Quant Guide 2017: University of California, Berkeley

Haas School of Business, Berkeley, USA

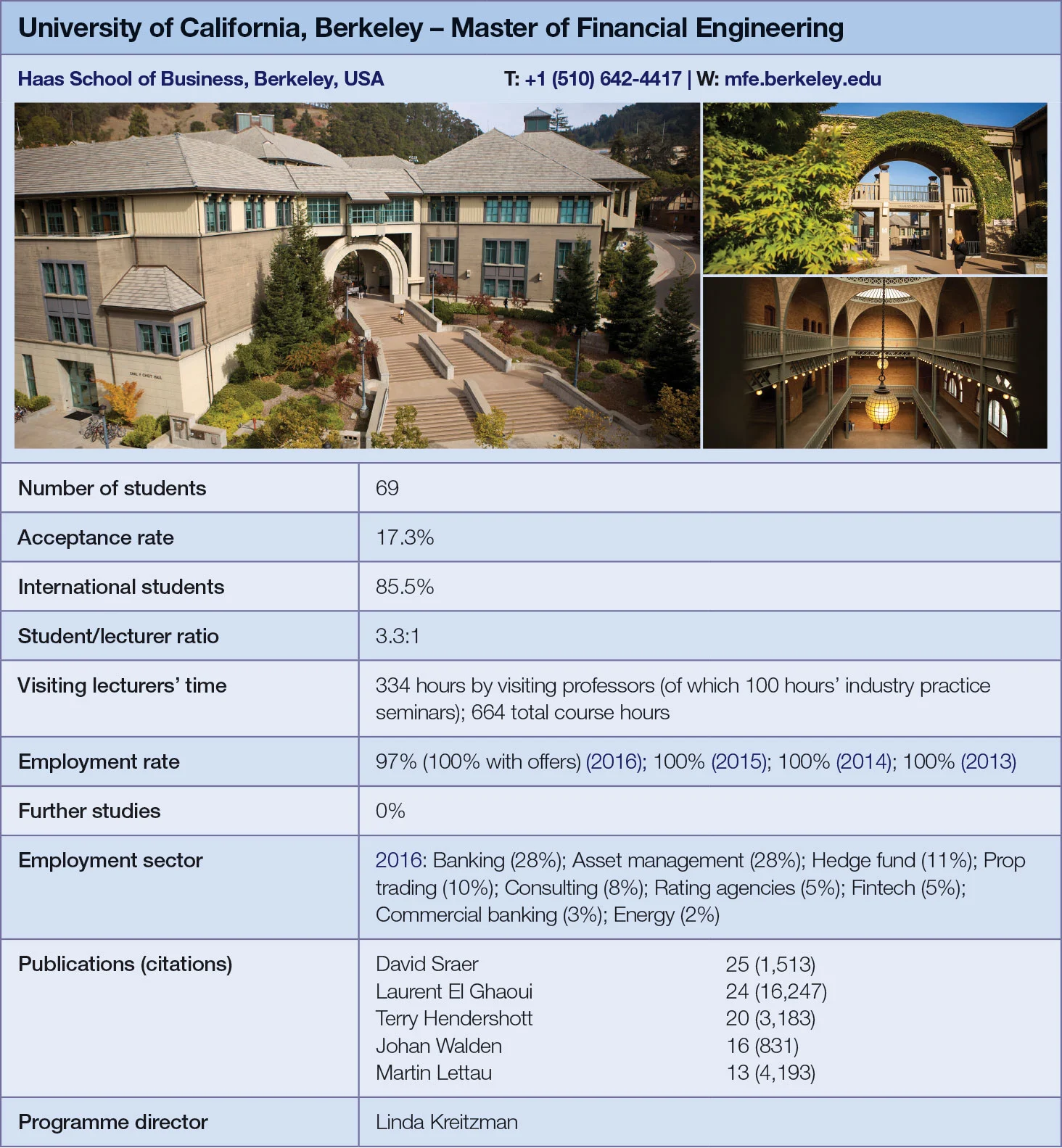

Master of Financial Engineering | metrics table at end of article

Haas’s master of financial engineering programme was launched in 2001. The programme begins in March, with an internship period from October to January, and graduation the following March. Last year, it admitted just under 70 students, but it will soon be able to accommodate up to 100 people.

The expansion reflects strong demand from the financial industry for quants with the broad skill-sets Haas aims to arm students with, says Linda Kreitzman, the programme director. Buy- and sell-side firms are increasingly seeking quants with stronger programming skills, for instance, while fintech firms now want more rounded graduates too.

“Firms now want a ‘full-stack’ quant who is good at everything, from coding to finance intuition and statistics, plus machine learning – the hottest topic,” she says.

Haas prides itself on keeping check with changing demand patterns too: most recently, the programme administration has included systemic risk, fintech and data-centric courses in the curriculum.

Unlike some one-year programmes, the degree has a strong practical focus: students are required to complete a 10–12 week internship as part of their qualification, and take part in an applied finance project run by Morgan Stanley. As well as offering students an opportunity to gain hands-on experience, the bank also provides participants with a financial incentive: the best project is awarded $5,000.

The degree starts with a series of mandatory foundation courses: a 30-hour maths foundation for financial engineers course, as well as courses in programming and statistics. In the former, students gain a grounding in programming in C++, focusing on the skills required for pricing and risk-managing financial instruments in different asset classes.

Students are allowed to waive a foundation course in exceptional circumstances, but that doesn’t happen very often, says Kreitzman, since the courses are designed to make the transition into the programme easier.

In the early days of the programme, students cover the basics of asset pricing, look at statistical techniques used in quantitative finance, and explore the tools of stochastic calculus for effective pricing of complex financial derivatives in continuous time. They also participate in seminars, run by practitioners, which are aimed at preparing them for careers in industry.

Later in the year, students cover fixed-income security markets, pricing and uses for portfolio management or for hedging interest rate risk, as well as gaining an insight into optimisation models in finance.

As part of the programme, students are required to choose a number of elective modules with differing credit weightings. Some of the examples of previously available optional modules include high-frequency finance, financial innovation in a global marketplace and behavioural finance.

From time to time, students take part in various extra-curricular challenges. This year, Citadel launched a series of “datathons”, one of which took place at the University of California, Berkeley on February 10, during which participants competed with each other in analysing large and complex datasets.

The programme also offers weekly financial practice seminars delivered by finance practitioners. In the first term, speakers introduce students to the jobs available in the financial sector and the skills they would need to be successful. In the second term, industry guests talk about the changes in the financial world. Recent speakers have included senior practitioners from BNP Paribas, Citi and Morgan Stanley.

Students receive career advice as part of their formal curriculum too. During the spring and summer terms, Kreitzman teaches a course aimed at preparing students for a career in the financial sector, with its growing appetite for more well rounded and tech-savvy individuals.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director