fence and only put them in the non-ring-fenced [entity] if they have to,” says one UK-based corporate treasurer.

The rules

The UK ring-fencing rules – which grew out of the 2011 Independent Commission on Banking report, known as the Vickers report – require firms that hold more than £25 billion ($33.5 billion) of total core deposits as of January 1, 2019, to separate their retail businesses operationally and economically from other activities such as wholesale and investment banking.

The legislation defines all deposits as core deposits unless they are from high-net-worth individuals, large- to medium-sized companies or financial institutions. Six UK banks are caught by the rules: Barclays; Co-operative Bank; HSBC; Lloyds Banking Group; Royal Bank of Scotland (RBS); and Santander’s UK retail operation.

At present, derivatives businesses at many large banks receive funding from their treasuries based on a group funding rate, reflecting deposit funding, which is often cheaper than what the investment bank can obtain on its own. Once ring-fencing comes into effect, the non-ring-fenced bank will have to rely on more expensive, commercially raised debt, or wholesale funding, such as interbank deposits and term funding based on their own rating.

An independent study carried out earlier this year for one UK bank found the funding spread of its non-ring-fenced entity was estimated to rise by 20–200 basis points, according to one person familiar with the matter.

Funding rates are a key component to derivatives pricing. This is due to the funding valuation adjustment (FVA) – an item in the profit and loss statement that takes into account the funding cost of derivatives. For example, an uncollateralised swap with a corporate would need to be hedged with a cleared swap. If the corporate is out of the money, the bank doesn’t receive variation margin, but has to fund the margin to post it to the clearing house for the hedge, creating a funding cost.

An increase in funding costs means an increase in FVA. For new trades, market participants say some banks have already started pricing this effect into trades, effectively passing on the cost to clients.

“We have had instances where you look at trades with the same counterparty and one’s got a maturity of 12 months and one’s got a maturity of two and a half years, and you can see the funding effect with banks pricing in a jump in their funding cost post-ring-fencing,” says JCRA’s Harkins.

Long-dated, uncollateralised legacy trades are likely to cause more problems for UK banks. Many of these funding-heavy trades sit in non-core units set up by banks such as Barclays and RBS after the 2008 financial crisis to run down capital-intensive assets and reduce risk-weighted asset (RWA) numbers. Banks were under pressure from shareholders to run down these assets as quickly as possible, but as the process progressed, some trades proved stickier than others.

For some credit-heavy trades, we have seen prices that are more interesting for the banks buying it, or potentially have created bigger losses for the banks selling it

Rates trader at a European bank

As UK banks did not price-in the higher post-ring-fencing FVA at inception, these positions face an increase in costs, meaning there was even greater motivation to get them off their books. In some cases, discounts of up to 25% on the mark-to-market were offered by some UK banks for unwinds of long-dated inflation and interest rate swaps.

“Some [UK] names have a target to finish by the end of this year,” says a rates trader at one European bank. “For some credit-heavy trades, we have seen prices that are more interesting for the banks buying it, or potentially have created bigger losses for the banks selling it,” the trader adds.

The dealer novating in the trade would normally capture the benefit, but as the client needs to bless a novation, they’re in a position to profit from the move. Given the clamour among dealers for corporate business this year, the European bank’s pricing expert says banks are generally happy to give some, if not all, of the discount to clients.

This has allowed clients to earn a spread when they novate a trade from a UK bank to a non-UK one, which is likely to buy it at prices closer to the market.

“We have had a couple of instances in the past where some of the UK banks have had RWA targets at particular points in the year and we have been able to get quite attractive discounts to exit existing positions. Also, in some instances, we have been able to put the trades on with new banks at quite attractive levels, where we are essentially arbitraging the two,” says JCRA’s Harkins.

“If the mark-to-market on a particular transaction is £50 million, paying a bank say £40 million–£45 million to take it off their books, then putting the same trade on with a new bank, but getting paid more by the new bank than it costs you to exit from the incumbent bank, means our clients can sit in the middle earning that spread between the two bank counterparties,” he adds.

Others say clients have been able to use the novation as leverage to move mandatory break clauses, which gives dealers the periodic right to alter or terminate the trade, which is often exercised – or at least brandished threateningly – if a swap becomes too costly.

Changing risk profile

One impact of ring-fencing is the change in the risk profile of ring-fenced and non-ring-fenced entities because of changes in their funding structure. The non-ring-fenced bank, where most of the derivatives business is likely to reside, is expected to have a lower rating than the bank at the group level.

A credit report issued by Standard & Poor’s in May 2017, applied a negative adjustment to the long-term rating on Barclays Bank plc, which will be the non-ring-fenced part of the group. This offset the positive impact of the additional loss-absorbing capital the bank will be required to raise under new regulatory requirements. The report stated it expects Barclays Bank plc’s long-term rating to be one notch lower than the supported group credit rating.

If the non-ring-fenced entity has a lower rating than the current booking entity, some worry this would activate a downgrade trigger in swap contracts. These triggers include two ratings thresholds, which if breached require the downgraded party to take action. The first threshold requires a counterparty to pay extra initial margin, known in this instance as independent amount.

Banks give a lot of value to triggers that are a few notches away from their rating and less value to triggers that are beyond that

François Jarrosson, Rothschild

“Some of the UK banks have a downgrade trigger with their counterparties. They were worried about whether they put these trades or transactions inside their ring-fenced or non-ring-fenced entity – the latter’s credit rating might be immediately different from that of their ring-fenced entity. And that will cause an automatic downgrade trigger they want to avoid,” says one London-based consultant familiar with ring-fencing preparations at UK banks.

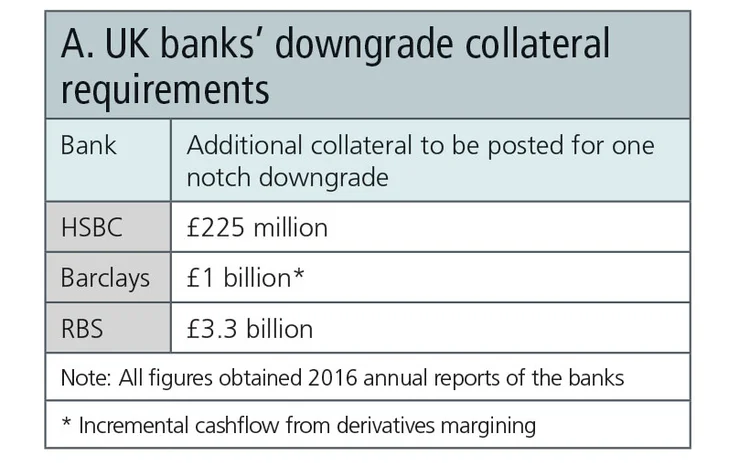

The amount of collateral required to be posted can be eye-watering. According to the Royal Bank of Scotland’s (RBS) 2016 annual report, a simultaneous one-notch long-term and associated short-term downgrade in the credit ratings of RBS group and RBS plc – the principal direct operating subsidiary undertaking of the company – by the three main rating agencies would have required the bank to post an estimated additional collateral of £3.3 billion, without taking account of mitigating action by management (see table A).

If a second, lower downgrade trigger is breached, dealers have to find a replacement bank to step into the trade – a procedure that comes at a hard-to-value cost to the exiting bank. This was a big problem for Spanish and Italian banks during the recent European sovereign debt crisis.

One UK bank’s regulatory expert says where there are downgrade triggers in place, banks would have to try and mitigate the impact ahead of the ring-fencing date.

“If downgrade triggers are extensively or have extensively been used by banks, then it becomes a material issue. When you get downgraded, it is effectively at least going to double the cost of people with downgrade triggers who are already getting out of what they are doing. It would definitely be something you would want to act on to reduce the book in advance,” says the regulatory expert.

This means clients would have to agree to relax the triggers, which is an additional cost for banks.

“Clients are better protected when keeping triggers in place, but clearly it comes at a price since new bank counterparties will not find them attractive. Meanwhile, an existing bank counterparty would pay dearly to remove them. Banks give a lot of value to triggers that are a few notches away from their rating and less value to triggers that are beyond that,” says François Jarrosson, a director in the hedging and derivatives team at Rothschild in London.

As soon as banks tried to get their head around ring-fencing, one of the first questions they were asking is should the legal documents supporting these transactions be updated or not

London-based consultant

Another concern is which entity was referenced originally in the downgrade triggers. Typically, it is the group entity, but after 2019, when the swaps sit in a different unit, legacy swap documentation can be unclear on which credit rating to reference.

“As soon as banks tried to get their head around ring-fencing, one of the first questions they were asking is should the legal documents supporting these transactions be updated or not,” says the London-based consultant.

“The question is, if the reference entity is changed, what would a bank need to keep the transaction valid? Do they need to rewrite the contract, or is putting an amendment to the new contract enough? From what I heard from the lawyers, the answer is different depending on where the counterparty is located and type of contract. No-one wants to be surprised and notice a counterparty is not paying them for some obscure reason. So they are amending or getting assurances around enforceability of these contracts,” the consultant adds.

Benefits

It is not completely bad news for UK banks, however. For one, the rise in funding costs means that for trades where they have a funding benefit – for instance, if a bank was out-of-the-money to a corporate – they would receive variation margin from its cleared hedge, but would not have to pass it on to the corporate.

Some banks are also looking for ways to keep swaps within the less-risky ring-fenced entity instead of outside it, in which case the bank might actually benefit from the trade because of lower funding costs.

The ring-fenced entity is allowed to trade simple derivatives products such as swaps, forwards and options on interest rates, foreign exchange and commodities to reduce risk and manage its balance sheet. Since the ring-fenced entity will house the retail and small business deposit businesses of banks, it would be able to access cheaper funding.

“Nowadays, a bank might offer better discounts for terminating swaps that will sit outside the ring-fenced bank, which is due to higher funding levels, as opposed to swaps that will sit inside the ring-fenced bank, which will benefit from tighter funding levels. This is especially true in the context of uncollateralised swaps – hence most of the corporate business,” says Rothschild’s Jarrosson.

The total loss-absorbing capacity rules could also soften the funding blow. From January 2019, banks face a firm-specific minimum TLAC requirement, that can be met with capital instruments or long-term unsecured debt that can be written down into equity or bailed in to absorb losses during a resolution process. It also requires a certain amount of the loss-absorbing resources to be committed to subsidiaries or sub-groups that are considered material for the resolution of the entity as a whole – called internal TLAC.

Some say if internal TLAC is committed to the non-ring-fenced entity, which means the holding company purchases the internal TLAC issued by the subsidiary, a blended rate based on the holding company could be used for funding, which could be lower than a standalone rate.

“These factors are likely to mean that if a blended rate were used for funding cost, post-ring-fencing, the external impact might be quite low. Of course, different houses have different structures and approaches and may be affected far more directly,” says a regulatory expert at one UK bank.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Esma to issue guidance on active account reporting

Briefing and Q&A aims to clarify how firms should report data ahead of RTS adoption

Forex looks to flip the (stable)coin

Friction-free foreign exchange is the prize offered by stablecoins such as Tether and USDC. But the prize remains elusive

Market warns BoE against blanket mandatory gilt repo clearing

Official says proposals receiving push-back on one-size-fits-all approach and limited netting benefits

Banks eye cost cuts ahead of RateStream Treasuries push

FX SpotStream’s move into rates seen as both fee-saver and potential boost to streaming execution

Real money investors cash in as dispersion nears record levels

Implied spreads were elevated to start 2026. Realised levels have been “almost unprecedented”

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments

China eases cross-border grip in new derivatives rules

Lawyers hail return to a “more orthodox territorial approach” to regulating the market

Fannie, Freddie mortgage buying unlikely to drive rates

Adding $200 billion of MBSs in a $9 trillion market won’t revive old hedging footprint