FRTB: the nightmare before Christmas

A long-awaited Basel Committee review of trading book capital rules is nearing its conclusion. That is worrying banks, which point to major outstanding problems with the framework. But supervisors argue a simple recalibration is all that is necessary

Need to know

- Banks complain of serious outstanding problems with the Basel Committee's trading book capital rules, which supervisors plan to finalise in December.

- Regulators say there is no time for sweeping changes – and only a recalibration is needed to temper the overall capital impact.

- Dealers cite problems such as non-modellable risk factors, the rules for securitisations, equities and a new desk-level model approval process.

- On calibration, banks and regulators disagree over which statistic should be best used to gauge the overall capital impact.

- Picking the wrong level could make some businesses uneconomical, or cause "huge jumps" in capital as desks lose modelling approval.

Banks are scared stiff about the likely outcome of the Basel Committee on Banking Supervision's review of trading book capital rules, which is expected in December. Although the Fundamental review of the trading book (FRTB) has been through three iterations and four quantitative impact studies (QISs) since 2012, industry sources say there remain serious outstanding problems with the committee's proposals. But despite this, supervisors seem destined to finalise the rules largely as they currently stand – albeit with a recalibration of the framework to temper the overall capital impact.

Faced with the potential of a nightmare before Christmas, some banks have sent their regulatory affairs teams on a whirlwind tour of different jurisdictions worldwide to talk to any regulator who might listen to their case. "We are trying to engage constructively to help share with them what the rules are doing and our concerns around the impact on markets," explains one industry source.

Given the issues banks have identified, trade associations argue that a rewording of the text is needed. "The industry is hoping for more technical solutions to address the fundamental problems, which do not really go away with recalibration," says Jermy Prenio, deputy director of regulatory affairs at the Washington, DC-based Institute of International Finance (IIF), an industry group working closely with banks on the FRTB.

But supervisors at the Basel Committee are under pressure from ministers in the G20 group of leading economies to introduce the legislation and, as such, remain eager to get the FRTB finished by the end of the year. They admit that some minor issues with the rules may have to be ironed out in the monitoring period before they are implemented, making the finalised text something of a work in progress (see box: Work in progress).

However, they insist the project's tight deadline leaves no time for sweeping changes. "The secretariat wants to finalise everything by the end of this year so it can report to the governors and heads of supervision – and then it is implementation after that," says one regulator close to the trading book group. "In this period right now, we are in final calibration mode. We will rely on the data we have this time around and scale it down."

The Basel Committee did not put anybody forward to comment for this article.

Fundamental flaws

Begun in 2012, the FRTB was designed to address weaknesses in trading book capital rules identified by the Basel Committee in the aftermath of the financial crisis. The rules deal with a number of major issues relating to areas such as securitisations, diversification and liquidity risk. They also redraw the boundary between trading books and banking books, replace value-at-risk with expected shortfall as the basic risk measure in internal models and bring in a new standardised approach to market risk capital. In addition, the FRTB ushers in a new desk-level model approval regime, which will determine when banks can and can't use the more sophisticated internal models approach to calculating trading book capital.

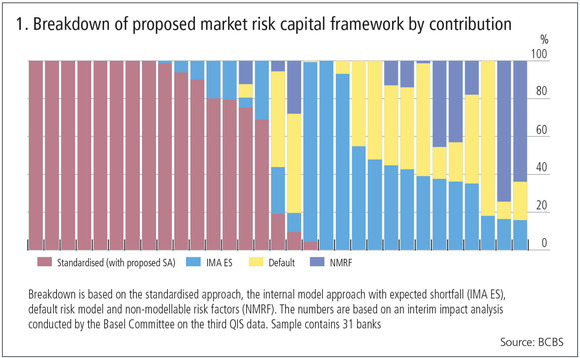

One source of discomfort for more sophisticated banks is a framework for 'non-modellable risk factors', or risks that aren't captured by banks' internal models. Under the proposals, a trading desk would face an additional capital charge for each risk factor if it is considered to be based on insufficient data. Seen as a way to clamp down the use of poor-quality data from illiquid markets, industry groups say the framework was responsible for 29% of the total capital banks calculated they would need to hold under the fourth QIS, which concluded in September.

Regulators believe the framework is essential for restricting risk modelling based on illiquid proxies. "If there is no liquidity for an asset, you won't be able to hedge it or sell it in a reasonable time frame with reasonable certainty. In this context, my view is that the trading book is not the right place for it to be in," says Federico Cabañas, a senior policy expert at the European Banking Authority (EBA) and a representative of the EBA at the trading book group. "Of course, there are calibration issues around how it is computed in the new framework, but right now banks can include elements that are completely illiquid in their internal models based on proxies. I don't think that is the right approach."

The way the framework is defined is a big source of confusion for banks, because the eligibility criteria used to deem a risk factor non-modellable can be interpreted in different ways. In the latest QIS, the framework produced capital charges that diverged by multiples from bank to bank.

"Every bank that did their QIS has interpreted it differently," says a risk manager at a large European bank. "It is partly because, while the underlying treatment has been formulated, there is very little guidance on how you apply this in practice. There are no examples; we are creating our own examples."

Under the latest version of the proposals, a risk factor is deemed modellable if it is based on data from at least 24 representative transactions in a given year, with a maximum of one month between two consecutive trades. The transactions have to be conducted on arms-length terms between independent parties, and the price has to come from a committed firm quote, rather than a third-party valuation. Industry sources argue that would cause more than half of the risk factors to be deemed non-modellable.

"You potentially have a standard where more than half the market does not qualify," says one industry source. "It is a challenge to try and fix the capital implications of that so it is not a material number."

Double trouble

The rules on securitisations – for which all banks must use the standardised approach – are another bone of contention. In the impact study, the rules led to a doubling of capital levels, mainly due to an overlap between two charges for credit spread risk and default risk.

The charges were meant to help align rules on capital for the banking book and trading book, curbing the possibility of banks shuffling trades between them to reduce their capital. However, the ultimate impact has shocked even some regulators, who point to this as one area that will be recalibrated.

"The problem is to link up the default risk on the trading book to default risk in the banking book, but there is also credit spread risk on securitisations, because they are all fair-valued in the trading book," explains the regulator close to the trading book group. "So we got a credit spread risk charge and decided to add the two together. Those were some really big numbers based on the initial calibration we did, so we've had to come up with a fix there."

Industry sources remain sceptical about whether such a recalibration will prove effective, and worry the charges could make it uneconomical for banks to make markets in securitisations. At the very least, they believe a recalibration must take place across the full capital structure – not just junior or more subordinate tranches. "If they don't do it across the entire capital structure, it will be a big problem for the industry to support a functioning securitisation market," adds the industry source.

One way to solve the problem of overlapping charges for credit spread risk and default risk would be to calibrate credit spreads based on a stress period, so that they already reflect default pricing. Risk.net understands that this idea was proposed to supervisors by banks in October, but sources close to the trading book group say industry representatives didn't initially have the right data to back up their plans.

Thomas Ehmer, a London-based senior manager at consultancy Baringa Partners, thinks regulators are too committed to the idea of modelling the two risks separately to do a U-turn at this stage. "Given the trading book group have gone down the route of separately modelling credit spread and default risk, I don't think they will change course and significantly change this framework now," he says. "I think they are going to stick to the approach currently proposed because the alternatives are not more compelling either. Previously, you could, for example, model credit migration and default risk together, which was not very transparent."

For trading desks to gain approval to use their own internal models, they must first meet two important tests in the latest version of the FRTB. One of these tests involves banks back-testing their internal trading book models to ensure their accuracy. The other, which is proving yet another bugbear for banks, involves profit-and-loss attribution.

In the test, a desk's so-called hypothetical P&L, based on front-office pricing systems, is compared with a theoretical P&L, based on internal model-generated risk measures. If the values differ significantly, this is seen as indicating a potential weakness in the risk measurement models used by the desk.

There are two metrics used to measure this, which are tested against certain thresholds laid out by the Basel Committee. One is the mean of the difference between the theoretical and hypothetical P&L – also known as unexplained P&L – divided by the standard deviation of the hypothetical P&L. The second is the variance of the unexplained P&L divided by the variance of the hypothetical P&L.

In an analysis of the third QIS by the Basel Committee, which was released on November 18, banks found the second metric tougher to meet. For all of the time periods and different thresholds considered in the impact study, the fail rate among banks was higher than 70% at desk level. Perhaps more significantly, banks struggled with the numbers: only 16 out of 78 participating banks actually submitted data for the test. Even in the more recent fourth QIS, industry sources say participation was low and as a result, regulators would be "blind" in terms of calibrating the final thresholds.

Due to the challenge of running and passing the P&L attribution test, more sophisticated banks worry they could be forced to use the more punitive standardised approaches. Eduardo Epperlein, global head of risk methodology at Nomura in London, says some of the metrics the Basel Committee is looking for simply aren't available at many firms. "There may have been some expectation in the early days that banks have a generic tool on the back of the risk models to do this, but no risk models I am aware of today are able to replicate front-office P&L or back-office P&L," he says. "It is probably the most significant implementation challenge of the whole of FRTB."

One stumbling block is aligning the different time zones a bank operates in, explains Epperlein. The official risk P&L of a bank is usually calculated at the close of business in the region considered most appropriate. Typically, a bank would be dealing with at least three time zones – something that would have to be considered when constructing the metrics required by the Basel Committee.

"If you want to build a risk system synchronised to that, you need the risk system to have, for every risk factor based on the time zones, three time series calibrations," he says. "That is not normally how the risk systems are built, since for risk management purposes, we wouldn't normally recognise diversification resulting purely from having exposures in different time zones."

Elsewhere, the treatment of equities in the FRTB is also highly contentious among dealers. In particular, banks complain the current proposals don't recognise the benefits of hedges against equity positions. This means hedges are seen to be posing an additional risk, rather than reducing the risk of the position being hedged.

"The current equities framework needs refinement," says the industry source. "It can create perverse incentives with regard to hedging of this risk which may lead to less equity activity, which impacts liquidity."

Of all the moans the industry has with the FRTB, sources believe this is the area most likely to be reviewed by the Basel Committee.

Vital statistics

The EBA's Cabañas and others don't expect the Basel Committee to get round to addressing many of these concerns before the final text comes out.

"To my knowledge, the committee has not been working on any substantial policy changes to the FRTB package at this later stage," he says. "It is mainly working on the calibration of both the internal model and the new standardised approach, focusing especially on the relationship between both approaches. The calibration of the new standardised approach is particularly important, considering it has to work as a credible fall-back to the internal model."

When it comes to calibration, though, the Basel Committee and the industry are at loggerheads over whether the median or mean is the correct figure to use when assessing the overall increase in capital. Industry groups believe the mean is the way to go, but supervisors think a median figure better reflects the impact on a 'typical' bank. Focusing on the median increases the probability of more punitive charges for the largest global dealers.

"The median represents the results obtained for the most typical bank in the sample, and we believe this is a better indication of expected impact, especially if the sample data is skewed due to the existence of outlier values," says Cabañas.

An analysis of the fourth QIS conducted by the IIF, along with the Global Financial Markets Association (GFMA) and the International Swaps & Derivatives Association, highlighted a weighted average capital increase of 4.2 times compared with current levels. The Basel Committee has yet to publish its analysis of the fourth QIS, but its analysis of the third QIS showed the FRTB would have resulted in a weighted average capital increase of 74%, a simple average increase of 41%, and an 18% rise for the median bank.

Industry groups say a big contributor to the capital hike was an add-on for residual risk – a charge which was hastily inserted into the proposals to curb exotics trading, despite a lack of agreement within the trading book group (see box: Residual risk bites back). The charge turned out to be applicable to more instruments than originally anticipated, becoming responsible for 47% of the overall capital jump in the latest study. Given the backlash from the industry, it is thought likely that it will now be adjusted. "There is an understanding this charge should not comprise more than 10% of the standardised charge in general," says the regulator close to the trading book group.

The level at which regulators ultimately calibrate the rules will have serious implications. First, overall capital levels that are too high may force dealers to exit some businesses. Second, the finalised FRTB could create a 'cliff effect' if a desk that is allowed to use internal models suddenly loses its approval and has to employ the standardised approach instead (see table A). In the analysis carried out by the GFMA, IIF and Isda, which considered 28 banks, the average difference in capital between the internal models and standardised approaches was 4.6 times for equities alone. Dealers are even more concerned about this in light of the more scrupulous tests desks will have to pass to gain modelling approval.

The regulator close to the trading book says the current goal is to have standardised capital levels that are roughly double those of the internal model approach, although these could be reined in as the final rules are implemented. "There is a 2:1 ratio mentality, although it could be 1.5:1," he says. "We are certainly not in a 6:1 or a 10:1 mentality. It won't be in that regime."

The regulator close to the trading book says the current goal is to have standardised capital levels that are roughly double those of the internal model approach, although these could be reined in as the final rules are implemented. "There is a 2:1 ratio mentality, although it could be 1.5:1," he says. "We are certainly not in a 6:1 or a 10:1 mentality. It won't be in that regime."

But some industry participants think this is still too high. Having to switch desks from the internal model approach to a standardised approach could result in "huge jumps" in capital, they complain. This would certainly not be the kind of Christmas surprise that many bankers are hoping for in their seasonal stocking.

Work in progress

Despite banks' clamour for the Basel Committee on Banking Supervision's Fundamental review of the trading book (FRTB) to be reworked, supervisors say only a recalibration is sure to be offered before the final text arrives in December.

That doesn't mean that nothing will change subsequently, however. "The FRTB package will be approved hopefully by the end of the year, so all the main policy lines will be clear by then. However since some of the elements of the reform depend on the final result of the work from other committee groups that is currently underway, there will be some elements that will have to be revisited," notes Federico Cabañas, a senior policy expert at the European Banking Authority (EBA) and a representative of the EBA at the trading book group.

Because the committee is eager to finish its work, supervisors say some outstanding issues might only be fully resolved during the implementation phase. One of them is the need to review the risk weights for securitisations.

"On securitisation, the intention is for the default charge to align with banking book capital charges," says Cabañas. "The committee is also reviewing the risk weights for banking book securitisations. In particular, it is considering the simple, transparent and comparable criteria for securitisations ... Certain elements of the framework might change because of this fine-tuning."

The Basel Committee's framework for securitisations held in the banking book was finalised in December last year. But since then, the committee has been working with the International Organization of Securities Commissions on criteria for "simple, transparent and comparable" (STC) securitisations. Eager to revive the continent's securitisation market, European Union supervisors are pushing hard for STC securitisations to receive favourable capital treatment under Basel rules.

On November 10, the Basel Committee issued a consultation explaining the rationale for incorporating the STC criteria into the revised securitisation framework and the proposed options for doing so, seeking industry comment by February 2016. The committee plans on finalising the rules in the first half of 2016.

At the same time, the committee is working on a comprehensive treatment for sovereign exposures, which will affect both banking book and trading book capital rules.

Basel rules offer a number of ways to mitigate capital requirements on sovereign risk in the banking book, allowing a zero risk weight in some cases. In light of the European sovereign debt crisis, however, EU regulators believe the sovereign exposure framework is in need of a revamp. As with securitisations, the Basel Committee has been investigating the idea – and the outcome of that review may mean additional changes.

"No matter where you have the sovereign positions, obviously this would affect positions in the trading book," says Cabañas. "No matter what we say now, that is something that may be subject to further considerations as part of an overall review of the treatment of sovereign exposures."

Residual risk bites back

Of all the areas of concern in the Basel Committee on Banking Supervision's proposed standardised approach to trading book capital, the residual risk add-on tops the list. Dealers describe the add-on as "unrealistic" and "dogmatic" and complain it is extremely punitive.

The charge, introduced at the last minute in instructions to the fourth quantitative impact study, was designed to capture risk not adequately captured by the other main add-ons for instruments with optionality. The residual risk add-on was alone responsible for half the capital hike banks reported as part of the exercise.

There were two main reasons for this, say dealers. First, the charge was set at 1% of the notional of each trade; a level considered way too high. Second, while it was designed only for exotic products, the wording of the rules implied it could apply to all instruments that might see a client walking away from a trade. Consequently, some banks worry that the product scope may become "unlimited".

It's not just banks that are unhappy with the charge. Sources close to the Basel Committee's trading book group say the add-on made it into the latest proposals despite a lack of agreement among supervisors. "Depending on who you ask around the table, there are different views as to whether there was agreement and what the scope was," says one regulator close to the trading book group. "It was one of many issues in the standardised approach. The issues we discussed were in a 50-page paper and this was issue seven on page 45. There was not necessarily significant discussion about the ramifications."

The group's main objective was to clamp down on exotics, the regulator says, and the discussion within the trading book group didn't go much beyond that initial consideration. "There are people at the committee level that are very fearful of models," says the regulator. "So they looked at this and said 'one percent of notional: why not? This is all the exotic stuff: what are they doing in this space anyway?' It was a quick and easy fix."

In light of the impact study results, the residual risk add-on is likely to be scaled down. Supervisors have been debating a "sensible application" of the charge, the regulator says, and are eager that it should make up no more than 10% of total capital under the standardised approach.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

CGB repo clearing is coming to Hong Kong … but not yet

Market wants at least five years to build infrastructure before regulators consider mandate

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

FCMs warn of regulatory gaps in crypto clearing

CFTC request for comment uncovers concerns over customer protection and unchecked advertising

UK clearing houses face tougher capital regime than EU peers

Ice resists BoE plan to move second skin in the game higher up capital stack, but members approve

The changing shape of variation margin collateral

Financial firms are open to using a wider variety of collateral when posting VM on uncleared derivatives, but concerns are slowing efforts to use more non-cash alternatives

Repo clearing: expanding access, boosting resilience

Michel Semaan, head of RepoClear at LSEG, discusses evolving requirements in repo clearing