This article was paid for by a contributing third party.More Information.

Yen rise spurs Japanese rates market surge

Traders are moving on an expectation of increased yen volatility in 2025, says Japan Exchange Group

Looking back to the early 2000s, global traders were betting big on the yen and Japanese government bond (JGB) markets, convinced that Japan’s economic troubles – stagnation, deflation and an ageing population – would drive up rates. But, instead of cashing in, they got burned, consistently getting caught out by the ever-persistent Japanese retail and institutional investors and the Bank of Japan (BoJ).

Japanese investors held on to their low-yielding assets, favouring their safety and stability. With memories still fresh from the bursting of the 1980s asset bubble, their risk aversion and lack of alternative investment options played a part too. At the same time, the BoJ’s aggressive monetary policies – including massive bond purchases and yield curve control – kept yields low. These moves suppressed rates and propped up bond prices, making it a costly mistake for those who bet against them.

Since the BoJ eased its monetary policy in 2013, Japan continued to experience an ultra-loose, low-rate environment. During this period, the dynamism and functionality of the yen rate market were lost, and a sense of resignation permeated among market participants.

Now it is 2025, and many of the world’s central banks, including the US Federal Reserve, are continuing to consider the timing of rate cuts. However, one central bank among the advanced economies is taking a different path – the BoJ.

Cost-push inflation began affecting Japan’s standard low-price expectations. The yen’s depreciation since 2022, resulting from drastic rate hikes by central banks worldwide, further fuelled domestic price increases in Japan.

In March 2024, under new governor Kazuo Ueda, the BoJ raised rates for the first time in 17 years, exiting negative rates. Simultaneously, the bank abolished the yield curve control policy that had set a cap on 10-year yields and announced a plan to reduce JGB purchases. Shortly thereafter, in July 2024, the BoJ implemented a further surprise 15 basis point rate hike. An anticipated additional 25bp rate hike by the bank in early 2025 will probably inject further vitality into the market.

Record high

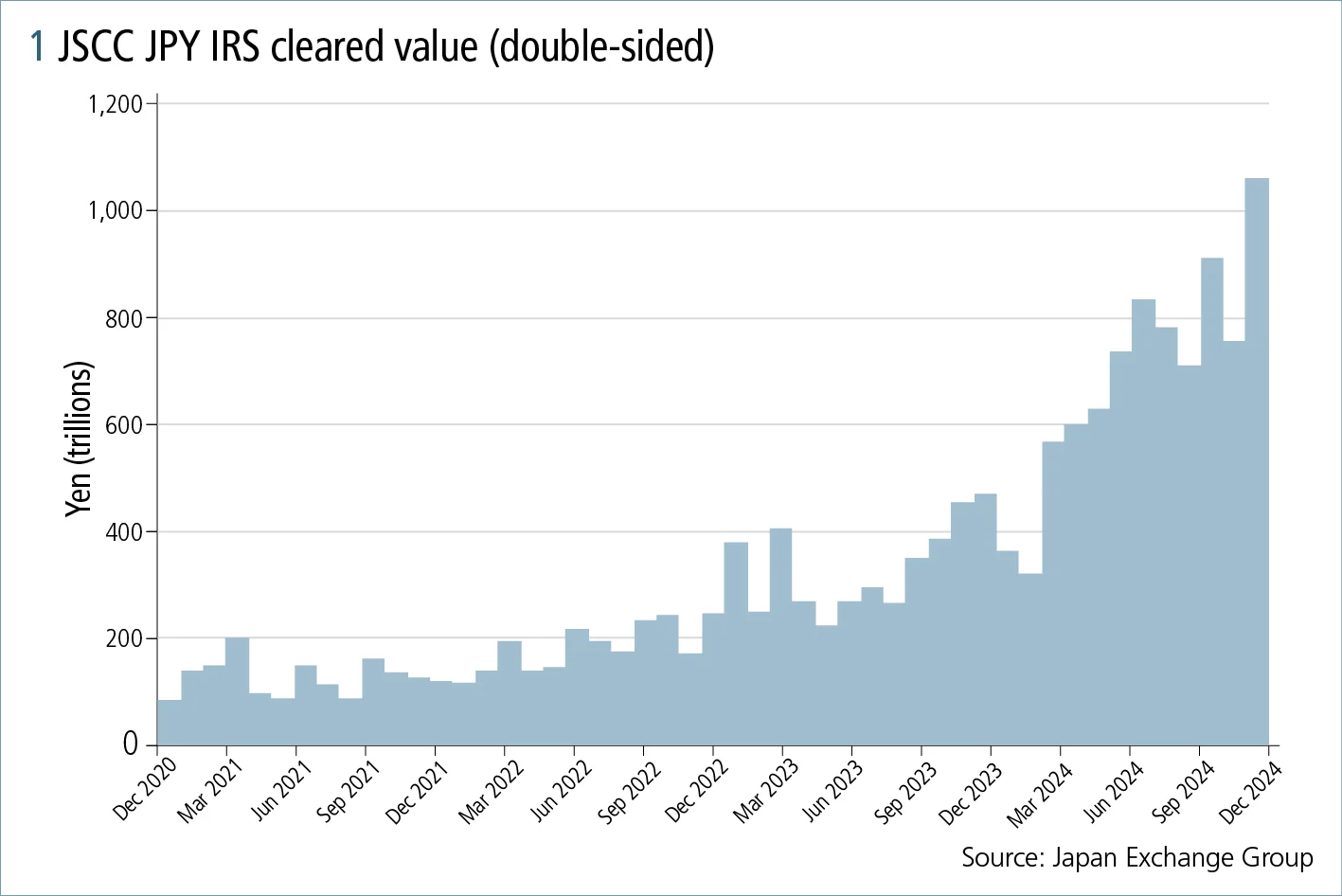

Following the BoJ’s bold moves to adjust its monetary policy, the yen rate-swap market has come alive with unprecedented activity. Since March 2024, the notional amount of JPY interest rate swaps (IRS) cleared by the Japan Securities Clearing Corporation (JSCC) has surged, setting record highs for five consecutive months.

In December 2024, the monthly clearing volume rocketed to a remarkable JPY1,060 trillion ($6.7 trillion) – more than a tenfold increase from JPY82 trillion in December 2020. While US clients are still not permitted to clear yen rate swaps through JSCC – due to regulatory restrictions imposed by the Commodity Futures Trading Commission, which encouraged a recent intervention by US senators – US dealers, as well as European and Asian dealers and clients, are behind this surge of liquidity.

Particularly noteworthy have been the short-term swap balances, specifically those with tenors of two years or less, which expanded by 50 times from December 2020 to October 2024.

These short-term swaps primarily span the different BoJ policy meetings, allowing traders to speculate on future BoJ policy changes at specific meetings. It is estimated that offshore hedge funds clearing at JSCC is taking on risk amounting to several trillion yen.

“We have seen trading activity in yen interest rate swaps increase significantly over the past few years. In 2024, DV01 [dollar duration] volumes nearly doubled year on year, with shorter-maturity instruments accounting for approximately 30% of the overall platform flow,” says Taichi Shibuya, head of Japan at Tradeweb – a global operator of electronic markets for rates, credit, equities and money markets.

“Clients are using a variety of trading protocols to execute this volume based on the type or size of the transaction and the actual market environment. These protocols range from the auction-like request-for-quote and two-way request-for-market to net-present-value list-trading, which enables clients to create and execute lists of multiple swaps quickly and efficiently.”

Furthermore, Japanese banks, unaccustomed to a changing rate environment, are finally taking steps to hedge against this new economic reality. For the first time in a decade, many mid-sized and smaller banks are hitting the JPY300 billion ($2 billion) threshold on outstanding over-the-counter (OTC) derivatives positions to trigger Japan’s mandatory clearing, prompting their entry into the swap clearing ecosystem. JSCC saw three newly onboarded regional banks nationwide in 2024, setting a record with 122 clients.

Hiroshi Kobayashi, chief manager of the clearing planning department and OTC derivatives clearing service at JSCC, states: “I frequently receive requests from Japanese regional banks expressing their desire to use JSCC’s clearing services, as they plan to expand their rates trading businesses. Additionally, some clients who have onboarded to JSCC’s JPY IRS clearing service are now considering becoming direct clearing members of JSCC to further expand their rates businesses.”

To make JPY IRS trading more efficient, another JSCC initiative will see US-dollar cash classified as eligible collateral from January 2025 to further facilitate access by non-Japanese clients, in partnership with State Street. JSCC has also worked with trading venues such as Tradeweb to enhance straight-through processing, in line with US and European Union swaps trading regulations.

“We have enabled institutional clients executing Japanese yen swaps on our multilateral trading facilities and swap execution facilities to clear their transactions via the JSCC,” says Shibuya. “This development has helped investors express their views in Japanese interest rate products much more efficiently than before, while simultaneously benefiting from more connectivity, flexibility and choice.”

Yen rate futures growth

The burgeoning market for short-term yen rate swaps is fuelling an expansion of the listed futures market targeting the BoJ’s policy rate, known as the Tokyo Overnight Average Rate (Tona).

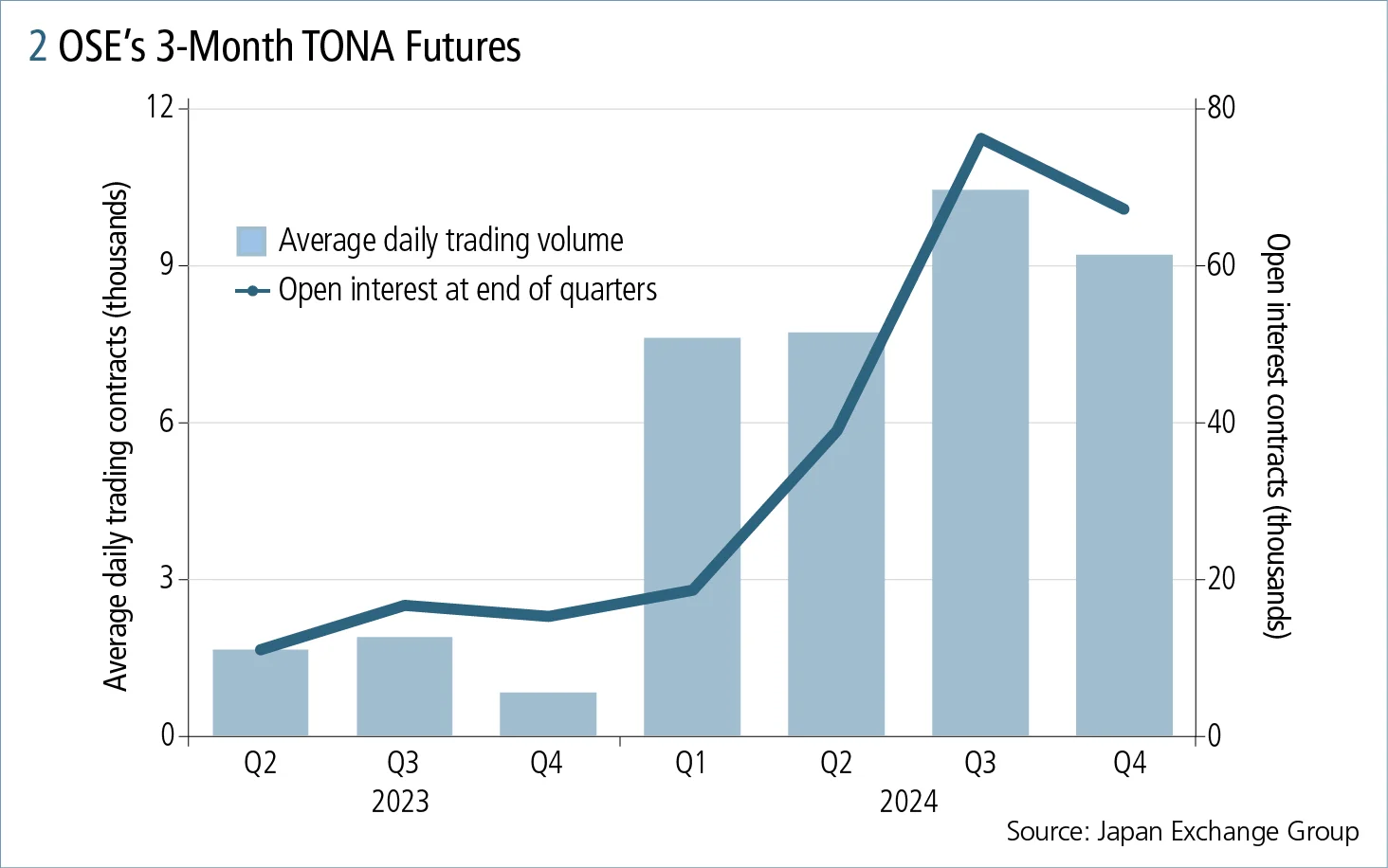

Since debuting in May 2023, 3-Month TONA Futures on the Osaka Exchange (OSE) have experienced remarkable growth in market size and participant numbers, establishing themselves as the most liquid Tona futures market globally. This growth gained momentum after January 2024, driven by rising expectations of BoJ rate hikes. Particularly striking was the increase in open interest, which soared from 15,000 contracts at the start of 2024 and touched 90,000 in November 2024.

The driving forces behind the expansion have been hedge funds and dealers, which now hold more than 70% of the open interest. These market players have been strategically positioning themselves based on expected shifts in the BoJ’s monetary policy, trading futures either outright or with rate swaps as a package. Notably, positions held before the BoJ’s policy meeting in December 2024 showed that the highest open interest was concentrated in the December 2024 contract month.

US market participants, restricted from clearing yen rate swaps through JSCC, may be using Tona futures as a proxy to simulate yen rate exposure cleared at JSCC.

Commenting on the evolving market last year, Yoshihide Koyama, assistant general manager at Ueda Tradition Securities, the largest interdealer broker for yen rate swaps, says: “Cross-margining between OSE’s Tona futures and JSCC-cleared yen rate swaps becomes feasible and important. As OSE Tona futures liquidity grows, their adoption by margin-conscious hedge funds is expected to increase.”

“The US, experiencing a whirlwind of rate hikes since 2022, faced moments when liquidity in many products declined, leading to reduced hedging functionality in the market,” adds Koyama.

“Amid the challenging environment, traders used a combination of cash instruments, futures and swaps, leveraging package transactions to maintain market hedging capabilities. The increased trading activity in secured overnight financing rate futures and swaps in the US can be seen as a natural response to the market demands during a rate hike cycle. This trend may also offer insights into what the yen market will seek and where it is headed as it enters its own path towards rate hikes. The growing open interest in Tona futures raises the question: what movements in other products will this trend lead to next?”

Kensuke Yazu, general manager at OSE, notes: “Initially, local financial institutions were conservative in beginning to trade our Tona futures, but their participation in this market has been steadily increasing. Local institutions indicate that, if policy rates continue to increase, they will expand their trading and hedging using OSE Tona futures. OSE is committed to enhancing the market liquidity, as evidenced by the introduction of liquidity-providing schemes for market-makers to calendar spread trading in August 2024.”

Rising JGB futures and repo

The rising tide of activity in the yen rate market is spilling over into markets beyond overnight interest swaps (OIS) and Tona futures.

In Japan’s most liquid yen rate market, the 10-year JGB futures, open interest soared past JPY20 trillion in 2024, nearly doubling the levels seen before the introduction of the BoJ’s 2013 quantitative and qualitative easing policy. The share of trading volume by overseas investors has also surged, climbing from about 50% in 2013 to over 70% in 2024, with a record daily trading volume of 327,674 contracts on June 10, 2024.

Since 2022, the BoJ’s fixed-rate purchase operations have gobbled up a significant amount of cheapest-to-deliver (CTD) JGBs, leading to a limited supply for the settlement of futures contracts maturing from March to September 2025, potentially making the physical delivery of JGBs challenging. Although the BoJ released some CTD issues into the market through supplementary supply operations at the end of 2024, easing some concerns about a CTD squeeze, market participants remain cautious but are watching vigilantly for trading opportunities.

Interest in asset swaps – driven by the BoJ’s rate policy changes – between cash JGBs and JPY IRS is surging, and domestic Japanese banks are increasing their participation.

“The primary tools for directly hedging the BoJ’s recent rate hikes are short-term OIS contracts, particularly those within one year, such as BoJ meeting swaps,” points out Koyama. “This trend is evident in the rising clearing volume reported by JSCC. In the absence of one-month futures in Japan, hedging short-term interest rates heavily depends on the liquidity of the OIS market.”

“For medium- to long-term interest rates, liquidity is concentrated in instruments such as 10-year newly issued JGBs, JGB futures, as well as in the OIS market where transactions are possible on an annual basis,” Koyama adds. “Package transactions that combine these products are expected to play a complementary role in hedging against liquidity shortages during periods of market stress. To facilitate this, it will be essential to standardise transactions and diversify market access, such as using on-exchange and off-exchange trading on-platform. Preparing for package transactions across different products is as essential as hedging against rate hikes, highlighting the need for proactive market readiness.”

“We have also been witnessing stronger demand for package transactions across yen rates products, such as non-contingent JGB asset swaps,” remarks Shibuya. “This is a major success story for us, as we have helped this market become more electronic by allowing the JGB and JPY IRS transaction legs to be executed separately, using the best-positioned dealers each time. Another area of focus for us and our clients is instruments trading against JGB futures, which have been ripe for electronification for some time.”

The JGB repo market has also witnessed solid growth, and the recent interest rate changes have invoked renewed interest from domestic and foreign member banks and brokers. In 2024, the volume of repos and outright trades cleared by JSCC reached JPY62,391 trillion, smashing the previous record of JPY56,422 trillion set in 2023. Even without a regulatory clearing mandate in Japan, the clearing ratio of Japan’s repo and outright trades has consistently been around 80%, reflecting strong market confidence in JSCC’s clearing services.

To meet the increasing demand for repo clearing, JSCC plans to launch a sponsored clearing solution in June 2025. This innovation will smooth access to clearing by entities that are unable to participate in JSCC’s mutualised clearing fund, such as Japanese money reserve funds. This initiative is poised to bolster the stability and resilience of the JGB repo market. Additionally, JSCC is exploring the potential introduction of an agency clearing solution, similar to the existing client clearing setup for JPY IRS and futures, to further enhance the market access choices available to bond investors.

Looking back, looking forward

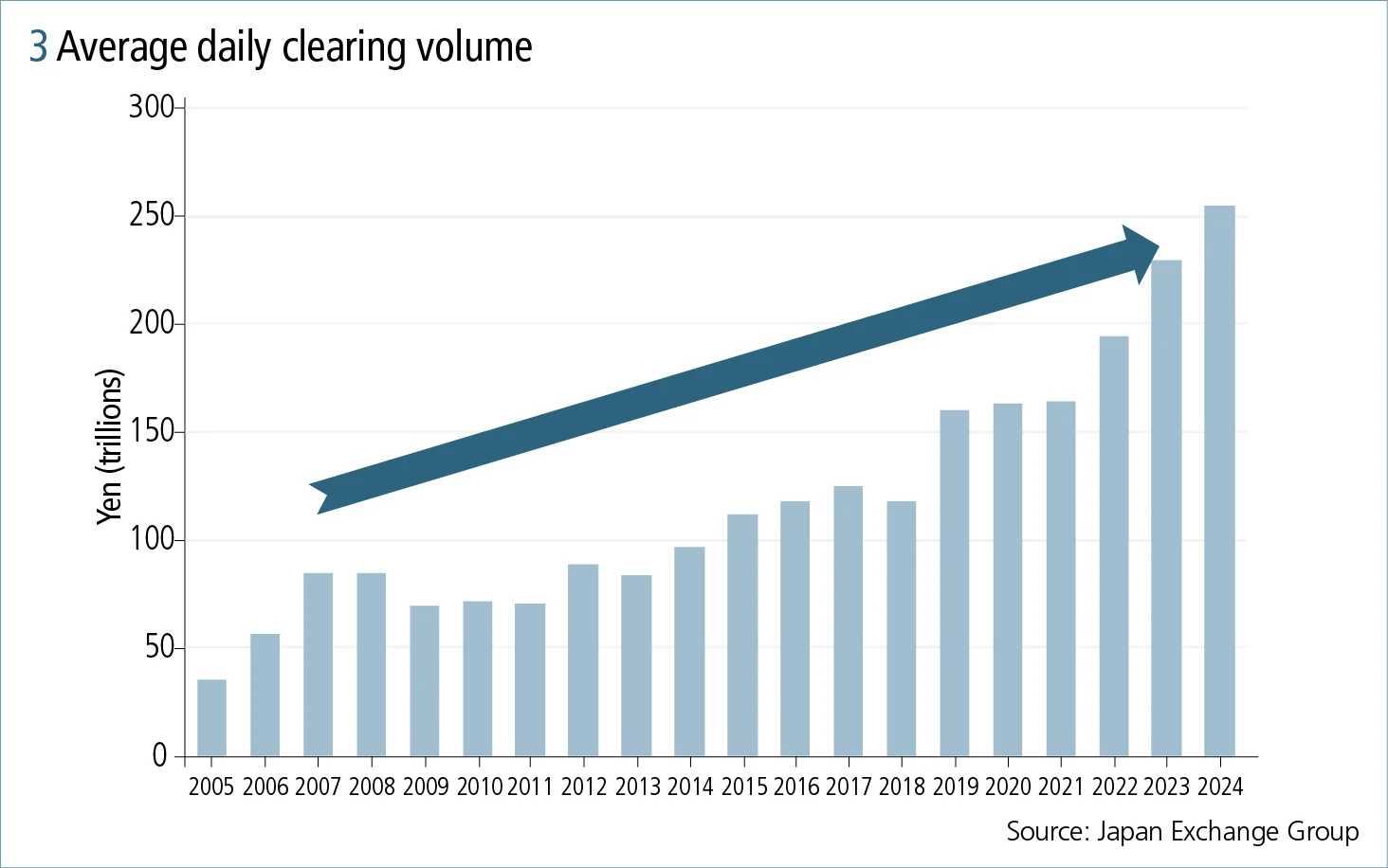

Starting in 2013, the yen rate markets had been experiencing a deep freeze but, in 2022, a market revival began with the BoJ adjusting its yield curve control policy. By 2024, the market had quickly thawed, with volumes increasing significantly.

Overseas tourists are taking advantage of the weak yen, enjoying the history of Kyoto and the delights of the Japanese powder snow – known as Japow – at Niseko. However, with further inflation expected in Japan, interest rates will continue to increase in 2025, fuelling a continued expansion of market participants and activity as the revived yen rate market grows even stronger. As a result, investors can reap the rewards from JSCC’s cleared markets by tuning in to the yen rate markets – via cash JGBs, rate swaps and rate/government bond futures.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net