Review of 2016: turn and face the strange

Post-crisis reform has caused upheaval, but gave recent years a sense of direction; in 2016, that was missing

What a weird, worrying year. Confusion and conflict were rife – most obviously in the world of politics, but the mood seemed contagious. The combination of political upheaval and controversial in-flight reforms left many market participants with no clear sense of direction.

It was a year in which regulators finally unveiled their painstakingly reformed market risk capital framework, but those rules had little to say about one of the year's biggest trading book losses – the $712 million charge at Standard Chartered, which resulted from a revaluation of its derivatives portfolio. Similar charges have regularly blown a hole in bank earnings reports in the past two years as cost structures and pricing practices have changed. During this period, regulators and accounting standard setters have provided little or no guidance – traders, quants and auditors at each bank are making and breaking their own rules as they see fit.

Challenges to common sense could be seen elsewhere – in the outlines of an operational risk framework that would shackle banks to their past failings; a leverage ratio that was supposed to introduce international comparability but allows French banks to behave entirely differently to their US rivals; a clearing system that may have reduced concerns about counterparty risk but is now prompting concerns it may be a source of liquidity stress.

In this article, we look back at some of the year's biggest stories.

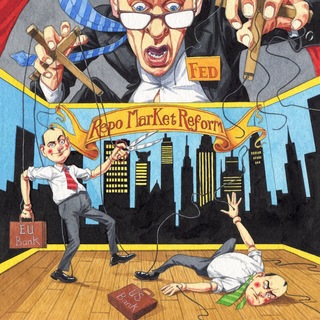

REPO MARKETS, NATIXIS AND LEVERAGE

Befitting its status as a key funding source for banks and hedge funds, the US Treasury repo market has traditionally been predictable, dull, and largely ignored. That was not the case in 2016.

Befitting its status as a key funding source for banks and hedge funds, the US Treasury repo market has traditionally been predictable, dull, and largely ignored. That was not the case in 2016.

Among the indicators that something was up, three French banks elbowed aside their US rivals to become the biggest US Treasury repo counterparties to money market funds (MMFs) – a story Risk broke in September; banks that used JP Morgan to clear their general collateral finance repos suddenly found themselves being charged more than those using BNY Mellon; and participants braced for a quadrupling of rates on overnight repo as the third quarter drew to a close.

The explanation for all of this is complex, with a trio of regulatory initiatives playing a part – US reform of the MMF sector, the Federal Reserve's efforts to take intraday credit risk out of the triparty repo market, and transatlantic differences in implementation of the leverage ratio. The latter factor is what allowed French banks to build their huge US Treasury repo books – and consequently support MMF and hedge fund liquidity needs – but the playing field will be levelled in 2018, when the largest US arms of foreign banks become subject to US regulation. At that point, participants worry quarter-end stress – and higher repo rates – will be the norm, not the exception.

Speaking to Risk, Federal Reserve governor, Jerome Powell, said it is up to the market to adapt to these new pressures. One way to take some of the stress out of the system would be to allow more widespread repo clearing – high on the to-do list for the Depository Trust & Clearing Corporation, according to its clearing head, Murray Pozmanter.

"As the balance sheet that was supplied by traditional players has been pulled back and in turn pushed spreads wider, there has been a greater demand from counterparties to broaden their sources of funding" – John Kolb, Natixis

"The leverage ratio, the liquidity coverage ratio, tri-party repo reform, MMF reform – these are some of the central pillars of post-crisis reform... I don't sense any appetite for adjusting these reforms, at least until we give markets a significant amount of time to adapt to them" – Jerome Powell, Board of Governors of the Federal Reserve System, September 1

"On BrokerTec, I am seeing a 50bp bid and no offer at JP Morgan, and a 39bp bid at BNY Mellon. So it is currently 11bp more expensive to finance yourself at JP Morgan" – New York-based repo desk head, July 21

"We devised a system to allow the clearing banks to message each other via FICC to facilitate substitutions. To cut a long story short, one of the clearing banks decided they didn't want to build that system, so we had to suspend interbank trading" – Murray Pozmanter, DTCC, July 27

"It's going to be a very wild day" – hedge fund repo specialist, September 29

BREXIT – THE PUBLIC IMPACT

A little after midnight on the morning of June 24, the northern English city of Sunderland triggered a 4% collapse in the value of sterling after a larger-than-expected share of its voters called for the UK to leave the European Union. It was the first in a string of local upsets, which ultimately added up to a national victory for the Leave campaign.

A little after midnight on the morning of June 24, the northern English city of Sunderland triggered a 4% collapse in the value of sterling after a larger-than-expected share of its voters called for the UK to leave the European Union. It was the first in a string of local upsets, which ultimately added up to a national victory for the Leave campaign.

Severe volatility in thin Asian trading continued as the day wore on, and spread beyond sterling to hit stocks and bonds. Banks had approached the event with strict instructions to limit their exposure, so they could meet client needs on the day; and some clients were in real pain. Hedge fund H2O, for example, saw a combined $165 million drop in the net asset value of its funds on the day of the referendum result – losses it claimed to have mostly recouped in the week that followed.

But banks were also thought to have suffered some paper losses, for example on credit valuation adjustment (CVA) – a measure of derivatives counterparty exposure. A combination of lower rates and wider credit spreads was estimated to have generated losses of $25 million or more at each big dealer.

Volatility soon ebbed, but uncertainty about the impact of the vote remains. Three questions were posed in the days after the vote that are yet to be answered: on the future shape of a standalone UK's regulatory regime; its access to European markets; and whether London could retain its dominant role in euro-denominated clearing. On the latter question, French president François Hollande was quick to insist clearing would have to move to the continent – but it was much too early to be so categorical, as our Regulation editor pointed out.

A related question is whether UK-based clearing houses would still be approved for use by overseas members following Brexit: this requires recognition or authorisation by the relevant overseas supervisors, a decision currently based on European regulation.

"If you walked on our floor at around 7am to 7.30am this morning, it felt a little Lehman-esque in activity, size and shouting" – Frits Vogels, Icap, June 25

"Bond markets have behaved properly – the ones that have not really behaved are equity markets, such as the Nikkei, Euro Stoxx and especially the S&P. That's where we suffered most on June 24" – Bruno Crastes, H2O Asset Management, June 29

"Nothing went the right way" – head of CVA trading at one European bank, June 30

"It is the EC and Esma that will determine whether UK CCPs are equivalent, not the French president" – Philip Alexander, Risk.net, June 29

"We will need to see where the withdrawal agreement ends up between the UK and the EU before we know for sure how third countries such as the US will treat UK CCPs from an equivalence or recognition perspective" – Simon Puleston-Jones, FIA, July 1

"Businesses dislike uncertainty and they create their own certainty if you don't present it to them" – Etay Katz, Allen & Overy, September 22

BREXIT – THE HIDDEN IMPACT

One of the bigger Brexit stories only came to light months after the vote – the huge margin calls issued by derivatives clearing houses on June 24 and 27, to cover swings in a range of currencies, yield curves and stock markets. This real-life stress test for the cleared swap markets passed without mishap, but provoked debate among market participants and regulators about the concentrated liquidity risks it revealed.

One of the bigger Brexit stories only came to light months after the vote – the huge margin calls issued by derivatives clearing houses on June 24 and 27, to cover swings in a range of currencies, yield curves and stock markets. This real-life stress test for the cleared swap markets passed without mishap, but provoked debate among market participants and regulators about the concentrated liquidity risks it revealed.

On the day of the result, sterling saw its biggest intraday trading range for more than 20 years versus the euro and dollar; it was also the biggest intraday range in more than five years for UK and German government bond yields, the FTSE 100 and the Euro Stoxx 50. Even US yields racked up their second-biggest intraday move in five years.

The combined margin call for the largest members of CME, Eurex, LCH and Ice was estimated at somewhere north of $25 billion, with individual banks having to stump up multiple billions. In some cases, those calls had to be authorised by the top management of the banks in question.

The calls were first publicly mentioned at a Commodity Futures Trading Commission (CFTC) meeting on October 6, where banks vented their frustrations with an unnamed central counterparty (CCP). On October 19, Risk was able to reveal the full story of the industry's anger at LCH's margining practices – following that with news that LCH planned to make revisions to its intraday margining, and then with a longer article that examined the systemic risks associated with the new mandatory clearing regime.

"We had an event – it was Brexit – and one CCP behaved poorly during that, so we need to do better" – John Dabbs, Credit Suisse, October 19

"We are committed to allowing FCMs to use unallocated excess in the first intraday MDR call beginning on November 3" – John Horkan, LCH, October 20

"Suddenly having to make a 10-digit payment makes people uncomfortable" – US-based clearing head

"Brexit was a very volatile day and margins were increased as they should be in a situation like that. There is a concern that you don't want to be calling for a lot of margin in particularly volatile times if you can avoid that by having adequate margins in the first place" – Timothy Massad, CFTC

"People had known the vote was coming and had taken precautionary measures. Well, what would have happened in a surprise event? How would the industry have handled that?" – Craig Pirrong, University of Houston, October 31

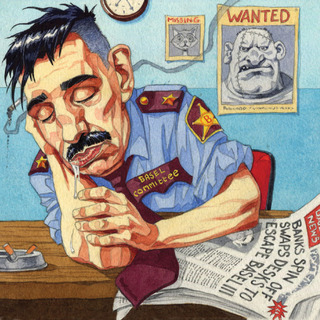

OP RISK UPHEAVAL

One by one, the pillars of bank op risk management cracked or toppled this year. The Basel Committee on Banking Supervision started the assault in 2015, giving advance warning it was minded to scrap the advanced measurement approach (AMA) – under which banks were allowed to calculate their own regulatory capital requirements.

One by one, the pillars of bank op risk management cracked or toppled this year. The Basel Committee on Banking Supervision started the assault in 2015, giving advance warning it was minded to scrap the advanced measurement approach (AMA) – under which banks were allowed to calculate their own regulatory capital requirements.

Official proposals arrived in March this year, triggering a fierce pushback, but not a unanimous one. Writing in Risk, one former op risk manager agreed with regulators that the models were too complex.

As the year draws to a close, all the indications are that the AMA is dead and buried. But regulators are thought to be looking for a way to make its replacement – the standardised measurement approach (SMA) – more forward-looking. Critics of the SMA object to the fact that a bank's loss history would be the sole determinant of its capital requirements, meaning there would be no capital incentive for an institution to tighten up its practices in response to an event.

As one illustration of the SMA's impact, Risk revealed in November that Deutsche Bank could face a lasting capital hit as a result of its pending Department of Justice fine for the issuance and underwriting of mortgage-backed securities. In its current form, the SMA is also thought likely to see a bigger capital jump at European banks than US institutions.

The other sacred cows threatened this year were key risk indicators – practitioners argued their value is being undermined by weak risk culture at many organisations – and the 'three lines of defence' model, a theoretically elegant approach to risk management that falls down in practice, according to some banks.

"While internal models are an essential part of risk management for many banks, the question is what role they should play in prudential rules. This is particularly relevant for operational risk" – Bill Coen, Basel Committee on Banking Supervision, May 18

"It isn't the mathematics that I struggle with, but the fairy-tale stories that are used to justify all the adjustable parameters, which are generously stuffed into the typical AMA model" – Ruben Cohen, operational risk consultant, July 5

"Under the SMA, the impact [of a $14 billion settlement] could be way above $14 billion" – New York-based operational risk manager, November 1

"Our initial estimates are that the impact on the US banks would not be very significant, and that's how we want it to be" – regulatory source close to the Basel Committee, April 11

"The three lines of defence is a great theoretical concept, but to put it into practice well is exceptionally difficult" – Sam Lee, Sumitomo Mitsui Banking Corporation, August 17

"It is really hard to get the initial population right for KRIs" – Ann Rodriguez, formerly GE Capital, February 16

THE HARSH REALITY OF LIBOR REFORM

The world's central banks and regulators have been commendably frank and open about the need to replace Libor as an interest rate benchmark. Back in 2014, a group of 21 officials from 11 countries concluded it would be dangerous to continue anchoring derivatives and other instruments to a shrinking interbank lending market, even after reform of the Libor quoting process.

The world's central banks and regulators have been commendably frank and open about the need to replace Libor as an interest rate benchmark. Back in 2014, a group of 21 officials from 11 countries concluded it would be dangerous to continue anchoring derivatives and other instruments to a shrinking interbank lending market, even after reform of the Libor quoting process.

At the start of 2015, national working groups began the harder work of deciding what to replace it with. They have found the options for a new risk-free rate (RFR) are limited, partly because volumes in some of the candidate markets have been shrinking.

A second problem is that, while the industry might recognise the benefits of a new rate, many quail before the huge logistical challenge of transitioning to it. Regulators have been stepping up the hearts-and-minds rhetoric this year, but with little obvious effect.

"Who we must convince are the major dealers who offer you these swaps, and encourage and require customers to move into new products, which they don't want to do unless regulators encourage that process as well" – Darrell Duffie, Stanford University, January 26

"It isn't realistic. It is such a painful process that people won't change that quickly" – senior rates trader at a US bank, March 7

"Without robust and reliable RFRs that are ultimately embraced by end-users, the reform process is incomplete" – Chris Salmon, Bank of England, May 16

"It turns out that there just aren't that many active fixed-income markets. Or at least, active enough to support a rate" – David Bowman, Board of Governors of the Federal Reserve System, November 10

STANCHART'S CVA SHOCKER

One of the year's biggest derivatives stories arrived on February 23, in the guise of Standard Chartered's annual report. There, on page 231, was the news the bank had changed its approach to CVA; a few-dozen pages later came the revelation it had lost $712 million as a result.

One of the year's biggest derivatives stories arrived on February 23, in the guise of Standard Chartered's annual report. There, on page 231, was the news the bank had changed its approach to CVA; a few-dozen pages later came the revelation it had lost $712 million as a result.

In a sense, this was not a surprise: rival dealers in Asia had long believed the UK bank was mispricing derivatives counterparty risk. In fact, the bank revealed it had been calculating counterparty risk on the basis of credit ratings. Other banks had switched to market-implied default probabilities – typically derived from credit default swap spreads – a decade or more earlier.

Standard Chartered insiders claimed traders had been agitating for a change for some time. The new policy is understood to have been spurred by the arrival of Bill Winters as chief executive. At his earlier home, JP Morgan, market-based pricing was a cornerstone of the derivatives business.

But the story also has wider relevance. Many of the local players in the world's derivatives markets still do not fully price CVA – and the revaluation losses at Standard Chartered are a sign of what awaits when banks decide to follow suit, or are pushed by their regulators. In June, participants in the yen interest rate swaps market predicted the emergence of a pricing difference between the product's two major clearing houses – LCH and the Japan Securities Clearing Corporation (JSCC) – would force banks to recognise the suite of adjustments that affects swaps pricing, known as XVAs. In November, Australia's ANZ announced a A$168 million ($122 million) CVA loss of its own, as it updated its methodology.

"Prior to now, we have not had an observable market for the majority of our derivatives positions, given the markets we operate in and the counterparties we deal with" – Standard Chartered spokesperson

"I remember having debates with other banks many, many years ago and being astounded people were still arguing that you could use historical spreads" – CVA expert, March 15

"What we saw recently with the JSCC-LCH basis has resulted in the Japanese market recognising the existence of XVAs" – Kuniomi Kimura, Nomura, June 9

"We have seen initial signs that some Chinese banks are starting to calculate CVA" – Ellen Tang, Standard Chartered, November 7

"At the moment, if you look at CVA across banks, you see a spectrum" – Jon Gregory, derivatives valuation expert, December 20

THE ALL-SEEING EYE OF THE CFTC

Regulators on both sides of the Atlantic have been given new authority to pursue insider trading cases in the derivatives markets, and spent some of this year trying to set the boundaries of their new powers – tricky, because insider trading cases often rest on an abuse of fiduciary duty, which does not exist in the average swap.

Regulators on both sides of the Atlantic have been given new authority to pursue insider trading cases in the derivatives markets, and spent some of this year trying to set the boundaries of their new powers – tricky, because insider trading cases often rest on an abuse of fiduciary duty, which does not exist in the average swap.

In the case of the Commodity Futures Trading Commission, cases may instead be brought on the legal concept of 'misappropriation' – the use of information that a trader had a duty to hold in confidence. In an interview with Risk in March, officials from the agency explained this could snare – for example – a bank trader who told a hedge fund client about the positioning of the bank or other market participants. Would such information ever make its way to the agency? Perhaps – in a separate interview, the head of the CFTC's surveillance team warned traders that the regulator has eyes and ears everywhere. Not quite in those words, admittedly.

In court, the CFTC has also been pushing ahead with market manipulation cases – including one against Don Wilson, founder of proprietary trading firm DRW Trading – that critics feel are aggressive.

In Europe, participants in commodity derivatives markets have been required since July to make public any 'inside information' before they are allowed to trade on it, but regulators are – understandably – refusing to publish an exhaustive list of the scenarios in which disclosure would be required. Equally understandably, participants are now planning to err on the side of caution, raising awkward questions for firms seeking to offset losses resulting from a non-public event, such as an oil rig going offline.

"If [a market-maker] discloses the bank's positions to a hedge fund trader who trades on that information – not necessarily even against the bank – we could charge both the employee of the bank as well as the hedge fund trader" – Joan Manley, CFTC, May 23

"We see very, very deeply into the derivative markets, into futures and swaps" – Matthew Hunter, CFTC, August 16

"I think it's clear that, if you have a very large market position and you believe how you trade will affect the price, you need to be really careful" – Dan Berkovitz, WilmerHale, September 15

"If you are directly affected by that inside information, should you or shouldn't you be allowed to cover yourself in the markets?" – Jonathan Whitehead, Societe Generale Corporate & Investment Banking, December 19

TOO TOUGH ON SWAPS?

If the non-cleared derivatives market was a lake, what kind of lake would it be? In June, Risk depicted it as a beauty spot made toxic by the run-off from a nearby industrial facility – a dark haze hung over the water, dead fish floated in the shallows, and would-be picnickers looked on in dismay.

If the non-cleared derivatives market was a lake, what kind of lake would it be? In June, Risk depicted it as a beauty spot made toxic by the run-off from a nearby industrial facility – a dark haze hung over the water, dead fish floated in the shallows, and would-be picnickers looked on in dismay.

The serious point was that a combination of revamped pricing practices and new regulation is interacting with the market's bespoke collateral agreements in a way that makes the non-cleared product increasingly difficult to trade. In the 18 months prior to June 2015, non-cleared notional as measured by the International Swaps and Derivatives Association, fell from somewhere north of $111.2 trillion to $74 trillion, and senior traders from a number of banks warned the collapse could continue.

It was the first of a four-part series of articles on the market's challenges, which went on to cover negative interest rates, the countdown to the market's new initial margining regime, and hopes that collateral agreements could be standardised. At its conclusion, Risk published a comment from Scott O'Malia, the chief executive of Isda. The toxic lake analogy had been "a bleak interpretation", he argued – the non-cleared market is changing, rather than dying.

The year offered support for both pessimists and optimists: buy-side firms complained they were being quoted "ridiculous" charges to unwind bilateral trades, and the arrival of the new non-cleared margining regime drove more users to the cleared space. Set against that, buy-side firms turned to the non-cleared over-the-counter market for a variety of needs – to avoid the liquidity risk that now stalks corporate debt, or to search for higher-yielding investments. And as the year drew to a close, some users of commodity derivatives – where the drop in traded notional has been particularly steep in recent years – insisted bilateral OTC products offer benefits they cannot find elsewhere.

"The past two months have been brutal. Even for plain vanilla swaps, getting out of trades is difficult" – trader at a US life insurer, May 19

"There is a real risk the non-cleared market grinds to a halt" – Chris Murphy, UBS

"We need to figure out a solution for the non-cleared market, and I think that solution has to take the form of more standardisation of document terms" – Jonathan Hunter, RBC Capital Markets, June 1

"We blacklisted some clients that have these CSAs... [The negative rate floor] means you have to turn your swap into an option. You have to book it differently, risk-manage it differently and value it differently" – credit and funding risk specialist at a Nordic bank, June 2

"There's always been a trade-off between a model that's accurate but difficult to compute, versus something less complex that still has sufficient accuracy to capture the material risks we can agree on" – Gordon Lee, UBS, June 7

"Today, we are essentially not in the business of doing swaps bilaterally" – Olivier Herregods, Credit Suisse, June 13

"There's no doubt the derivatives markets have changed. But the non-cleared derivatives market will continue to play an important role in the risk management strategies of end-users" – Scott O'Malia, Isda, July 4

MARGIN MAYHEM

Preparations for the start of the margining regime for non-cleared derivatives took a knock in June, after it was reported the European Commission had decided to delay the September 1 start date. Banks leapt at the chance to push for a global delay, and even in the week prior to the deadline, some traders were still holding out hope of a reprieve.

Preparations for the start of the margining regime for non-cleared derivatives took a knock in June, after it was reported the European Commission had decided to delay the September 1 start date. Banks leapt at the chance to push for a global delay, and even in the week prior to the deadline, some traders were still holding out hope of a reprieve.

A let-off would have been helpful for the 20-odd banks caught in the first phase of the new rules – which required them to begin exchanging initial margin for the first time – but Canada, Japan and the US ultimately held firm. In the event, dire forecasts of gridlock proved wide of the mark. But not by much: banks raced to get new collateral and custodial agreements in place during the final days of the regime, but had some way still to go when the rules took effect, leaving some temporarily unable to trade with up to 50% of their biggest counterparties.

That experience scarred the dealers. As preparations got underway for phase two of the rules – compulsory variation margining for thousands of buy- and sell-side entities from March 1, 2017 – they vowed not to engage in the kind of contract negotiations that slowed down phase one. Clients would be told to take it or leave it. But, as Risk reported in December, clients had other ideas.

"Our objective is to deliver the standard before the end of the year and for firms covered by the first wave of the rules to be required to comply before the middle of next year" – European Commission spokesperson, June 10

"We don't want a delay in timing in one jurisdiction that can create a lack of competitiveness for US firms" – Marnie Rosenberg, JP Morgan, June 14

"I personally think it will be a horror show on September 1" – collateral manager at a European bank, August 23

"There are no custodial accounts for banks to post initial margin to, that's the issue" – counterparty risk manager at a US bank, September 2

"Depending on how you count, between 150,000 and 200,000 documents have to be replaced between now and March 1... In the history of contract law, nothing of this scale has been attempted in this short a time frame" – a risk manager at a US bank, December 7

FRTB – THE BIG QUESTIONS

Almost 12 months after the publication of new market risk capital rules, two big questions remain unclear: how difficult will it be to win modelling approval? And how much of a capital benefit will banks enjoy?

Almost 12 months after the publication of new market risk capital rules, two big questions remain unclear: how difficult will it be to win modelling approval? And how much of a capital benefit will banks enjoy?

The first of these questions is unclear, because the Fundamental review of the trading book contains two different definitions of the all-important P&L attribution test – an apparent mistake thought by some to reveal divisions among the regulators who drew up the rule – but also because the industry subsequently raised some tough questions about its scope. A promised FAQ document is still in the works.

The second question may seem obvious. According to one industry study, the internal models approach (IMA) will generate capital around 1.5-times higher than current levels, while desks using the sensitivities-based approach (SBA) will see capital jump up to 6.2 times. But approval will be granted at the desk level, so a lot depends on each bank's desk structure and which desks pass the FRTB's tests. Beyond that, regulators are still debating how and whether to restrict the capital savings that models offer – a floor on the output was officially mooted in late 2014, and has now become the subject of a mighty, transatlantic tug of war.

"If you narrow down the scope of your desk too much, the chance that you are going to fail on backtesting increases" – a risk and regulation consultant, April 7

"We have already seen banks pull down numerous desks within their trading businesses, and all before any of these regulations go into force" – Debbie Toennies, JP Morgan, April 13

"The test is fundamentally flawed; you cannot set a threshold high enough for it to make sense" – Lars Popken, Deutsche Bank, April 15

"You might fail the test because of reasons that have nothing to do with the quality of your modelling. And to pass by design, you would really need to bring everything together" – head of risk analytics at an unnamed bank, August 2

"I expect an aggregate output floor will be part of our package of reforms. It will be based on the standardised approaches" – Stefan Ingves, Basel Committee on Banking Supervision

"It becomes potentially unmanageable to optimise our activities against these model constraints" – James von Moltke, Citi, November 30

"If you put in the money, the people and the work, it looks like we will still fail – so what's the point of doing it?" – risk manager at an Asian bank, December 5

FRTB – MORE BIG QUESTIONS

And those are just the big questions. There are also some huge questions – how will banks respond to the new regime? Will smaller banks shut down their trading businesses because of the new capital, IT and operational costs? Will big banks continue their retreat? Will fewer institutions seek IMA approval, ending the two-decade-long expansion of capital modelling?

And those are just the big questions. There are also some huge questions – how will banks respond to the new regime? Will smaller banks shut down their trading businesses because of the new capital, IT and operational costs? Will big banks continue their retreat? Will fewer institutions seek IMA approval, ending the two-decade-long expansion of capital modelling?

And then there are the smaller, more technical questions – about the workings of the SBA, the IMA data requirements, and whether IMA banks will be able to pool data to avoid having risk factors classed as 'non-modellable'. The debates bubbled away throughout the year.

In December, Risk published the results of a survey in which 12 regional banks were asked a mix of these questions. Some of the more eye-opening findings: six of the nine banks that currently model their market risk said they were less likely to do so under the FRTB; three of that same subset believed more than half their desks would fail the P&L attribution test; seven banks believed no more than 40% of their risk factors would be deemed non-modellable; eight said they would sign up to a data-pooling utility and felt it was likely one would be launched; eight had done less than a quarter of the required implementation work.

"Interest rates and forex at a product level are the ones we are most concerned about. Even for correlation trading, there may have been some significant changes, but the capital there is really, really large. I don't know what is going to happen with it" – source at a large US bank, March 28

"We, as a participant, would certainly be open to any ideas around data pooling, because at the end of the day, this [FRTB] is a significant increase in costs" – Manoj Bhaskar, HSBC, April 12

"Banks will undoubtedly want to wait for clearer guidance before investing a lot in analysing desk-level performance" – Ed Duncan, Barclays, September 29

"We probably wouldn't go for IMA approval under the current FRTB because of the level of cost and the overhead required" – Maurice Harty, Bank of Ireland Global Markets

"[Regulators] haven't given great detail on how the floors are going to be structured, what the percentages are going to be, or if they will apply at the book level or by risk type. Making a decision on IMA versus SBA right now may not work" – Richard O'Connell, Credit Suisse, December 6

THE NEW BLACK

Seven years after regulators first committed to their programme of post-crisis reforms, banks, investors and other market participants are still not sure what products, services – and business models – will work best.

Seven years after regulators first committed to their programme of post-crisis reforms, banks, investors and other market participants are still not sure what products, services – and business models – will work best.

In February, Risk revealed a number of unnamed banks had engaged lawyers to explore the possible spin-off of cleared swaps businesses. The rationale was that, by selling a majority stake to a non-bank investor, the new entity would be freed of layered regulatory constraints. The business itself would be relatively capital-light and, because it was cleared, would also be free of the requirement to conduct detailed counterparty credit analysis – making it potentially attractive to private equity buyers.

If any such deals go ahead, lawyers predicted the first would materialise in 2017. The idea certainly has not gone away: detailing a strategic reboot in November, Germany's Commerzbank revealed it would be housing its structured equities business in a separate legal entity.

Other new models, have not yet broken through in the way predicted. Citadel Securities is making a success of its venture into over-the-counter derivatives market-making – but other tech-savvy liquidity providers cite regulatory ambiguities as a reason to remain on the sidelines. One of these, Teza Technologies, is now going in the opposite direction, Risk was first to report in September: the Chicago-based firm is exiting proprietary trading and devoting its resources to a fast-growing hedge fund business instead.

"Banks are trying to make a strategic divestment of the cleared swaps trading business and move it outside the Basel III world. It just doesn't make sense anymore to keep that inside the bank" – a lawyer, February 8

"We are systematically giving up businesses in which we can't see any future for us" – Martin Zielke, Commerzbank, November 8

"The CFTC has been made aware that this is a major obstacle to bringing in a more diverse set of market participants, so why is there so much resistance to modifying the rule?" – Robert Creamer, Geneva Trading, July 25

"Teza leaving the US Treasury market will create space for others dying to get in. It's not like a firm exiting a business where there are only a handful of players" – Senior executive, US-based proprietary trading firm, September 2

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Trump tariffs sent FX options traders on a wild ride

As US assets sold off, dealers found themselves on the front lines of a hedging scramble

Vanguard is new kid on the CDS options block

Counterparty Radar: Passive behemoth held a quarter of reported notional among US retail funds in Q4 2024

EMS vendors address FX options workflow bottlenecks

Vol jump drives more buy-side interest in automating exercises and allocations

Inside the week that shook the US Treasury market

Rates traders on the “scary” moves that almost broke the world’s safest and most liquid investment

Patience pays off for XVA desks in wild week of tariff swings

Dealers avoided knee-jerk reactions that could have caused credit spreads to widen further

Treasury selloff challenges back-office systems, data feeds

FIS and Trading Technologies suffered downtime during peak activity

FX liquidity ‘worse than Covid’ amid tariff volatility, dealers say

Available liquidity for single clips dropped to as low as $20 million ahead of tariff pause

New FX swap matching platform aims to bridge voice and e-trading

FXswapX seeks to electronify “the last bastion of voice trading” in the interdealer market