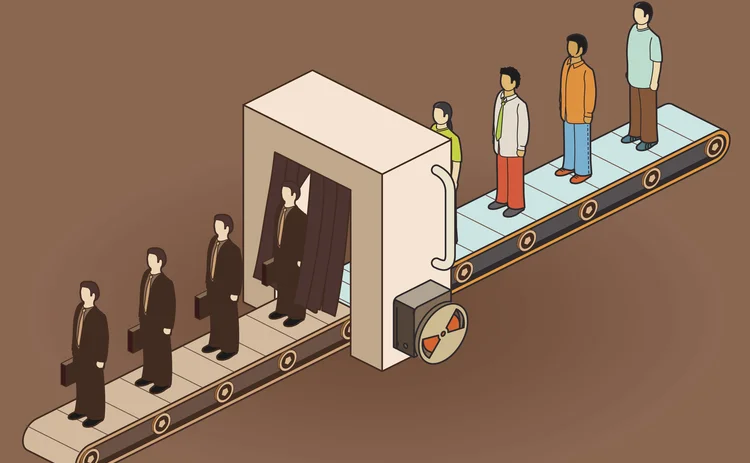

The quant factory: not muppets, but not perfect

Universities offering quant master’s programmes must adapt to stay relevant, writes UBS’s Gordon Lee

This article is the first in a series looking at the future of the quantitative finance profession, as part of Risk’s 30th anniversary coverage. The accompanying feature can be found here. Risk’s inaugural guide to the world’s leading quantitative finance master’s programmes is available here.

The topic of education in mathematical finance and its value to the quant community has always been contentious. Five years ago, Jesper Andreasen, Risk’s quant of the year in 2012, issued a blistering critique of the quantitative finance education system, infamously branding the graduates it now produces as “muppets”.

More optimistic souls would argue such criticism is wide of the mark. In my interactions with academics and students over the past decade – both as an adviser and a hirer – I have found the discipline contributes meaningfully to our profession.

This is not universally the case, however. There remain well-founded concerns over both the quality of candidates seeking to study on specialist master’s programmes, and the relevance of the course material to the industry’s rapidly changing needs.

Over the years, I’ve encountered many graduates from these courses who can tell me all about martingales and risk-neutral measures, but only a few who can tell me why they are used and how they relate to a bank’s trading business. This is symptomatic of the fact that many courses were developed within maths departments – usually after universities discovered that finance was a rich breeding ground of research and funding. Teaching students about how what they were learning fitted together and how it related to the real world was often of secondary importance.

There is no divine right for the quant profession to exist indefinitely; it is up to this generation to define it for the future

Just as financial markets have evolved dramatically in the decade since the advent of the financial crisis, so too have the roles quants are expected to perform within banks. We’ve moved on from the era of maths whizzes tasked with building exotic products, exemplified in the film adaptation of The Big Short, when credit salesman Jared Vennett – a fictionalised version of Deutsche Bank bond salesman Greg Lippmann, portrayed by Ryan Gosling – brings a quant genius from China to a meeting to show that he is “sure of his math”.

Even allowing for artistic licence, the role of a quant within a bank today is undoubtedly broader than it ever was back then. Some of the mystique and attendant sense of unquestioned authority senior quants used to radiate has gone; but it has been replaced by an acknowledgement that quants now play a pivotal role within many functions vital to the running of a bank. Witness The Wall Street Journal’s recent (some would say belated) assertion that “the quants run Wall Street now”.

Some of the new jobs quants are being thrust into share a broad DNA with derivatives pricing and modelling roles, but others are areas in which quants would never previously have been found: FRTB implementation, XVA pricing, compliance with the global non-cleared margin regime. Many are also swelling the ranks of data science teams – on both the buy side and sell side.

On the face of it, that should be good news for the specialist master’s programmes featured in Risk.net’s forthcoming guide and the army of grads that pass through their ranks each year. Sadly, some institutions remain stuck in the pre-crisis mindset: many persist with a relentless focus on high theory and pure maths, which amount to a refusal to acknowledge that the finance industry has moved on.

I have had the pleasure of being an industry supervisor for a number of graduate students over the past decade. My experience is that many are now actively looking to work in diverse areas in finance, from sales and trading, risk control functions to algorithmic trading and other areas. This suggests they are using the course as a stepping stone for a career in the wider financial world.

These new demands mean hirers require skills from their quants they traditionally wouldn’t have expected. Quants increasingly represent the bridge between a bank’s technology platform, the mathematical framework driving it and the business itself. To be successful in these roles requires a smattering of – shock, horror! – social skills and organisation finesse; not attributes that are imparted by many mathematical finance courses.

Happily, many have also recognised the need to constantly update the contents of their courses and maintain close industry contacts, in order to remain relevant to employers. I’d argue only institutions with course leaders who understand this can offer a credible education. They should also instil in their students a sense of business acumen and leadership currently missing from the curriculum (though in fairness, this criticism could be levelled at much of the education system).

Programme directors might not want to hear it, but it’s worth noting most quants who work in finance don’t have a master’s in quantitative finance

Programme directors might not want to hear it, but it’s worth noting most quants who work in finance don’t have a master’s in quantitative finance. Based on an utterly unscientific sample of the 20 or so quants that happen to sit near me as I write, only small handful have such a qualification; the vast majority have either a master’s or doctorate in mathematics, or a science subject not related to finance.

That raises the question of where all these newly minted grads end up. Clearly, a master’s in quantitative finance can still open the door to a bank’s modelling team but, increasingly, it also offers different career paths too. For example, banks’ derivatives and risk management desks, as well as hedge funds, asset management firms and insurers increasingly look for profiles with a quantitative background and who can display a skillset that enables them to have a broader view on the business, without necessarily being proficient in solving partial differential equations.

It cuts both ways of course: to work in a bank, the modern quant requires both technical smarts and good management skills – but would such a person still consider working in finance desirable when they could work for a tech start-up? As a profession, we need to think about the value proposition we offer the class of 2017. There is no divine right for the quant profession to exist indefinitely; it is up to this generation to define it for the future.

Gordon Lee is an executive director with the quantitative analytics group at UBS Investment Bank in London

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why