The basics of basis

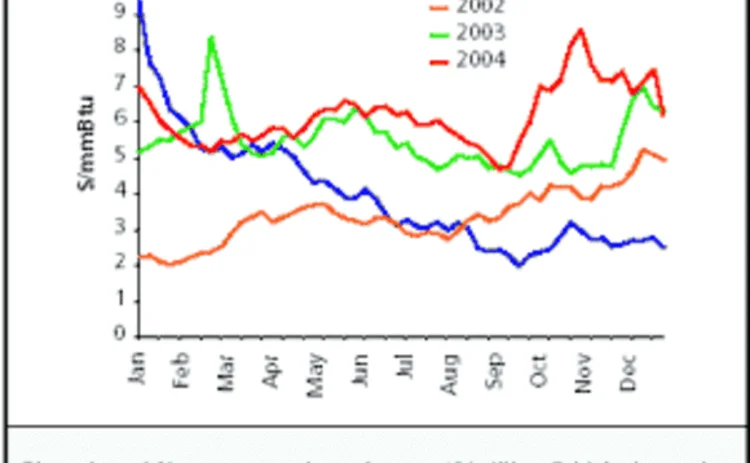

Basis plays an important role for trading in the very complex US natural gas markets: spot will differ from the benchmark Henry Hub New York Mercantile Exchange price on the same day. Eric Fishhaut describes how the basis works and demonstrates the relationship between the different market prices

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Foreign exchange

Will Taiwan lifers ramp up FX hedging amid tariff turmoil?

As TWD remains strong against the US dollar, Taiwanese life insurers are still poised to act

Deutsche Bank takes AutobahnFX on the open road

Proprietary trading platform sets out new workflow-based approach to collaborating with venues

Dealers bullish on Bloomberg chat interface for FX markets

Service expanded its API offering to integrate broker chats into banks’ engines for cash FX pricing late last year

LCH expects to boost deliverable FX clearing with new adds

Onboarding of dealers and link-up with CLS could swell interbank deliverable FX clearing volumes

Does no-hedge strategy stack up for mag seven mavericks?

At Amazon, Meta and Tesla, the lack of FX hedging might raise eyebrows, but isn’t necessarily a losing technique

Amazon, Meta and Tesla reject FX hedging

Risk.net study shows tech giants don’t hedge day-to-day exposures

Intraday FX swaps could signal new dawn for liquidity management

Seedling market could help banks pre-fund payments in near-real time and reduce HQLA requirements

Natixis turns on the taps in flow trading

French bank boosts flow business, balancing structured solutions capabilities