Monthly swaps data review: Libor dominance challenged

There are more sources of over-the-counter derivatives data available today than at any point in the market’s history. In this series of monthly articles, Clarus Financial Technology’s Amir Khwaja looks for trends

The advent of new margining rules for non-cleared over-the-counter derivatives appears to have pushed volumes towards clearing houses for non-deliverable forwards (NDFs) and inflation swaps – with LCH being the main beneficiary. In contrast, swaptions continue to be traded bilaterally.

Elsewhere, February was the first month in which the notional volume of US dollar overnight indexed swaps (OIS) – in which the floating leg references the federal funds rate – surpassed volumes of traditional Libor-referencing interest rate swaps, apparently a response to the Federal Reserve’s rate-tightening agenda. Volumes of risk remain far higher in interest rate swaps, however, by virtue of the market’s longer average tenor.

The impact of margin

New margin requirements for non-cleared OTC derivatives trades had two main policy objectives – to reduce counterparty risk and to encourage the use of clearing houses by hiking the relative cost of trading bilaterally. Is the second of these objectives being met? The data for products with a historically low proportion of cleared volume suggests it is – but only for linear products.

Non-deliverable forwards

Non-deliverable forwards (NDFs) were initially expected to become subject to a clearing mandate in 2015, but regulators chose to pass. Clearing services for the product saw very low voluntary uptake.

So, the interesting question is whether the first phase of the non-cleared margin regime – which required big dealers to exchange initial margin from September 1, 2016 – has produced an increase in volumes.

Figure 1 shows:

- LCH ForexClear has seen a sharp increase in monthly volumes from September 2016.

- Volumes jumped from around $60 billion a month prior to this date to $175 billion, $265 billion and $370 billion in the subsequent three months.

- Our research estimates 35% of global dealer-to-dealer NDF volume is now cleared.

- As clients are offered NDF clearing and as further margin deadlines pass, we expect this percentage to increase.

- Chile’s Comder shows a steady $20 billion of volume in Chilean peso trades each month.

- SGX is averaging just $40 million a month.

Inflation swaps

LCH SwapClear has offered clearing of inflation swaps since April 2015 and while volumes were low in 2015, the margin regime has had an impact.

Figure 2 shows:

- The advent of phase-one margining saw volumes leap from $15 billion in August 2016, to $85 billion in September.

- Recent months have hit record levels of around $115 billion.

- The split for euro, sterling and US dollar is roughly equal in the two most recent months.

Swaptions

CME Group has offered clearing of swaptions since April 2016, but there has been very little activity in this product and the September 2016 margin deadline has not been a catalyst.

This may be due to the fact CME interest rate swap volume is largely dominated by clients that are not yet in scope of the margin regime, while dealers that are subject to the rules have the bulk of their swap portfolios at LCH and so do not envisage any portfolio -margining -benefits.

It may also be the case that managing risk and default for the non-linear risks in swaptions portfolios is seen as unproven. Even the – arguably – more liquid and widely traded foreign exchange options market has not yet seen meaningful clearing activity, which might suggest the market needs time to come to terms with the concept.

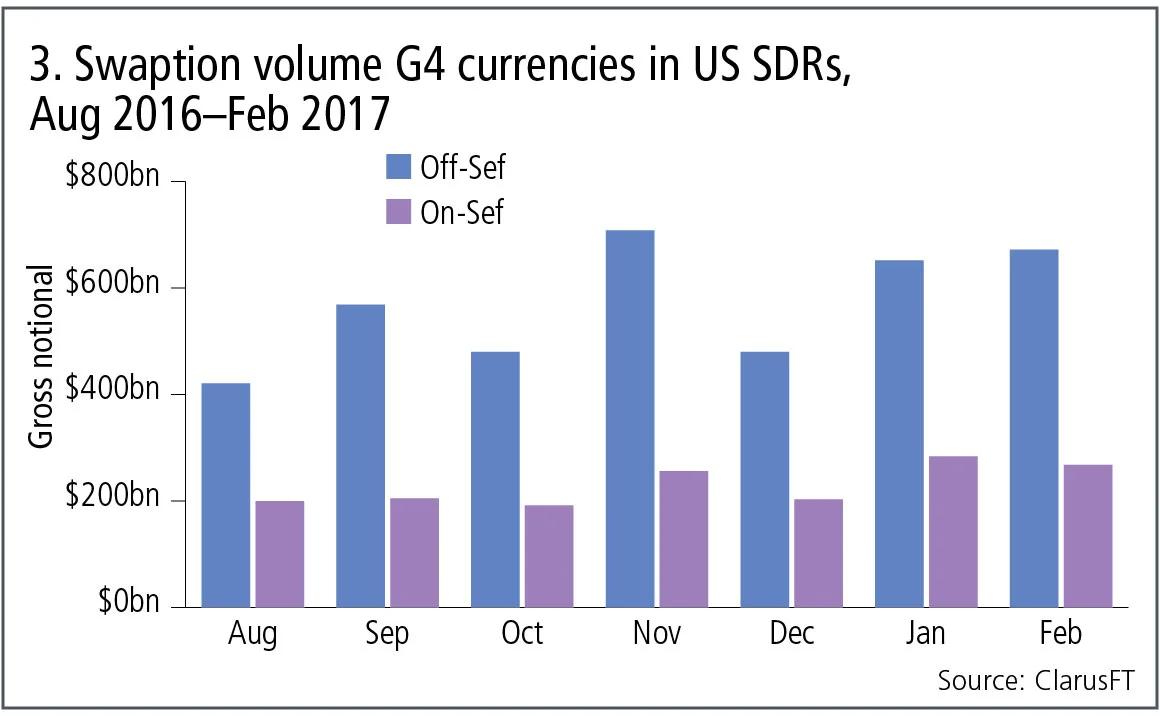

Data from US swap execution facilities (Sefs) and swap data repositories (SDRs) gives us a sense of the size of the swaptions market for US persons.

Figure 3 shows:

- $200 billion–$280 billion of monthly volume on Sef platforms.

- $400 billion–$700 billion monthly volume conducted off Sef.

These are significant numbers, suggesting the market would benefit from the ability to net multilaterally at a clearing house, rather than netting bilaterally with each counterparty. Only time will tell.

US dollar overnight indexed swaps

Another product that has seen significant changes in volume – for reasons unrelated to margining – is US dollar OIS, where the floating leg references the federal funds rate, rather than Libor.

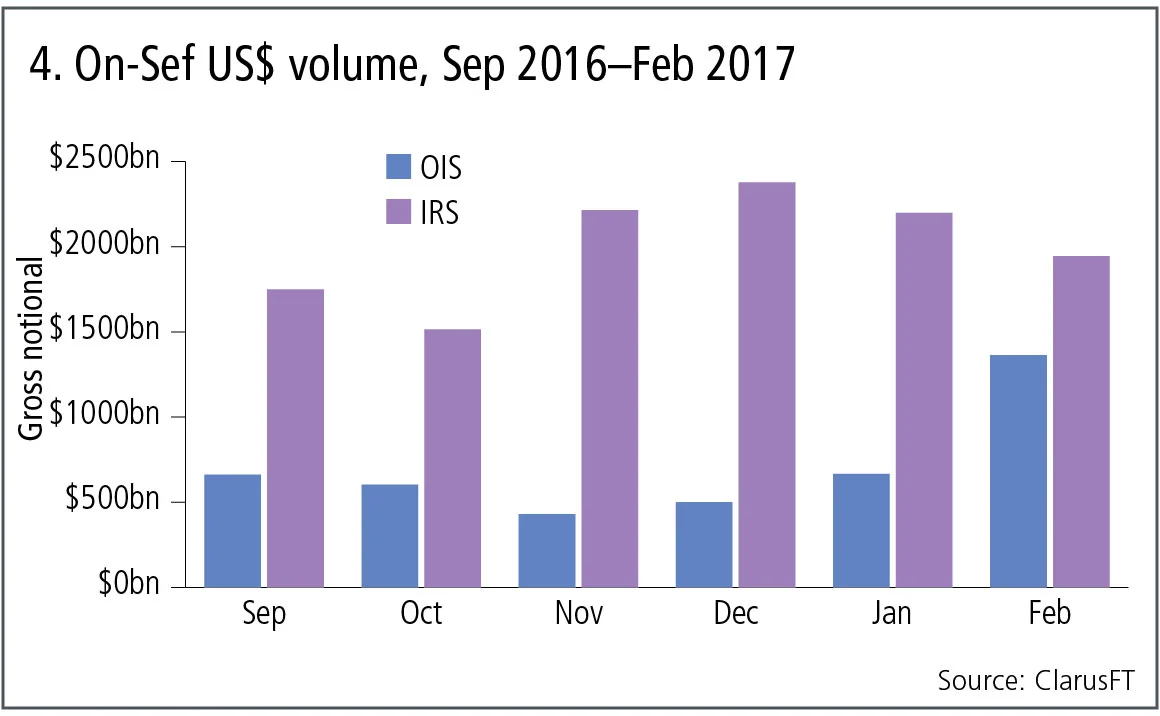

Figure 4 shows:

- Monthly on-Sef volumes of OIS and interest rate swaps.

- Interest rate swap monthly volume of between $1.5 trillion and $2.4 trillion (including Sef compression).

- OIS monthly volume of around $600 billion, increasing massively to $1.4 trillion in the most recent month.

- Such periodic jumps in US dollar OIS trading have occurred in prior months too and appear to reflect the increasing size and importance of the fed funds index as the Federal Reserve proceeds to raise interest rates.

- Feb 2017 OIS figures also include $164 billion of Sef compression at TrueEx, the first time we have seen such size in this product.

Turning to off-Sef activity and comparing OIS and interest rate swap volumes we see a different picture – with OIS notional volumes beating interest rate swaps. This is not a huge surprise, given the OIS product is not subject to the Sef-trading mandate, unlike vanilla interest rate swaps, but in tandem with the on-Sef volumes it illustrates an interesting trend.

Figure 5 shows:

- Monthly off-Sef OIS volumes are higher than interest rate swaps in most months.

- The gap is significantly in September 2016 and February 2017.

- OIS volumes range from $1 trillion to $2.5 trillion.

- Interest rate swap volumes range from $0.7 trillion to $1.2 trillion.

Note all these figures are understated as SDR volumes are capped for large trade notionals and the true volume is likely to be at least 30% higher.

Adding the on- and off-Sef volumes, February 2017 is the first and only month in the record where US dollar OIS volumes have beaten interest rate swap volumes.

It’s important to note the average tenor of US dollar interest rate swaps is much longer than for OIS, so the per-basis point risk in the former will be much larger for the same notional. Our research shows that over the past 12 months, the average tenor for US dollar interest rate swaps was five-and-a-half years, compared to three months for US dollar OIS. Nevertheless, the data shows the relative risk traded in US dollar OIS versus US dollar interest rate swaps has increased from less than 5% in 2014 to 20% in February 2017.

It will be interesting to see whether this trend continues and if more varied and longer tenors start to trade more frequently in the OIS products, gradually eroding the dominance of Libor as the major index in the swap market.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Integration strengthens e-trading in persistently volatile markets

Survey reveals that traders are grappling with daily volatility, while technology outranks liquidity as the top market structure concern

How Optimal aims to shake up US retail options trading

New wholesaler has assembled a team of market-makers to compete with Citadel, IMC/Dash and Jane Street

Repo stress drove 2025 SOFR-to-fed funds swap pivot

SOFR OIS volumes slipped to almost half of fed funds activity during September repo spikes

Renminbi options volumes plummet as vol grinds lower

USD/CNH volumes fell 84% in 2025 as PBoC currency management took hold

Esma to issue guidance on active account reporting

Briefing and Q&A aims to clarify how firms should report data ahead of RTS adoption

Forex looks to flip the (stable)coin

Friction-free foreign exchange is the prize offered by stablecoins such as Tether and USDC. But the prize remains elusive