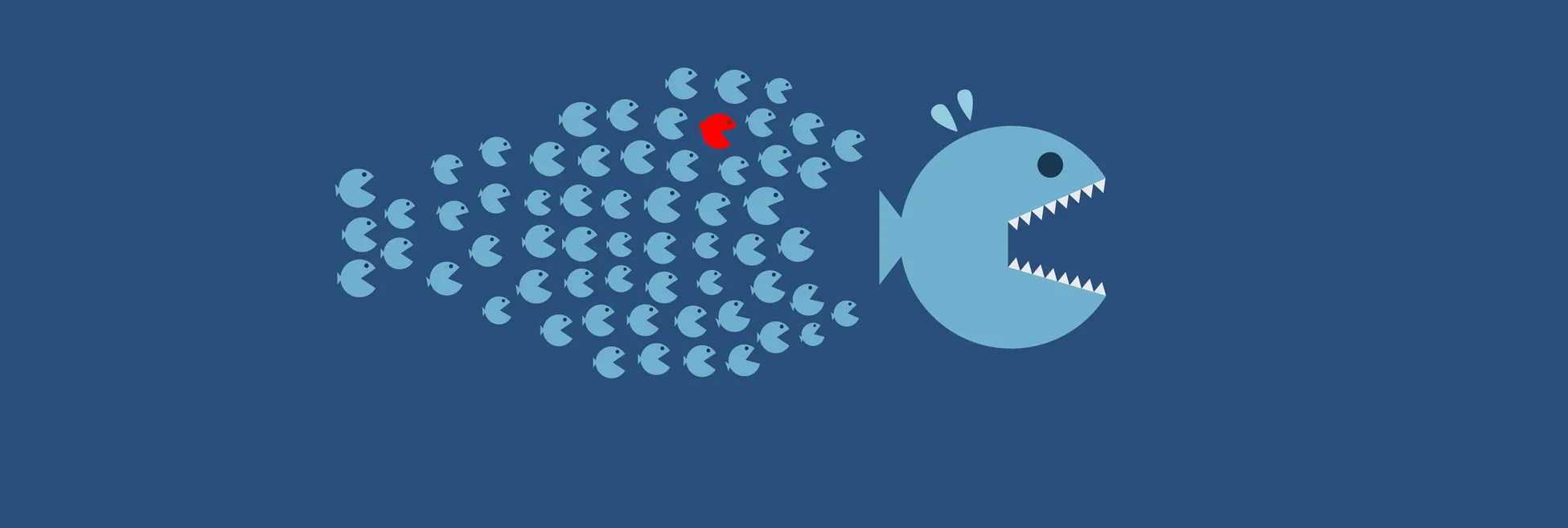

Inelastic markets: how index funds fuelled the meme stock frenzy

Retail traders can dictate prices in markets dominated by passive investors

The power of retail investors to sway stock markets puzzled Philippe van der Beck even before GameStop’s shares rallied 2,000% in January.

Since late last year, van der Beck and fellow PhD student Coralie Jaunin have been trying to explain how amateur day traders have been able to move the price of stocks like Ford, General Electric and General Motors – a phenomenon that appears to have become

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Investing

BlackRock appoints Pierre Sarrau as chief risk officer

Current CRO Edward Fishwick will be head of research at BlackRock’s RQA group

Japan’s yen swaps go global

JSCC isn’t just clearing swaps, it is clearing the way for the next stage of Japan’s financial evolution

How Bessent learned to stop worrying and love the T-bill

Short-dated issuance shows no signs of slowing. Some fear it could end badly.

Why a Trumpian world could be good for trend

Trump’s U-turns have hit returns, but the forces that put him in office could revive the investment strategy

Hedge fund holdouts boost euro steepener bets into year-end

After some investors took profits in September, those that stayed in the trade are now doubling down

Dutch pensions weigh hedge unwinds ahead of transition

As January 1 nears, Dutch pension funds consider unwind timing to avoid rush to the exit in thin year-end liquidity

BlackRock, Citadel Securities, Nasdaq mull tokenised equities’ impact on regulations

An SEC panel recently debated the ramifications of a future with tokenised equities

Institutional priorities in multi-asset investing

Private markets, broader exposures and the race for integration