China’s insurers wrestle with ALM as liabilities lengthen

Clampdown on overseas investment fuels pressure to find long-duration domestic assets

A recent surge in the amount of long-term protection business being written on China’s market has left domestic life insurers struggling to manage their liabilities with the limited range of long-duration assets available onshore – a problem exacerbated by the government’s recent attempts to rein in overseas investment.

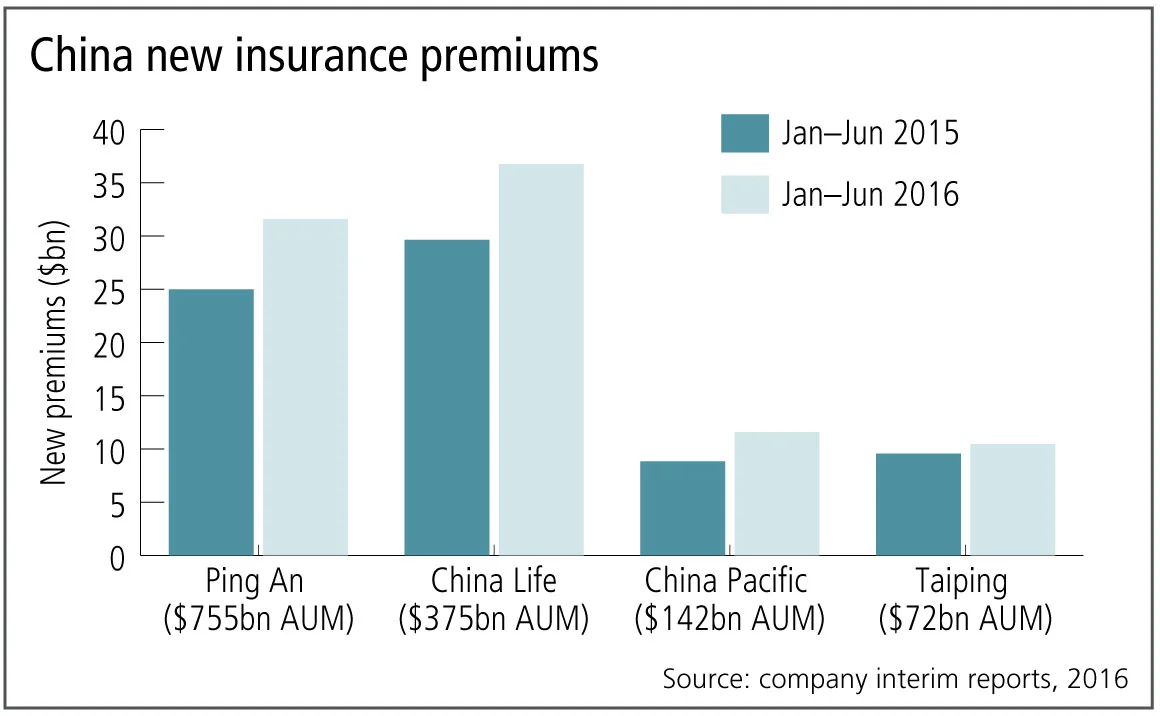

In the first six months of 2016, China’s four largest life insurance firms – with combined assets under management of nearly 10,000 billion yuan ($1,500 billion) – wrote an average of 23% more life premiums than they did in the first six months of 2015 (see graph).

“These reports show a very coherent trend: consumers’ awareness of and appetite for protection products is definitely improving,” says the head of fixed income at one Hong Kong-based asset manager. “But, as insurers write products for longer payout periods, the need to invest in relevant asset classes with long enough durations increases as well.”

The demand for long-dated assets may be about to increase even further, following recent efforts by the China Insurance Regulatory Commission (CIRC) to curb a type of product known as universal life, which has been proving particularly popular among yield-hungry investors.

Universal life products typically combine a death benefit with an attractive level of guarantee (usually well above 3%) and low surrender charges. Such products carry a high level of liquidity risk; insurers might not be able to sell assets fast enough to meet the high guarantees if economic conditions turn against them or a large number of investors switch out of the product. This keeps demand for long-duration assets relatively low among insurers providing them.

Measures aimed at curbing these products include a 3% cap on the guarantee and limiting annual sales of the product to 200% of insurers’ capital or net assets. Such steps appear to have worked. The latest data from CIRC shows that in January, new premiums from universal life fell from 34.8% to 11.4%, while premiums for conventional life insurance policies rose from 64.7% to 88.3%.

Realigning the insurance industry may have helped to head off a potential source of systemic risk, but it is also likely to put pressure on the fairly limited supply of long-dated instruments that are available for managing risk.

“Due to the nature of these protection insurance policies, the insurance companies will require more long-duration assets. It will be a challenge for insurers to manage this,” says Eunice Tan, an analyst at ratings agency Standard & Poor’s (S&P).

Overseas curbs

The introduction of the China Risk Oriented Solvency System (C-Ross) at the start of last year refocused attention on asset and liability management (ALM), since the new risk-based framework penalises insurers for running large duration gaps.

In response to the new rules, several large insurers started exploring ways in which they might invest overseas. But, following a clampdown on capital outflows by China’s authorities, such plans appear to have been shelved.

“Being able to invest overseas would give us access to a larger pool of longer-term assets, but with the government taking steps to stabilise the renminbi’s exchange rate, this is just not possible right now,” says the chief risk officer of one Chinese insurance company.

In 2012, Beijing raised the cap on overseas assets in which insurance companies can invest to 15% of their total portfolio. Last year, however, threatened with volatility in the currency markets, the authorities imposed new restrictions, including a total ban on purchases in excess of $10 billion and closer scrutiny of smaller transactions.

Although insurers may still be able to invest abroad within the limits imposed by the regulator, the uncertainty of the new restrictions and the threat of more capital controls in the future makes it difficult for them to plan for overseas expansion. This puts further pressure on the onshore market for long-dated instruments.

Lack of choice

While there are some long-dated debt instruments available on China’s market, including a few bonds that go out to 20 or even 30 years, the issuers are limited to quasi-sovereign entities such as China Development Bank and the Export-Import Bank of China.

“There is some long-dated paper available, but it is just not diversified enough, which means the insurers are not able to pick up enough of a credit spread compared to, for example, if they were to invest in the US dollar debt markets,” says the fixed-income asset manager.

Having a diversified portfolio of investments can help to improve insurers’ capital position under C-Ross. Good-quality corporate bonds – rated AA or above – are not available on the market beyond five years, unlike in Europe or the US, where it is relatively easy to get hold of highly rated corporate debt of 20 years or even longer, says the asset manager.

Tan at S&P says that investing in lower-rated long-term corporate debt would expose insurers to a higher level of credit risk – something they are likely to want to avoid.

There is some long-dated paper available, but it is just not diversified enough, which means the insurers are not able to pick up enough of a credit spread

Head of fixed-income at a Hong Kong asset manager

The lack of diversity in the onshore bond market and challenges of investing offshore means many insurers are now probing alternative investments as a way of meeting ALM needs.

“If we only look at bonds, these aren’t sufficient right now, but we have started to look at property and other investments that can provide us with a longer horizon. There are some alternatives out there, but even here the choice is limited,” says the chief risk officer at the Chinese insurance company.

The Hong Kong-based fixed-income asset manager says the insurance regulator has been actively encouraging insurers to invest in infrastructure as a way of resolving the duration mismatch they are presently facing.

Hidden dangers

But there could be hidden dangers in investing in alternative assets such as infrastructure, warns Tan at S&P. “Many of these alternative investments come in the form of debt schemes, wealth management products and trust funds. The challenge of these investments is they might expose companies to additional levels of market and credit risk, which can be tricky. There is also the danger of shadow banking,” she says.

Property investments also tend to be less liquid than tapping the bond markets, although the fixed-income asset manager says this shouldn’t be too much of a problem as long as life insurers make sure they have a sufficient supply of bonds they can sell to offset any liquidity risk from their property investments.

Bonny Fu, a partner in the actuarial and insurance advisory department at EY, says that while conditions imposed by CIRC are pushing insurers towards more traditional protection business, they are going to have to take a careful look at how they balance their product offerings with what is possible under their ALM strategy.

“When insurers sell long-term business that targets a higher new business margin, they should control the length of their liabilities to avoid the penalisation of the very high interest rate risk capital charge due to asset and liability duration mismatch,” says Fu.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

FCMs warn of regulatory gaps in crypto clearing

CFTC request for comment uncovers concerns over customer protection and unchecked advertising

UK clearing houses face tougher capital regime than EU peers

Ice resists BoE plan to move second skin in the game higher up capital stack, but members approve

ECB seeks capital clarity on Spire repacks

Dealers split between counterparty credit risk and market risk frameworks for repack RWAs

FSB chief defends global non-bank regulation drive

Schindler slams ‘misconception’ that regulators intend to impose standardised bank-like rules

Fed fractures post-SVB consensus on emergency liquidity

New supervisory principles support FHLB funding over discount window preparedness

Why UPIs could spell goodbye for OTC-Isins

Critics warn UK will miss opportunity to simplify transaction reporting if it spurns UPI

EC’s closing auction plan faces cool reception from markets

Participants say proposal for multiple EU equity closing auctions would split price formation