Aligning Operational Risk Management Frameworks to Appetites

Introduction

Three Historical Spikes in Operational Risk Losses

First-Order Effects: Transforming Credit Defaults and Market Turmoil into Operational Risk Losses

Second-Order Effects: Transforming Rising Unemployment and Falling Interest Rates into Operational Risk Losses

Conclusions and Root Causes

Regulatory Change: Part of a Perfect Storm

Macroeconomic Threats: Tax, Rising Interest Rates and New Asset Bubbles

New Technology: Changing Business Models and Risk Profiles

Three Horsemen: Societal, Political and Environmental Change

Backtesting to the Mid-1990s and Conclusions

Defining and Cascading Operational Risk Appetites

Aligning Operational Risk Management Frameworks to Appetites

Estimating Exposures to Tail Events

Solutions for a Triumvirate of Seemingly Intractable Problems

Conclusions

“You don’t get any credit for disaster averted.”

Hank Paulson, Secretary of the US Treasury, 2006–9

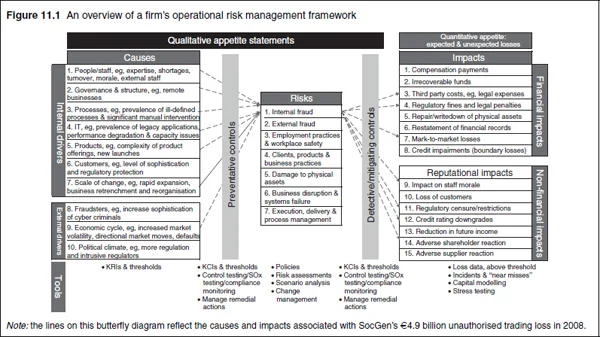

Operational risk is categorised by Basel II into a series of events. These events are synonymous with risk, as a risk is the potential for an event to occur that has the potential for an adverse impact.11“Risk can be defined as the combination of the probability of an event and its consequences” (ISO/IEC Guide). There are a range of causes that increase the likelihood of an event, and also a variety of financial and nonfinancial impacts.

Operational risk managers have developed a portfolio of tools to manage operational risk that are focused on understanding the firm’s profile, ie, causes, preventative, detective and mitigating controls, events/risks, and financial and nonfinancial impacts. This is illustrated in the “butterfly” diagram in Figure 11.1.

Tailoring these tools in line with a firm’s appetite for operational risk is very challenging because of the near-infinite complexity of the relationship between causes, controls and risks. Consequently, it has to be based on experience and judgement, and requires board-level engagement and

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net