State Street sees double whammy of op risk losses

Megan van Ooyen from SAS rounds up the top five op risk losses for July

Megan van Ooyen is a senior associate business operations specialist in the OpRisk Global Data group at SAS in North Carolina

It's been two years since the peak of the regulatory fallout from residential mortgage-backed securities. Since then, regulatory fines and settlements, which tend to result in the largest operational risk losses for financial services firms, have largely settled down. Barring a new scandal, op risk losses should remain tolerable for most financial institutions.

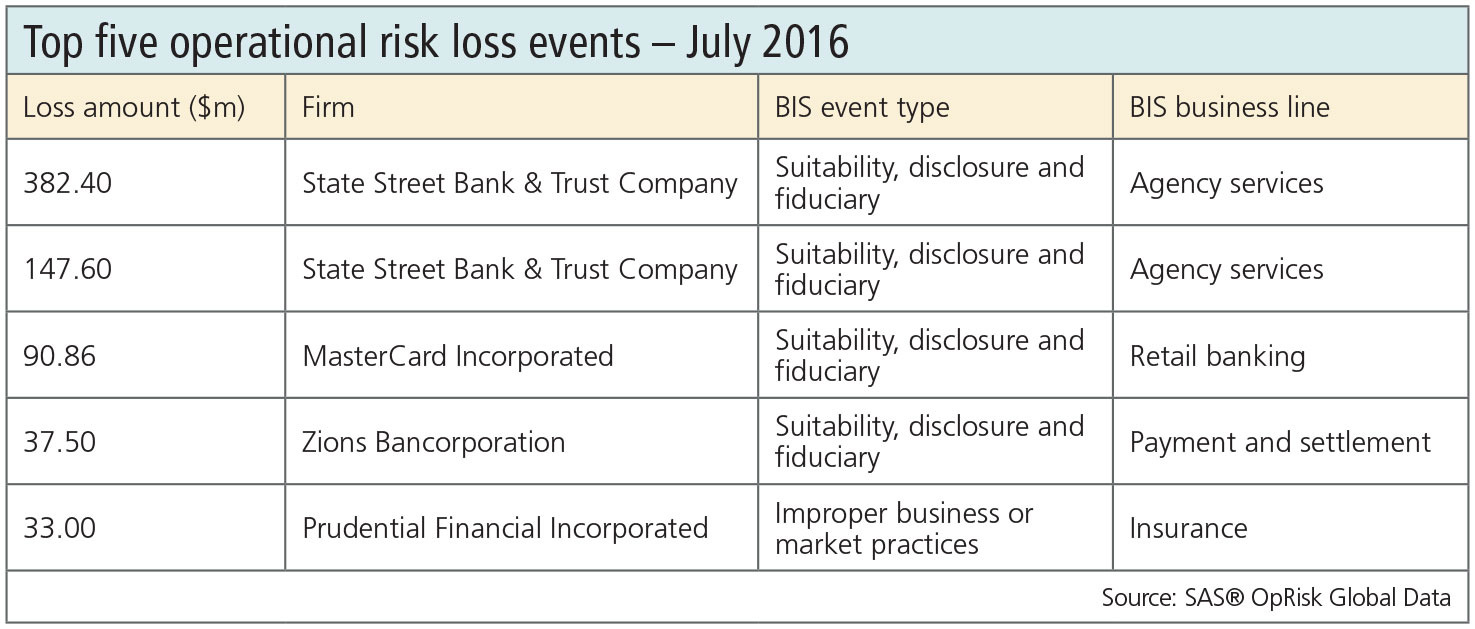

The two largest op risk losses in July were both suffered by the same company – Boston-based investment services firm State Street – in a double whammy totalling $530 million. The largest of these losses came at the hands of regulators, while the other stemmed from a class action lawsuit. In the US, class action lawsuits continue to be a persistent thorn in companies' sides. Just ask Utah-based banking group Zions Bancorp and New Jersey-based life insurer Prudential Financial, both of which also settled long-running class actions last month.

State Street has been battling foreign exchange transaction issues for almost a decade. Its State Street Global Markets (SSGM) division executes forex trades on behalf of custody clients – typically public pension funds, other financial institutions and non-profit organisations. SSGM claimed it priced these transactions based on a variety of factors, including the size of the transactions, currency inventory and risk management assessments. It also claimed it executed transactions at the best possible rates.

Click here to enlarge, or tap image on app

In reality, SSGM added predetermined mark-ups or mark-downs to interbank forex rates, regardless of any external factors. These additional charges remained the same for years, and they allowed the firm to generate significant fees while its clients bought or sold currency at some of the worst rates on the market.

The discrepancies in SSGM's pricing policies came to light in 2008 when a whistleblower alerted California's attorney general. Several US federal agencies initiated their own investigations and State Street faced mounting lawsuits from investors.

After years of litigation, State Street announced several related settlements in July. First, it paid $155 million in civil penalties to the Department of Justice for defrauding financial institutions – a violation of the US Financial Institutions Reform, Recovery, and Enforcement Act. It paid another $75 million in penalties to the Securities and Exchange Commission for contravening the US Investment Company Act by misleading registered investment company clients about its pricing policies. The firm also said it would disgorge $92.4 million in ill-gotten proceeds and pre-judgement interest to the affected clients. Finally, State Street paid $60 million to settle claims by the Department of Labor under the US Employee Retirement Income Security Act. The money will go to retirement and pension plan members who sustained losses due to State Street's pricing practices.

In last month's second-largest op risk loss, State Street set aside $147.6 million to resolve private class action lawsuits related to the same forex pricing dispute.

Elsewhere, credit card company MasterCard also suffered a series of blows in July. First, a US appeals court threw out a multi-billion dollar settlement that MasterCard and its rival Visa negotiated with merchants in 2012. The lawsuit is one of many that allege that credit card companies have complete control over interchange rates retailers pay when customers make a purchase with their cards. Cash may be king, but plastic rules in retail, so merchants are faced with the unappetising choice of either turning away customers with cards or coughing up the fees.

In the UK, at least a dozen retailers sued MasterCard and Visa over their abusive interchange fees. One of those retailers – supermarket chain J Sainsbury – won a $90.86 million award in July.

July's fourth-highest op risk loss belongs to Zions Bancorp. In 2010, Reynaldo Reyes filed a class action lawsuit against three of the firm's subsidiaries: Zions First National Bank (ZFNB), NetDeposit and Modern Payments. The lawsuit alleged that fraudulent telemarketers contracted with NetDeposit and Modern Payments to process payments for miscellaneous goods and services. To do so, the processors opened bank accounts at ZFNB in the telemarketers' names. The telemarketers then made unsolicited calls to individuals such as Reyes. They used aggressive and misleading sales tactics to convince their victims to buy products, and pressured individuals into sharing their bank account information.

NetDeposit and Modern Payments used the information to collect payments from the victims. Then they transferred the money, minus a processing fee, to the telemarketers' accounts at ZFNB. The victims say they never received their products, yet the payment processors continued to collect unauthorised payments from their accounts.

Typically, banks consider telemarketers high-risk and conduct additional due diligence. According to the lawsuit, ZFNB never bothered. If it had done so, it would have realised the telemarketers previously worked with payment processors the Department of Justice had closed for facilitating telemarketing fraud. Zions disputed the allegations, but nonetheless agreed to settle the case for $37.5 million.

Finally, in July's fifth largest op risk loss, Prudential Financial resolved a class action headache with a $33 million payment to investors that bought its stock between May 2010 and November 2011.

When life insurance policyholders die, many US states require insurance companies to make reasonable efforts to locate living beneficiaries before remitting unpaid benefits to the states' unclaimed property funds. The insurance industry, however, was in no hurry to identify deceased customers.

Megan van Ooyen

Megan van Ooyen

California regulators found that insurers failed to consult the US Social Security Administration's Death Master File, which contains federal death records, on a regular basis. They even withheld payouts when family members directly notified them of policyholders' deaths. This allowed insurance companies to continue collecting premiums from the policies' cash reserves, even after policyholders died.

In May 2011, Prudential revealed that 33 US states were auditing it for unclaimed life insurance benefits. In California alone, the audits uncovered over 1,000 active life insurance policies that belonged to individuals who had been dead for more than 15 years. In the face of increasing death benefit liabilities, the company recorded a $99 million charge in November that year.

Prudential's stock price took hits after the audits and the writedown. Unsurprisingly, shareholders filed a lawsuit. They argued the company should have known about the unclaimed benefits and increased policy reserves accordingly. Prudential never disclosed the liabilities, they said, but instead released financial results that overstated its operating earnings and encouraged investors to buy shares. Last month, Prudential decided to use some of its reserves to settle the shareholder lawsuit. It previously settled death benefit claims with beneficiaries in California and Minnesota, although it continues to face liabilities in other states.

The case, along with the other class action lawsuits against State Street and Zions, serves as a warning to the wider financial services industry: while regulators are the cause of the most spectacular op risk losses, class action lawsuits – and the legal fees and reputational damage that go alongside them – can often be more costly in the long run.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Fireside chat: Advancing FX clearing for safer settlement

Developments in FX clearing are supporting the creation of a safer, more scalable settlement infrastructure

FHLB Cincinnati explores AI to spot failing banks

Agentic model detects anomalies, monitors sentiment and drafts credit reports for analyst review

Iran strikes a stress test for CCP margin models

CME’s Span2 and Ice’s IRM2 are performing as advertised. The next few days could test their mettle

Most banks run physical climate scenarios beyond 2050

Risk Benchmarking data finds majority rely on geospatial asset mapping, while a third use third-party catastrophe models

Big banks love their climate vendors; small banks, not so much

Risk Benchmarking: Lenders with blue-chip loan books more likely to favour climate tools, research finds

Mob rule: populism’s rise pits banks against the people

Trump and fellow mavericks are reshaping politics, leaving banks scrambling to adjust to new and unpredictable risks

JSCC considers default fund consolidation

Japanese clearing house looks for efficiency gains amid expansion of clearing products and influx of international firms

EU clearing houses pressured to diversify cloud vendors

CROs and regulators see tech concentration risk as a barrier to operational resilience