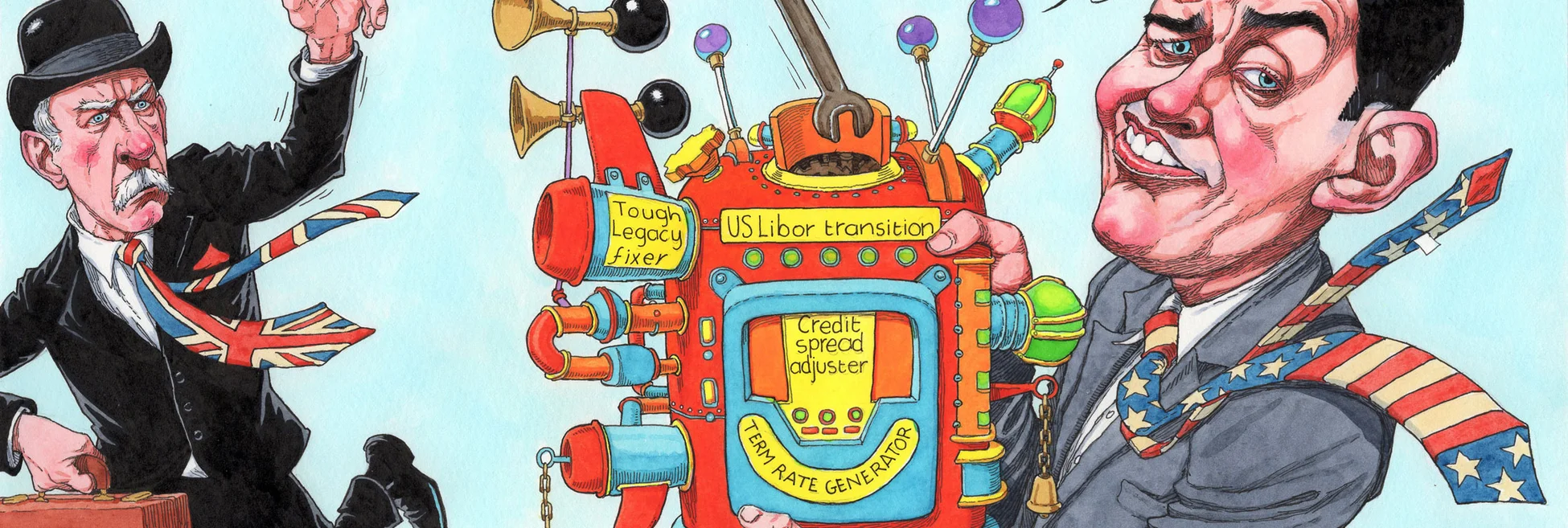

UK’s tough legacy fix spells trouble for US Libor transition

FCA will have little control over how synthetic Libor rates are used in other jurisdictions

In their rush to rid the financial world of Libor rates, regulators glossed over a stubborn problem: an untold number of so-called tough legacy contracts are hardwired to the discredited benchmark and cannot be re-hitched to alternatives. With less than 18 months until Libor’s scheduled phase-out, regulators are finally addressing the issue head-on.

“The whole ballgame here is tough legacy and there’s no simple solution for it,” says Anne Beaumont, a partner at law firm Friedman Kaplan.

On

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

EMS vendors address FX options workflow bottlenecks

Vol jump drives more buy-side interest in automating exercises and allocations

Inside the week that shook the US Treasury market

Rates traders on the “scary” moves that almost broke the world’s safest and most liquid investment

Patience pays off for XVA desks in wild week of tariff swings

Dealers avoided knee-jerk reactions that could have caused credit spreads to widen further

Treasury selloff challenges back-office systems, data feeds

FIS and Trading Technologies suffered downtime during peak activity

FX liquidity ‘worse than Covid’ amid tariff volatility, dealers say

Available liquidity for single clips dropped to as low as $20 million ahead of tariff pause

New FX swap matching platform aims to bridge voice and e-trading

FXswapX seeks to electronify “the last bastion of voice trading” in the interdealer market

Fed’s Bowman to ‘prioritise’ SLR exemption for US Treasuries

Reinstating Covid-era relief is a ‘no brainer’, dealers say, as bond markets reel from tariff chaos

Trump tariffs turn swap spreads into ‘pain trade’

Hedge funds bet big on Treasuries to outperform swaps. The opposite happened.