This article was paid for by a contributing third party.More Information.

Brexit: Pound Set For Volatile Fall after Calm Summer?

By Erik Norland, Executive Director and Senior Economist, CME Group

On July 23, the UK’s Conservative Party will announce it new leader, who will also become the country’s next Prime Minister, succeeding Theresa May. That will almost certainly be Boris Johnson, leader of the 2016 official “leave” campaign (the unofficial campaign was spearheaded by the newly formed Brexit Party chief Nigel Farage). Oddsmakers favor Johnson 95% to 5% over former “remain” supporter Jeremy Hunt, the current Foreign Secretary. In Johnson’s words, Brexit by October 31, 2019, is a “do or die” issue for the Tories. If they fail to achieve the UK’s departure from the European Union, the rising Brexit Party will assure that the Conservative Party’s goose is cooked in time for Christmas.

Curiously, the same oddsmakers who give Johnson overwhelming odds of becoming Prime Minister don’t think that Brexit is all that likely by December 31, 2019, much less by the October 31 deadline. They price a 55% chance that the UK will still be in the European Union (EU) by year’s end, and only a 45% chance that the UK will have left either with a deal (16%) or without one (29%).

Furthermore, the oddsmakers price a 77% likelihood of a no-confidence vote in 2019, presumably shortly after Johnson moves into 10 Downing Street. If the government loses a no-confidence vote, this will lead to new elections, which would almost certainly delay Brexit further. Opinion polls show a very fluid political situation in the UK, with traditional loyalties breaking down as leave-versus-remain supersedes the traditional left-right divide.

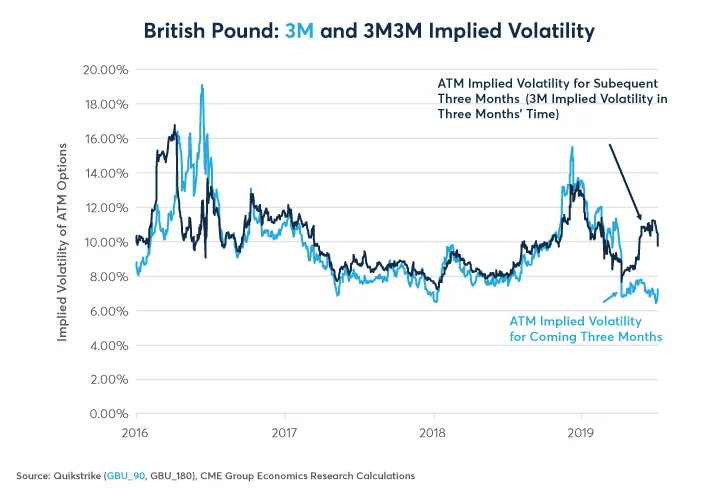

Given the potential, and near certitude, of high stakes political drama this fall, it’s not surprising that the options markets on the British pound (GBP) price a volatile fourth quarter. Three-month (3M) at-the-money (ATM) options, which don’t cover the October 31 deadline, traded at an 7.25% implied volatility recently. Six-months options, which do cover the October 31 deadline, traded at closer to 8.5% implied volatility. This connotes that the implied volatility for 3M options three months from now (3M3M) is close to 9.75%. Basically, traders expect a relatively calm summer for the GBP-US dollar exchange rate but a significantly more volatile period in the fall (Figure 1). That said, the implied volatility is hardly at extreme levels and for either 3M or 6M options, and it has the potential to drift significantly higher as the Brexit drama heats up again this fall.

Figure 1: British pound options project greater, but hardly exceptional, Q4 volatility.

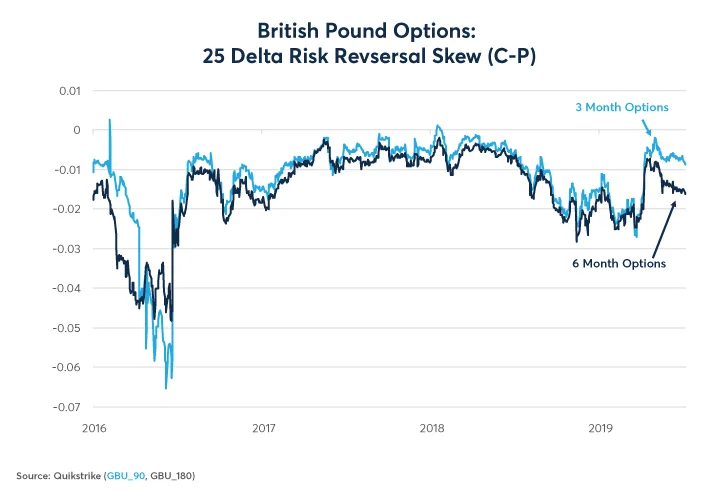

Options skew also hints a greater downside potential for the pound in the fall than over the summer. 3M 0.25 delta out-of-the-money (OTM) puts trade for about 1% implied volatility more than 3M 0.25 delta OTM calls. On the 6M options that difference is closer to 2%. In other words, the downside potential for the pound becomes more acute as we enter the fall months in the view of options traders.

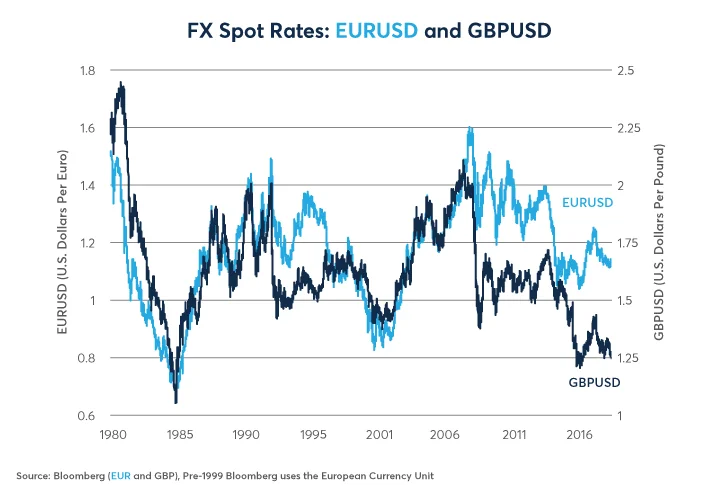

That said, traders don’t see the downside skew on the pound as being anywhere near as extreme as it was in 2016 prior to the Brexit referendum. At that point, OTM puts traded at an implied volatility as high as 5-7% more than equivalent OTM calls (Figure 2). This could be because the pound is already depressed by historical standards, having recently sunk to two-year lows. A longer historical view, however, suggests that if Brexit goes badly for the UK, the downside could be more substantial: the pound’s all time low was 1.05 versus USD set in 1985, about 15% below current levels (Figure 3). In any case, with so much bad news priced into the pound already, its not too surprising that the skewness isn’t especially negative. Indeed, the pound has substantial upside risk in the event of an exit with a deal or without.

Figure 2: Options traders see downside risks somewhat outweighing upside risks for GBP this fall.

Figure 3: The pound is historically weak versus EUR and USD.

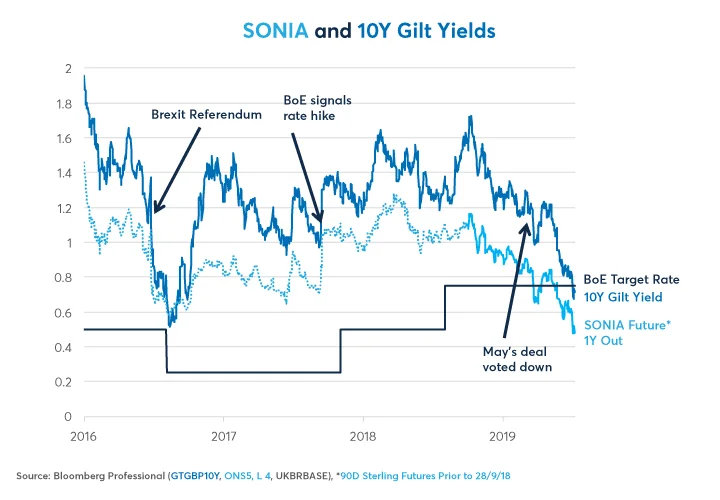

Figure 4: UK rate markets have abandoned rate hike expectations; BoE’s next move could be a cut.

Lastly, UK interest rate markets have abandoned pricing rate hikes and SONIA now prices that the Bank of England’s next move is more likely to be a rate cut than an increase. This reflects in part the global decline in interest rates which has swept both the US and European bond markets, as well as domestic factors such as a slowing UK economy and continued uncertainty surrounding Brexit.

Bottom Line

- Options traders see a calm summer but volatile fall for GBPUSD.

- Implied volatility is far below 2016 levels.

- Options skewness is negative, especially for this fall, but not exceptionally so.

- A great deal of bad news has been priced into the pound.

- SONIA futures have abandoned hopes for the BoE rate hike, now suggest a cut is more likely.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net